To maintain thought leadership, I can't stick to just the advanced finance books, I have to read the basic guides as well, and often I get some enlightening reads that change the way I look at my own personal finances.

Happy Ever After is the brainchild of Michael Gilmore who goes by the moniker Seven Dollar Millionaire. Every local finance influencer who has not heard of him should be ashamed of themselves as I was when I discovered that this foreigner came all the way over to Singapore to teach personal finance to migrant workers here! It's a brilliant rationale, the migrant workers are the lowliest paid workers in a nation that probably have one of the highest standards of living in the world. This alone should make a trainer like myself feel a little inadequate and uneasy.

I'm going to do a review in two parts, for now, I'm going to just explain two simple ideas from the book. If you want more, I suggest you buy the book from Amazon Kindle. If you have influence over Kino, I think this book should be on every shelf in a local bookstore. If anything, more volunteers to teach migrant workers is not a bad idea.

a) Your target portfolio size is 25 x Annual Expenses

The first idea is probably quite familiar to most readers and it is to imply use (25 x Annual Expenses) to determine the size of a portfolio to gain financial independence. It's simple and elegant. If you want to reach your target faster either save more or spend much less.

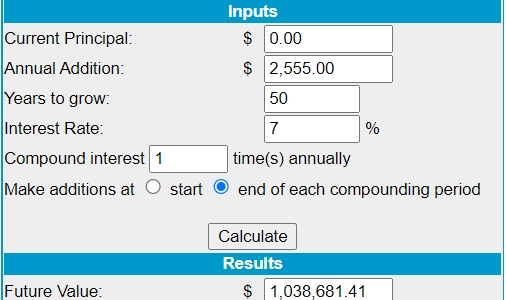

b) How investing $7 at 7% makes you a millionaire in 50 years

I've attached the evidence here:

The main point of the idea is that becoming a millionaire is not hard if you compound your investments over time, the question is perhaps how much is $1M worth in 50 years' time, and whether you can retain your good health when you finally get it. For a guy who starts work at age 25, he would have to funnel his CPF Life into his portfolio from age 65 to 75 to get this right.

I'm in the middle of conducting a class. I hope on Friday I can talk about the more counter-intuitive ideas from this book.

If you can, try to support the author and the book, he's already done a lot for migrant workers here while most of us hadn't.

No comments:

Post a Comment