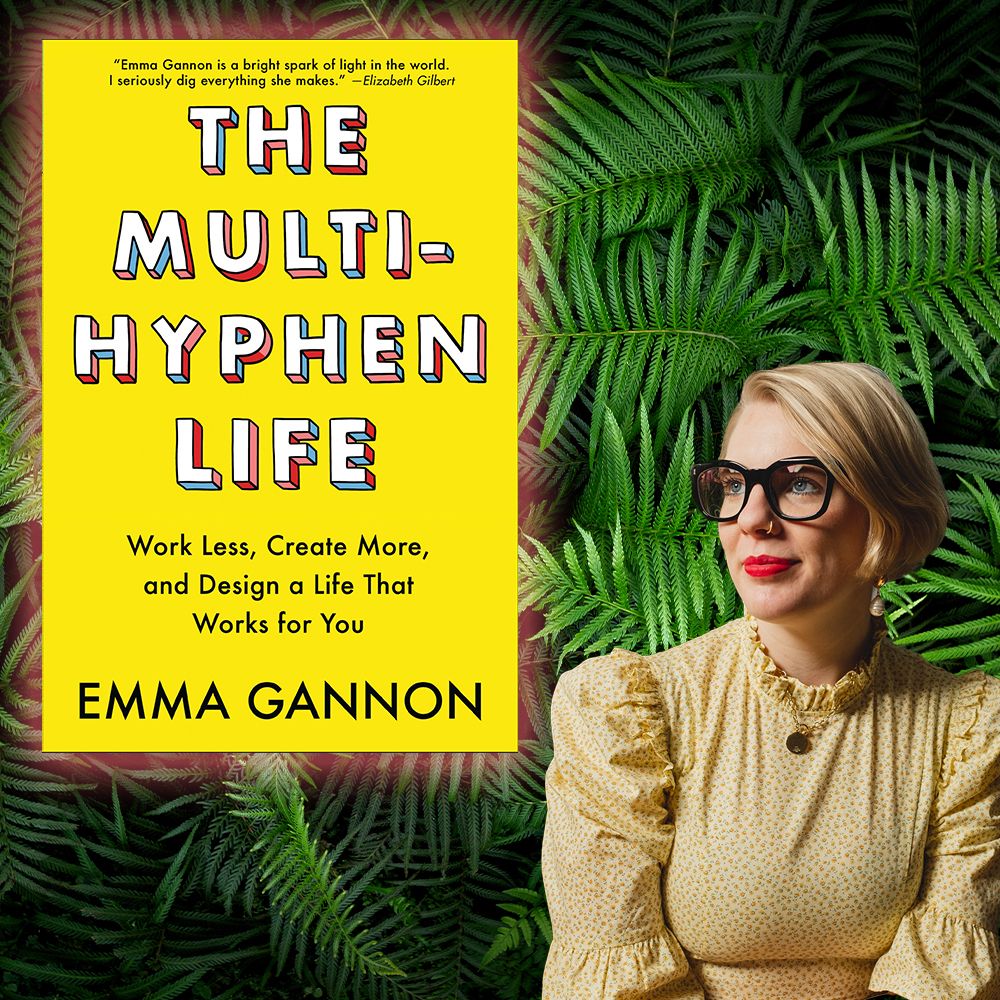

Today I will be spending more time to talk about the Multi-Hyphen Method by Emma Gannon.

The concept of a Multi-Hyphen career is not all that complex. In this economy, it is probably counterproductive to have a monolithic career.

Twenty years this was the norm and I started out as a Systems Analyst at Procter and Gamble. That lasted about 4 years until an outsourcing exercise sent me packing to the arms of Hewlett Packard. I spent about 14 years having my identity tied to that of an IT professional.

An engineer today will have a hard time hardwiring his career to his company or his primary vocation. The half-life of his knowledge is getting much shorter and he can become obsolete while remaining gainfully employed at his company. Looking at retrenched engineers driving Grab, I suspect most Gen Z workers will not be so eager to marry into their primary day jobs or companies.

So enter the multi-hyphenated career. We can have multiple careers at the same time.

Even my job is hyphenated today.

Perhaps one day I can call myself the following :

Engineer-Lawyer-Investor-Blogger-Author-Investment Trainer-Startup Founder

Basically, that's about it for the entire book.

I did not really enjoy this book. I felt that the rest of the book was written in a chaotic manner.

The author jumps from topic to topic, inviting readers to detox themselves from social media on some chapters and then talking feminism in others.

There are only three useful lessons I can extract from the book :

a) Manage your career and lifestyle from a position of strength.

Most hyphenated jobs are bullshit lah. This is often back-up plan for folks who do not have the skills for a company to want to hire you full time. If you look in Singapore, most of these Millenial careers have too much "Social Media", "Marketing" and "Consulting" in them.

Truth is, if you have "Software Developer" in your job scope, have a product to show off, there is no need for a hyphen to show that you mean business.

That being said, skills atrophy very quickly, and those with full-time jobs need to start building their side hustles or get their first hyphen quickly. By the time that Computer Science degree hits half-life, you should have a domain-knowledge or a side business very quickly.

The best time to hyphenate your career is while the going is good. Showcasing your coding skills on Youtube and putting up code on Github may be a better way to build a better iron rice bowl.

Otherwise, you'll become one of those house-husband-internet-business type of dudes career women can identify and judge very quickly.

b) No one knows what online skills will matter so pick them all up

When you have a legitimate IT role in a company, SEO seldom comes under your radar. When you become jobless, suddenly you become proficient in copy-writing, SEO, and mass-mailing.

Neither the author nor myself would know what new-fangled web IT skill-sets can pay the bills.

But at least I will tell you to try everything out, keep an open mind, and emphasize the hardest skill-set first.

I am sure marketing campaigns can be complex, but I don't have the bandwidth to actually know. I do know those engineer founders have a bad record with hiring marketers because it is so difficult to measure their performance. A failed campaign can be easily blamed on the product.

Creating a Django website with Data Science components and then building a mobile app to drive the features is really hard. The website alone requires knowledge in Javascript, JSON, Python, Django templates, etc...

Any see-gee-nah with a loud-mouth can claim to be a good marketer. In my opinion from observing others, the best founders keep firing them until they get someone that can deliver the goods. Engineering bosses have trouble identifying the good ones from the bad ones.

Learn the basic functionality of everything you can get your hands on Canva, Camtasia, Zoom, Gimp, Git, some email blaster, a suite of open-sourced Office tools. It's not the tool that matters, it's dealing with ambiguity and the settling in to use any tool quickly that matters more.

MNCs don't teach this skillset well.

c) Money management should take centre-stage as multi-hyphenation is a problem and not a solution

I'm multi-hyphenated enough to say that given a choice, most people do not want such complicated work titles. My fans like the fact that I can drink Butter Kopi on a weekday afternoon, but they are not there when relatives ask for the umpteenth time whether my law degree was wasted when I became an investment trainer.

The lament of Generation X men has always been why their dads can sustain and raise a family on one job but they can't. Worse, their children may have to take on multiple roles to sustain a singleton lifestyle.

The fundamental truth of all vocations is this :

- Having multiple gigs can be poisonous because of the lack of CPF-OA and SA contributions that can ruin your retirement plans.

- MNCs are poisonous because your roles are often narrow and you can become functionally obsolete while on the job.

- SMEs are poisonous because Singapore is full of horrible bosses who send you fake termination letters and slime you on their websites.

- Entrepreneurship is poisonous because of possible bankruptcy and stigma from failure.

The only solution is to see everything as a tool to attain financial stability, a job is a means to remove all debts and get a small income flowing initially to cope with emergencies and finally to wean away from a dead-end vocation in your 40s.

The biggest disappointment of this book is that something that tackles a multi-hyphenated career should have cashflow and money as its primary chapter.

The author admits that she's not particularly good at money so she made it the last chapter.