In practice, nothing has changed for me since face to face classes has yet to resume and all the shops I like to shop at (like Kinokuniya) remain closed. Nevertheless, looking at the infection and discharge numbers in Singapore, things should be looking up and we should be back in full swing in July.

On the whole, the circuit breaker has been a good time for me even though I expect to be negatively impacted if this goes on for a further three or more months. Let me break down my situation into different components.

a) Training business

We were really lucky to have a number of positives offset the negatives in my business. Although I was unable to meet our students face to face, our webinars are attended by hundreds of participants and we are able to survive throughout this period.

Transitioning into webinar classes was also quite smooth - we broke our lessons into smaller chunks and allowed more time to absorb the material. As we offer one day of face to face classes for all students, I will have three batches of students waiting for their lab sessions once the circuit breaker is up. I will honour this commitment because I still believe that networking and teamwork are important in the learning process.

The training business has changed irrevocably with the lockdown. We're no longer afraid of webinars and my future lessons will combine face to face classes with webinars. By 2021, I expect my program to become 4-day affairs - two weekdays and one weekend.

b) Financial markets

I've been quietly positioning myself to be hyper-bullish from 28 March when I conducted the 12th batch of my class. While I cautioned my students to hold back on leverage then, I took the portfolio they built and leveraged it by x1.25. ( Even without leverage, the students who went with me in March 2020 got their school fees back within 3 months. )

Thereafter, I've been upping my leverage and by early May, I was back at x2. As my computer program informed me that markets have already rebounded 10% from the bottom of 2,233, I have moved on and even went as far as to incorporate a V-shaped recovery stance relatively early. Things have been moving along fine today.

While I could have been more bullish in March by I know psychologically that's impossible. I am plugged into several discussion groups and decided that I cannot afford to be as bearish as the rest of the retail investors if I want to exploit the market recovery.

So far it's paid off rather well.

c) Financial Programming

The most dramatic improvement to my life was that I picked up Python programming and then proceeded to retool my R programming data science skills in a totally new language. This paid off big time as my lecture slides can be improved dramatically with real market data.

In this aspect, I regret that the circuit breaker has been too short. I've only touched the surface of what I can do with the Python language. I've only barely used the Yahoo Finance and the visualization functions. Just a few days ago, I managed to obtain some fundamental data of local stocks and see a lot of new capabilities that I previously never had even with Bloomberg. i.e. I can write a program to cherry-pick factors for me so that I can reduce my workload when I go to NLB.

Python is going to dominate my life for the next few months and it will likely eat into a lot of my leisure time after this CB is over. After dealing with all the data science functions like lasso regression and ARIMA time series, I will probably need to sign up for a Python web apps class.

d) Readings

I was supposed to read more fantasy fiction but this one just blew up all my plans.

This is an introductory text I bought from Kinokuniya many years ago. I was previously prevented from reading it properly because it was written in Python.

This CB, I was finally able to finish it cover to cover and I was even able to translate the NLP source code into the latest version of Python libraries.

I am now starting the next book I have in my library and this is too challenging for me. I thought by investing in some machine learning mathematics, I will unlock some bigger arcane power for me to create investing toolsets in the future.

Sadly without going back to University, I am unlikely to comprehend beyond 4 chapters of this text.

e) Leisure and Hobbies

Circuit-breaker has changed the way my group plays Dungeons and Dragons.

From now on, we will use Roll20 as our RPG platform and we don't see ourselves playing in other people's homes moving forward. Instead, we will play at home and then gather at someplace in town for dinner after everything is over.

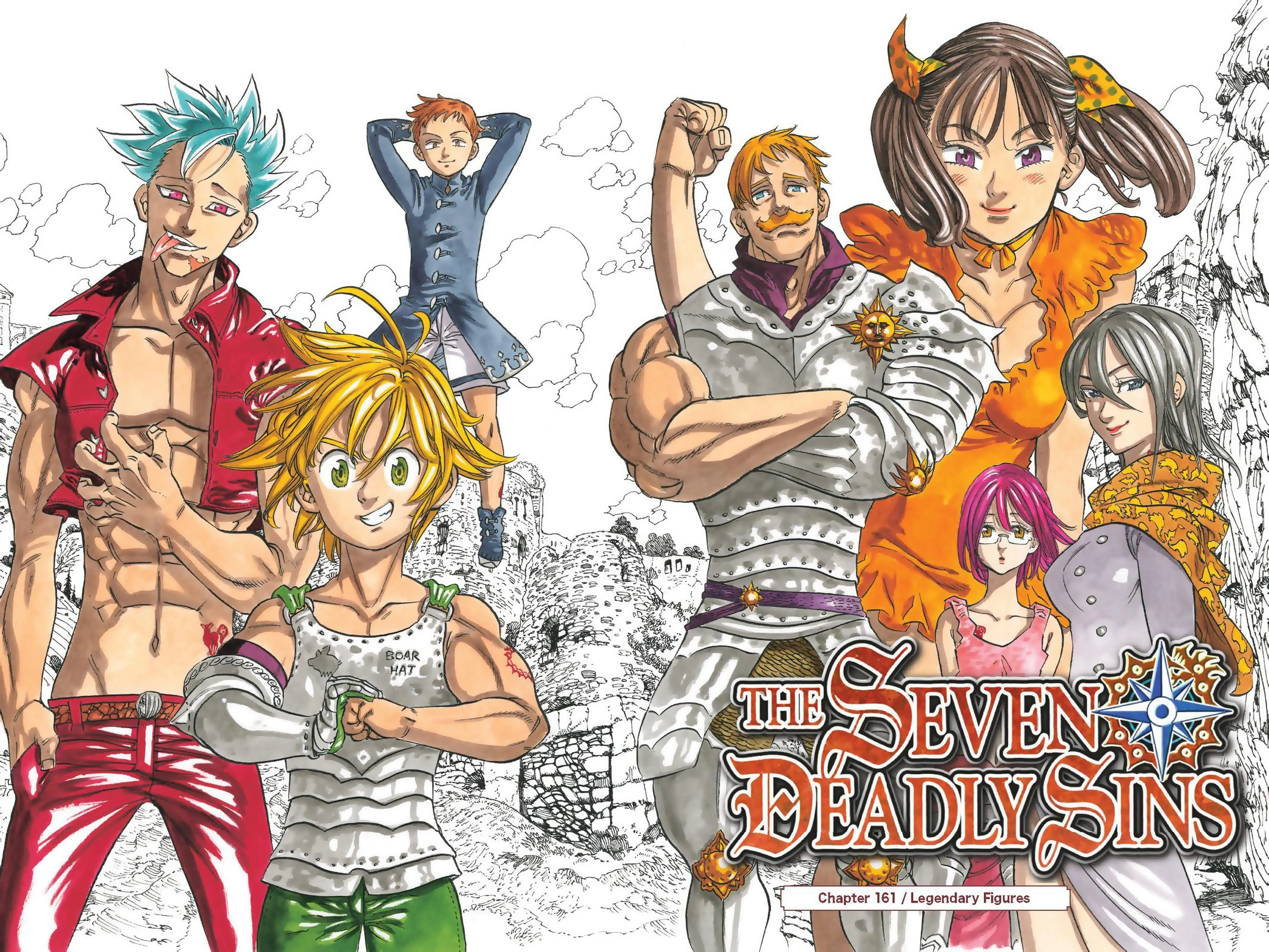

After a full day playing with market data with my Python programs, I am normally too tired to even read fiction so anime has become my main source of entertainment late at night. I am currently obsessed by The Seven Deadly Sins which is what happens to a party of D&D characters when the DM is very lenient and they become too powerful.

I really like the character known as Escanor ( the muscular-moustached dude in half plate ) because he really reminds me of what leveraged investing feels like.

On the whole Circuit Breaker has been quite fulfilling

At this stage, I can say that playing with FIRE has culminated in a relatively comfortable circuit breaker for me. Dividends have dropped, but so expenses have dropped even more. I might even have a comfortable budget to upgrade my tablet when retail shops reopen.

Also, this has also been an immense period of personal growth for me. I can finally run about 3.5km every day, and have converted my home into a laboratory where I can examine and learn new insights about local markets.

Finally, I think the time to really make money is when there is a chance things can take a turn for the worse. With the US facing riots and possibly a bigger wave of virus deaths, the position is dangerous, but if you wait for everyone to get bullish, you will be guaranteed to miss out on the market recovery.

No comments:

Post a Comment