I've been too busy to create an update on my business. After training there was that business with Sabana REIT, and then it was getting my Baldur's Gate 3 to run properly.

Last weekend, we managed to launch the first batch of The All-Weather Portfolio Masterclass, which centres around six Python Jupyter Notebooks. This is a huge risk because no other trainer in this market has been able to use computer code to teach beginners how to invest. The scope of the course is fairly ambitious, we managed to cover trend-following, mean-reversion, dynamic bond and short strategies in just under two days of face-to-face training. This is a steep learning curve for students, but it is also a ridiculously steep learning curve for me.

One of the biggest challenges is debugging code, as I found a logic error and had to update my code even after my lessons are over after I deployed training fees into the market. This caused me to turn over about half of my stocks after I corrected the program. The upshot of this is that I've learned to trade ETFs in a better way because Interactive Brokers allow the purchase of ETFs based on USD capital rather than units of stocks. Low costs and fractional ownership also made my mistakes less expensive. This enabled me to snap out of trading in SGX mode, which kinda these days if you use traditional brokers paired with CDP.

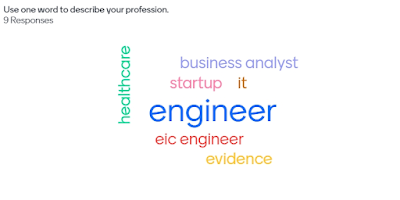

As the programme is attracting quite a decent number of engineers, the programme has started paying dividends as the folks started to tinker with code, ported it over to a Windows executable format and started looping it to collect reams of backtesting data. This gives me a platform to add materials to my program and refine it even further.

Although I pre-tuned the programs to run without much variable adjustment, I'm glad that some folks have decided to modify and personalise them for their own risk preferences. The beauty is that it is certainly possible to incorporate momentum measures to improve on the vanilla-flavoured asset allocations proposed even by financial advisors here.

The discussions in this program are very technical and involved, and I'm still troubleshooting some minor issues for students as I write this article.

The serious challenge is sustaining this programme and looking for folks who want a different twist to investing in ETFs. The next batch of training is in December, as of now, I'm unsure whether the markets will give me a profitable course intake.

In essence, you are building your own robo-advisor. The fact that mainstream media has revealed that robo-advisors are not even profitable businesses and still rely on VC funding warms the cockles of my heart, as even my humble programme offering is technically more profitable than theirs.

Maybe it's because I don't use beautiful people to advertise my product, most of the time it's just me.

No comments:

Post a Comment