Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Wednesday, August 31, 2022

Why we need to resist the idea of SAP Polytechnics and SAP Universities.

Saturday, August 27, 2022

On Wild Problems

- My stint as a trainer finally got me my CFA - nineteen years after I passed the Level 3 exams. It required 3 years of full-time work as a training professional.

- In law school, I always found some of my classmates ridiculous, I had classmates who dropped out in the final year after paying all the school fees.

- I used to get exasperated at friends who can only talk about publishing a book but never complete a proper manuscript, it was the main reason why I set out to write three books on personal finance as an IT engineer.

- Even if the last 2 seasons of Game of Thrones sucked balls, I watched it anyway.

Tuesday, August 23, 2022

FIRE is a good servant but bad master.

I had the good fortune to received a message on Linkedin from Keith Yap.

He wrote this, and I'm posting it here because somehow he could not comment on my blog :

His comment was very intriguing, I initially thought that there was possibility that he was tasked to write about FIRE from his bosses based on this message, so I offered to defend FIRE publicly against his supervisor which seemed to be someone from Enterprise SG. Many FIRE aspirants are conservative PAP voters and continue to pay taxes post financial independence, so there is no need to fear that FIRE metastasize into some kind of Tang Ping movement.

Thankfully, after a short exchange, Keith clarified that he wrote the article based on his own personal capacity.

I think his reply was even-handed and fairly neutral so it's safe to be shared on this blog :

Wednesday, August 17, 2022

Does FIRE subvert conventional ideas of work and finances ? WTF !

Monday, August 15, 2022

On Singapore's elusive third gear lifestyle

I'm trying to put something together to talk about quitting until I saw this article about a Japanese restaurant called Tenya that has raised salaries by 10% and instituted a four day week to solve their manpower crunch. ( link )

I think Tenya is onto something.

I called this the Singapore "Third Gear" problem. For folks who remember cars with a manual transmission, drivers would start at 1st gear and, as the vehicle moved faster, gradually shifted until 5th gear, when the car is reaching its fastest speed. When I was very close to becoming Financially independent, I realized that there was a problem in Singapore - Singapore workers can only be unemployed (first gear) or work crazy hours (fifth gear).

There is no middle-ground or third gear in Singapore.

No lifestyle design where you can work a little and live a little pushing many Singaporeans to emigrate somewhere else.

The first gear would be folks who do not have real jobs. These can be stay at home mums, folks living on government welfare by attending courses organized by the government during the pandemic, husbands who have successful wives calling themselves "business consultants", folks who inherit money, or anyone claiming to be a life-coach.

Fifth gear would be a majority of Singapore workers. Folks who are committed 9-5 on weekdays on jobs which provide a career path, decent pay, but very little leeway for work-life balance. If you belong to the professional or executive path, bosses expect you to be available 24-7. To be fair fifth gear in Singapore is probably a decent place to be because of low taxes and you really get to keep what you kill, but it is soul draining and some countries like Dubai pay even better for fifth gear work.

When I was teetering at the brink of financial independence, I was concerned about shifting down to first gear, this is even though I was not just financially independent on my own but I'm also a bit of an inheritor.

First gear may be irreversible, after a while, no sane HR professional would want to have a look at your resume. Worse, I can't seem to take first-gear folks seriously, they seem so out of touch with reality. For an ENTJ, it's better to lose my financial independence than to stop mattering in society.

And there's no respect. We're a nation of snobs.

So I stuck to fifth gear for 7 years after living on my investment income. But eventually you end up working for toxic environments as you rise through the ranks of management, where your skills matter less than your political maneuvering. Fortunately, I was able to let fifth gear go at age 39, long after investment payouts exceeded work take home pay.

But I can't find the third gear.

I delayed for 4 years to go back to school to contemplate my life and maintain an air of respectability.

Eventually, I found some semblance to the third gear after rejecting the legal industry.

In this life, I can free most of the time unless I am conducting a class, then all the work and attendance is non-negotiable given how much preparation my colleagues need to get a class for me. This third gear is very volatile and my sales can be very unpredictable and only those with a fairly high investment cash flow can sustain it for this long.

I suspect most third gear folks, if you can find them, are not conventionally employed in Singapore. Like me, they either report taxes as a sole proprietor or under the LLP structure.

( The guys who own a Pte Ltd actually work kinda hard and may even work on 6th gear until their business becomes profitable. )

The good news is that things are changing.

I think with the pandemic and tighter curbs to foreign labor, SMEs may finally be pushed to really start thinking about what the modern Singapore worker wants. Building a fifth gear job with no chances of advancement would mean that very few locals would want to work for SMEs. But upping the pay a little and then downgrading to a 4-day workweek is a good start and these jobs may meet the aspiration of the Singapore worker.

Not everyone is a an ENTJ. Many are INFPs who can't count, are lazy, and have an affinity for making bad life decisions..

At the very least, you can live the New Zealand and Aussie lifestyle in a low tax regime. Also you don't have to resort to career in sales to do this. How many balloons need to be forcibly taken away from children for angry parents to seek a statutory amendment to outlaw FAs here?

From a FIRE perspective, thanks to Tenya, Barista FIRE becomes a lot easier to attain in Singapore, where a fifth gear job can get you about $1,000 a month in investment income after 5-8 years, then you downshift to third gear lifestyle on a four day week in the F&B or retail industry.

At the end of the day, liberals like Tommy Koh can talk about Singaporeans being snobbish and the government can talk about a new social compact.

Just pressure SMEs to unlock a four day work week and make a third-gear lifestyle achievable, fewer folks would emigrate to Australia and New Zealand design a lifestyle there.

Friday, August 12, 2022

The best is yet to be - My adventures at ACS Independent

It is good that investment trainers to do some pro-bono by visiting secondary schools and presenting to students. If you're lucky, some students will get the message and you'll get to shape some lives, but it is also good for the trainer because you get practice to see whether you ideas can find traction in young minds. It is always challenging when the audience did not pay for your time or may not have the inclination to listen to lecture.

So I was delighted when the Entrepreneurship society of ACS Independent invite me to speak to their students for an hour and spent the afternoon in their campus premises. This is actually he first time I'm presenting in school premises as my slides have only been deployed in RI over Zoom for the past 3 years.

The talk was fine, but I felt that the material, honed over two years at RI, could not fully resonate with ACSI audience but I was mostly able to maintain the attention of these teenagers when I spoke of my personal story - about how outsourcing work can lead to suicides in the workplace and the scholar-farmer divide in the government sector is alienating to those labelled farmers. But I think I won the crowd eventually when I spoke about how the effects of compounding wealth over the years is literally the reason why "the best is yet to be".

Why do I know it works? Because I love triggering RI students about how compounding of wealth is embedded in their rival's school motto, and relying just on brains and not capital is a loser's game.

[ In such situations, I see myself as a cross between Magneto and Professor Snape. ]

Anyway, I was actually disappointed that kids have moved on their personal interests. I tried sharing my own personal interests on one slide but no one perked up. I think that's fair, you can't really tell young people about Pink Floyd or David Bowie ( but my son loves Rick Astley ). I also suspect my slides, being keyed to League of Legends, may not actually be played by teens today.

Naturally, I broke the news of speaking in ACSI after the fact, then my FB was flooded by extremely negative people who claim that ACSI does not need any help in financial management and some already come from billionaire families. One joker even said that ACS is so wealthy that my audience were probably all paid body doubles.

Maybe it's cool to demonize the wealth of ACS twenty years ago, but I find the kids in my class very ordinary.

The most intelligent question I was asked yesterday was whether I felt it was fair for policy makers to give 2.5%/4% for CPF when invested returns far exceed that amount. I was not very inclined to catalyse the birth of the next Chee Soon Juan, so I told him that while returns are low, the risk or standard deviation is zero, so CPF is actually a very attractive savings instrument. Furthermore, Singaporeans actually rushed to contribute to CPF during the pandemic so I am not inclined to disagree with current returns are puny.

Anyway, for the blog reader, what is the moral of the story ?

Harsh truth - ACSI has a very dedicated team of teachers who supported their CCA by inviting an investment trainer into campus. RI even has a dedicated segment for students who aspire to be future investment bankers. In every case, when I worked with our elite schools, no one burdened me with humiliating checks over my course materials and attempts at censorship.

Fact is people pay thousands of dollars to hear me speak.

The saddest story is that I took so much pains to volunteer to teach personal finance in my own secondary school and so far I've not managed to gain any ground over this as communications get dropped and people just wander off to take on other projects.

So in the future if ACSI and RI groomed more billionaires or generates the greatest number of jobs for Singaporeans, don't be salty, ask yourselves how much red tape the neighbourhood schools are saddled with before demonize others for their prosperity.

Wednesday, August 10, 2022

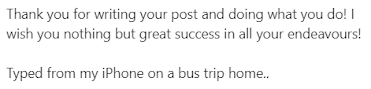

Keep discretionary expenses to things that suit your personality

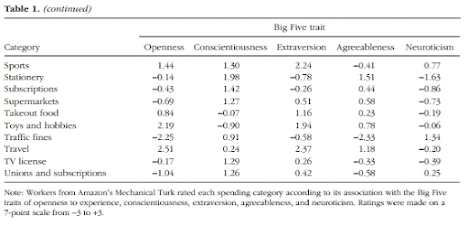

So basically, if you know your personality, you can use this table to guide you on what consumer products would give you the highest personal satisfaction. Buy enough to make yourself happy, then you can invest the rest. So extraverts should be happy attending a music concert with friends. Introverts are happy getting a bonsai plant. So unless the book you are giving is 50 Shades of Grey, expect your extroverted pal to keep it in his KIV list for decades, you might be better off signing him up with a club for swingers.

Monday, August 08, 2022

Thinking and lifestyle design using real options and annuities

This post came about because of MissFITFI's podcast with the owner of Saturday Kids. You can listen to the podcast here.

I want to focus on one important idea mentioned in the podcast which is the idea of placing little bets in life that have a small probability of success but can pay off in a large way. This idea can be broadened quite significantly on this blog.

Consider the term life insurance. This is basically a put option on your human capital. If you die, the insurance pays off a fraction of the loss of your human capital to your family. If you outlive the insurance, it expires worthless.

There is a class of life strategies that exploit a myriad of real options that behave like term life insurance. Advanced education qualification is a call option on your human capital. If there is a strong market demand for people with such advanced degrees, you can enjoy a higher salary or a boost in your human capital. If your advanced degree is in something that society does not value, it can remain dormant or "out of the money" until there is a shift in industry trends. Options gain value when the underlying security goes up in value or even when the situation is very unpredictable or volatility is very high.

If you are a fan of Nicholas Taleb's Antifragility, living an anti-fragile life is all about embedding real options in your life.

Now we consider the opposite of term life insurance, the annuity. An annuity hedges against longevity risk. If you live too long, the annuity pays a monthly stipend every month until you die.

If we consider term life insurance and annuity as a spectrum, then our lifestyle design based on real options is incomplete. While we need to make many tiny bets to get ahead in life, we need systems that pay out a predictable amount every regular time interval, at least to survive. The importance of having a steady job, some royalty payments, and dividends which are uncorrelated to market cycles are vital to survival in modern society.

Lifestyle design is all about having both real options and regular cash flows to suit your personal needs.

One way of approaching lifestyle design with this insight can be as follows:

a) You need to know your absolute base essential lifestyle and find ways to match this using earned and passive income. When doing this, you need to think like a landlord. Ideally, if you need to work harder to do this using passive income, do it as the payoff of getting time freedom is extremely high if you can meet this threshold.

b) Once basic needs are covered by earned or passive income, you can start to think about tiny bets that pay off in a big way. This way you can think like a VC. You can earn a qualification that will be valuable in the future, or put in some capital into a startup. In this example, it is better to do position sizing and make uncorrelated bets so that one big win would cover all your losses elsewhere.

c) Income-generating assets and real options should be interchangeable. Maybe some dividends are used to signup with a new Skillsfuture course or advanced degree. Once the advanced degree gets you a higher salary, you can farm extra proceeds into a bigger dividends portfolio. Balancing the two is an art and you can decide how to allocate your capital based on your own capabilities and personal situation.

Some readers will note that in a discussion that straddles between real options and cash flows, where do capital gains that are analogous to growth stocks stand in this spectrum? Stocks belong at the centre of this continuum. Some stocks pay a dividend and it has an option to grow if their valuation goes up.

( For the absolutely pedantic, stocks are also a written put option, it can drop in value when the underlying business loses money )

Saturday, August 06, 2022

Why you will fail at Value Investing - part 3

The idea is that if you can find an earnings power of 5%, you can comfortably add the stock to your portfolio.

Ok, so I'm done with my review, how can we treat the book as a whole?

I'm actually not militantly against this latest version of value investing. While there is a subjective component in each step of the analysis, an investor who applies this consistently as a whole against one specific industry may be able to find some success using this framework. But the question for folks like me is whether superior returns when it does occur, come with higher volatility. Furthermore, can these superior strategies beat momentum-based trends following stock picks in an economic expansion which is where tech-stock picking is at its strongest?

Finally, I'd like to say that I won't review a book if I don't really see some value in it. But perhaps a better value investing toolbox can be a wider literature review of books in this space, which is exactly what you will find on my blog over the next few weeks.

Wednesday, August 03, 2022

Why you will fail at Value Investing - part 2