Some readers may remember that I wrote an article on egg freezing some time ago. You can read the article by following this link. In that article, I discuss how enabling egg freezing puts men at a disadvantage because it has the effect of making young women temporarily unavailable. When women are confident enough to freeze their eggs, they will leave the mating pool and reappear at an older age. In that article, I urged policymakers to approve egg-freezing, but make it easier for men to marry foreign spouses as a counterbalance.

Recently, a pal sent me this article to read (link).

It is now time to review the concept of egg freezing.

Fortunately for policymakers, a medical anthropologist will be publishing a book that details the kind of person who will go as far as to freeze her eggs. Because the procedure is not exactly cheap, it comes as no surprise that women who undergo this procedure are high-achieving professionals.

What comes as a surprise to me is that 91% are single or in tenuous relationships, with a significant one-third of women having no previous relationship experience. Egg freezing is, therefore, some kind of plan B.

This leads to the anthropologist taking a potshot at men!

She blames egg freezing for this thing called the "mating gap".

- Men are reluctant to marry high-achieving women.

- Men are immature and not ready to start families.

- Men are ageist.

Thirdly, I think men evolved to prefer younger women, you can't socialise this away. It's ridiculous that a medical anthropologist will blame guys for rejecting older women when it's probably more likely that women will reject men with low economic resources.

Ok, now we need to see how all this new data changes my view on egg freezing.

I think egg freezing should still continue to be approved because it can generate new investment options. But we need to have a clearer view of the sorts of women who freeze their eggs - the odds of harvesting the eggs one day is very rare and it's not because of medical viability. If you can't get a relationship in your 20s, don't expect a relationship when you are older in your 40s.

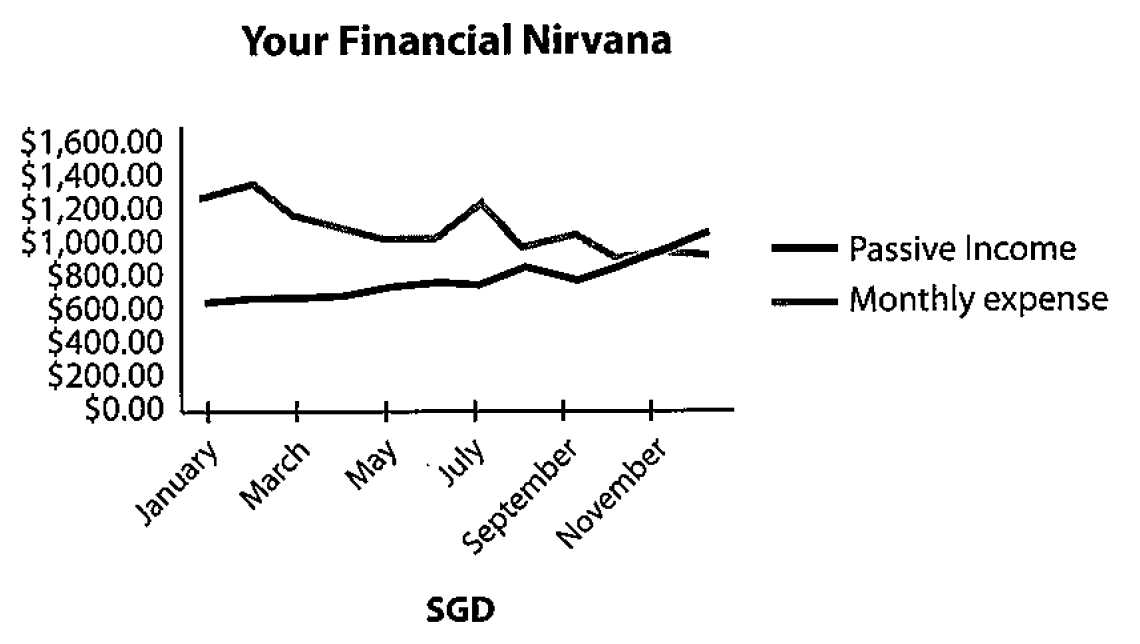

Now there is also the fear that the medical industry will promote egg freezing as some kind of miracle procedure that will never solve the relationship issues. Instead of freezing eggs, it may be better to invest in some US Office RETI counters for double-digit dividends.

Finally, I hope that some people will find this an entirely ridiculous idea.

There are men who are uneducated.

There are men who are short.

There are men who have no money.

I don't see these guys masturbating into a Tupperware and storing it in the freezer.

If no woman wants us, we just earn more, pick up some Thai, and try our best.

That is the BBFA way.