I'd like to see BIGScribe Investors Exchange as the Wrestlemania of Singapore Investing.

You can book your tickets for this event here.

Our last event sold out and I was told by the event organisers that we are selling the tickets at twice the rate last year. It's no surprise, because as of this time, we have four heavyweight speakers who will be talking about serious investing topics for that day.As you all know, I am a retail investor and a fan boy, so I look forward to the presentations just like members of the audience.

Which puts me in a fix, because I am the fifth speaker.

Traditionally the last speaker in a presentation team in SMU Law School presentations has to find a way to wrap up the proceedings and create a positive spin for the whole event. Even in Wrestlemania, the final event is when the Heavyweight title often changes hands. The wrestlers in the final event is seldom the best fighter in the WWE ( Leg Drop of Doom, anyone ? ), but the fight has to contain the best trash-talking and drama.

Last year, the topic of my speech was "50 Shades of Dividends Investing" and I was quite sure some folks were offended by my subject matter.

This year may be no different.

I will be talking about F.U. Money.

But for now, I'd like what F.U. stands for to be a mystery.

I will discuss what F.U money is, how to get it, how to make it grow. I will explain why we are so hot and bothered by F.U money. Why we want that F.U. moment in our lives and why we need to get that moment soon and not delay gratification indefinitely.

As in all my talks, I will discuss some empirical observations on blue chip stocks, dividends and REITs.

If you're lucky :

a) You might even become disillusioned and even a little angry with ETFs.

b) You may also never see some degree programmes the same way again after my talk.

c) You suddenly feel that contrary to modern concepts of self-help, delaying gratification has limits.

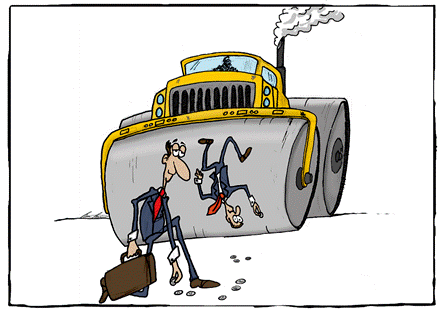

You see, my job should not be just to motivate you, my job is to show that you reality bites and how you can fight back.

Folks who follow me will expect that I try to back up every assertion with research and empirical findings to support my thesis. A lot of material was crunched to create the slides which are undergoing trimming right now.

We will take the data science of investing and try to marry it with the latest psychological research and I will show you how all this can be tied up to your personal goals of happiness and bliss.

It's time for Investors Exchange 2018.

Buy the tickets while stocks last.

And most of all - F.U. !!!