The biggest conclusion I get from reading this book is that most of us would likely fail at value investing.

If you look at the training provided by my peers in the training industry, a lot of younger trainers claim to be some kind of acolyte of Waren Buffett, but even Warren Buffett has evolved over the years. He started as a disciple of Benjamin Graham and adopted a deep value philosophy based on liquidation value, combining it with board control. Then Buffett pivoted under the influence of Charlie Munger and began to buy companies with powerful mindshare on TV. The latest incarnation of value investing subjectively imputes earning yields of digital companies by peer review.

If I adopt this alleged form of value investing, then value investing is effectively meaningless. It becomes ambulatory with the times - it can be anything you want it to be. So long as investment performance is good.

Nevertheless, I think there is great value in doing a thorough literature review and seeing what scraps can actually be used in Singapore.

There are three parts to doing value investing for the digital age, I will discuss business quality.

In the author's view, business quality is high if (1) the company has a low market share in a market that is very large and growing rapidly. (2) The company has a sustainable competitive advantage.

The moment we look at this definition of business quality, we will see logistical difficulties in finding such businesses. It is tough to generate a screen for low market share in a growing market. A retail investor would literally have to read the newspaper and find a company by pure luck. And weekly periodicals in Singapore put a very neutral spin on articles featuring local companies. No journalist would deliberately put in the article numbers on market share and the rate of growth of the industry at large - you need to find the exact article by chance.

Also, what are the odds of a Singapore company being able to compete globally? In many of these cases, authors of value investing companies will invoke Peter Lynch - buy what you know or follow your wife around when she goes shopping.

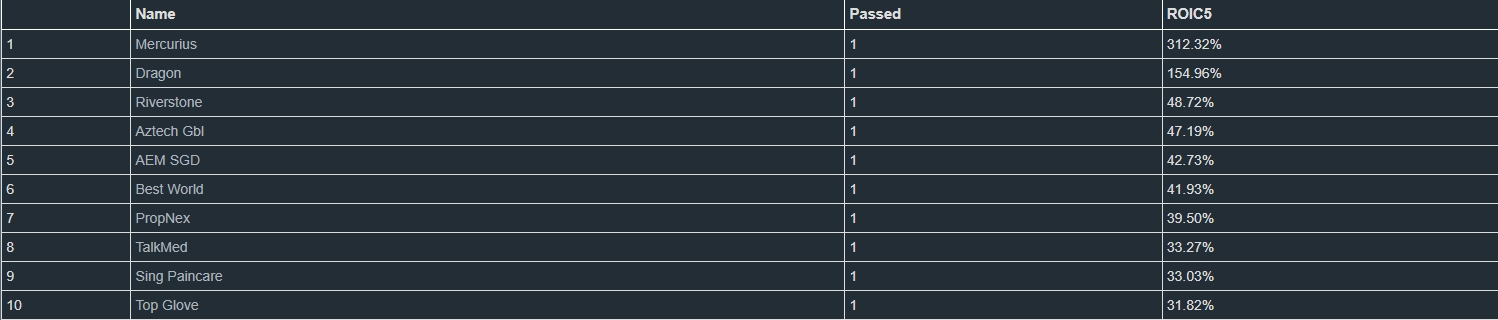

The idea of sustainable competitive advantage is slightly more useful because we can isolate a factor in screening. Companies with a high ROIC are generally seen to have large moats. Now let's see the highest 5-year average ROIC companies in SGX.

[ Note that most value investing acolytes prefer to subjectively evaluate the moat of a company. I hated that ever since someone else in an investment panel argues that Old Chang Kee had great investment moats when any Mak Cik from Batam can come over and start selling sardine epok at MRT exits. If you still prefer this form of subjective evaluation then you should revise Porter's 5 forces model and steer clear of eating too many curry puffs. ]

Theres no quantitive screen for a sustainable competitive advantage, or moats. And it changes if your industry does (like newspapers).

ReplyDeleteMarket share can often hint at a moat. In a local context, look at banks. Few competitors, high market shares, and a history of overseas competitors coming and failing. Concentrated market structure is similar to Australia or the UK. These banks will survive & generate returns (as long as the industry is not upended). Japan and Germany are opposite examples.

Market share is hard to find on local companies. In Malaysia a few years ago, I was surprised their normal Edge Magazine articles discussed market share percentages. The first step of any analysis. Singapore's Edge just helps you collect watches.

Morningstar has good categories of moats for simple people. This is not rocket science!

That statement on Singapore's Edge is gold !

ReplyDelete