Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Wednesday, September 28, 2022

Time for a Strategic Retreat

Friday, September 23, 2022

ERM Community Event Q32022 - Running your own Robo-advisor

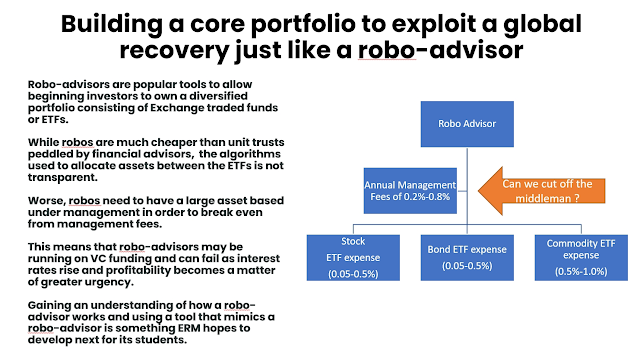

Pretty sure by now, folks who regularly attend evening investment webinars are sick and tired of discussions on inflation and the latest series of interest rate increases by the Fed. So when I was thinking about the next Early Retirement Masterclass community event, I wanted a seminar that has some link to the current macroeconomic situation, but it's really about something else.

For quite a while, I did not comment on robo-advisors because I see them as a "lesser evil" compared to getting a commissioned-based financial advisor, but over time, the lack of transparency over how these algorithms work on the back-end eventually began to grate on me. Worst, there are robos that just could not beat a naive strategy of buying, for example, every REITs in equal shares.

So I thought I would discuss robo-advisors with my community. We will not discuss specific product offerings in the market, but we will look into various approaches to allocating assets among different ETFs. I will round up a discussion with three theoretical frameworks for algorithmic asset allocation, and I will round up with a software demo of a Jupyter Notebook I wrote combining code snippets from different authors around the world that, when combined together, can be used as robo-advisor for ERM alumni and students.

We will be looking at numbers for traditional asset classes and crypto.

Date: 27 September 2022 7.30pm

Format: Webinar

Programme :·

ERM – Running your own Robo-advisor – 30 min

- Core portfolios with ETFs.

- Different algorithmic approaches to asset allocation.

·

ERM/CCI – Demo a Robo-advisor in Python Jupyter

– 15 min

- Demo on a beta tool that will be deployed to all ERM students in the future.

- Demo will cover main asset classes ETFs and major cryptocurrencies.

·

ERM Portfolio Update

Registration link :

https://us02web.zoom.us/webinar/register/3816560529405/WN_HlQhcGioQk24E9lDmImPaw

This seminar is open to everyone but is pegged at the standard of someone who has already attended my programme. There will be no recording for the session but a video will be shared on my Youtube channel soon after the event.

Beta Jupyter notebooks will only be made available within the ERM Community.

Tuesday, September 20, 2022

The Three House Investment Plan

Saturday, September 17, 2022

Letter to Batch 27 of the Early Retirement Masterclass

Dear Students of Batch 27,

It’s been a great honour and privilege to conduct a 5-Day Early Retirement Workshop for you.

We’re

getting into deeper bearish territory as the Fed is about to raise rates by

another 75 basis points. This will dampen demand and make it harder for growth

strategies to flourish. Correspondingly, every factor model built by this class

has shifted to favour a value-based strategy. We are slowly changing from a

course that invests in high dividend and low beta stocks. Now we buy cheap

stocks with decent momentum.

One consequence of a shift to value is that the factor models will start to highlight stocks that are unpopular with investors, so the rejection rate this round was much higher. Another anomaly is that, for the first time, the factor models did not flag a single bank or REIT in the final STI portfolio which may need getting used to. DBS was added as a bonus stock since banks do benefit from higher Net Interest Margins as interest rates go north.

The second consequence is that for the REITs segment, I’ve added the large STI REITs into to REITs universe for backtesting and this ended up favouring the very same 7 REITs in the STI. Choosing REITs with strong sponsors, while reducing volatility has resulted in lower yields for the final portfolio.

Students have commented that the dividend yield of this batch is on the low end at about 5.4%. For students who wish to have higher yields, they are welcome to research US Office REITs like Keppel Pacific Oak REIT, Prime REIT or United Hampshire REIT and make a discretionary investment on their own. I‘m not adding them into the batch 27 portfolio as I have a large allotment in my family fund.

The important takeaway is that the model portfolios built by ERM do not bind student decisions in any way and they are free to invest as they wish. The model portfolio exists as a tool to track the investment performance of all ERM students and bind the instructor into investing his training fees into choices made by the students. Poor investment decisions on the student's part are meant to affect the instructor first. This is the unique selling proposition of the course - I have skin in the game.

Lastly, I hope that Batch 27 will participate actively in the FB group. Sometime in Q3 2022, we should be meeting up for an online community webinar.

Hope

to see you then!

Christopher Ng Wai Chung

Wednesday, September 14, 2022

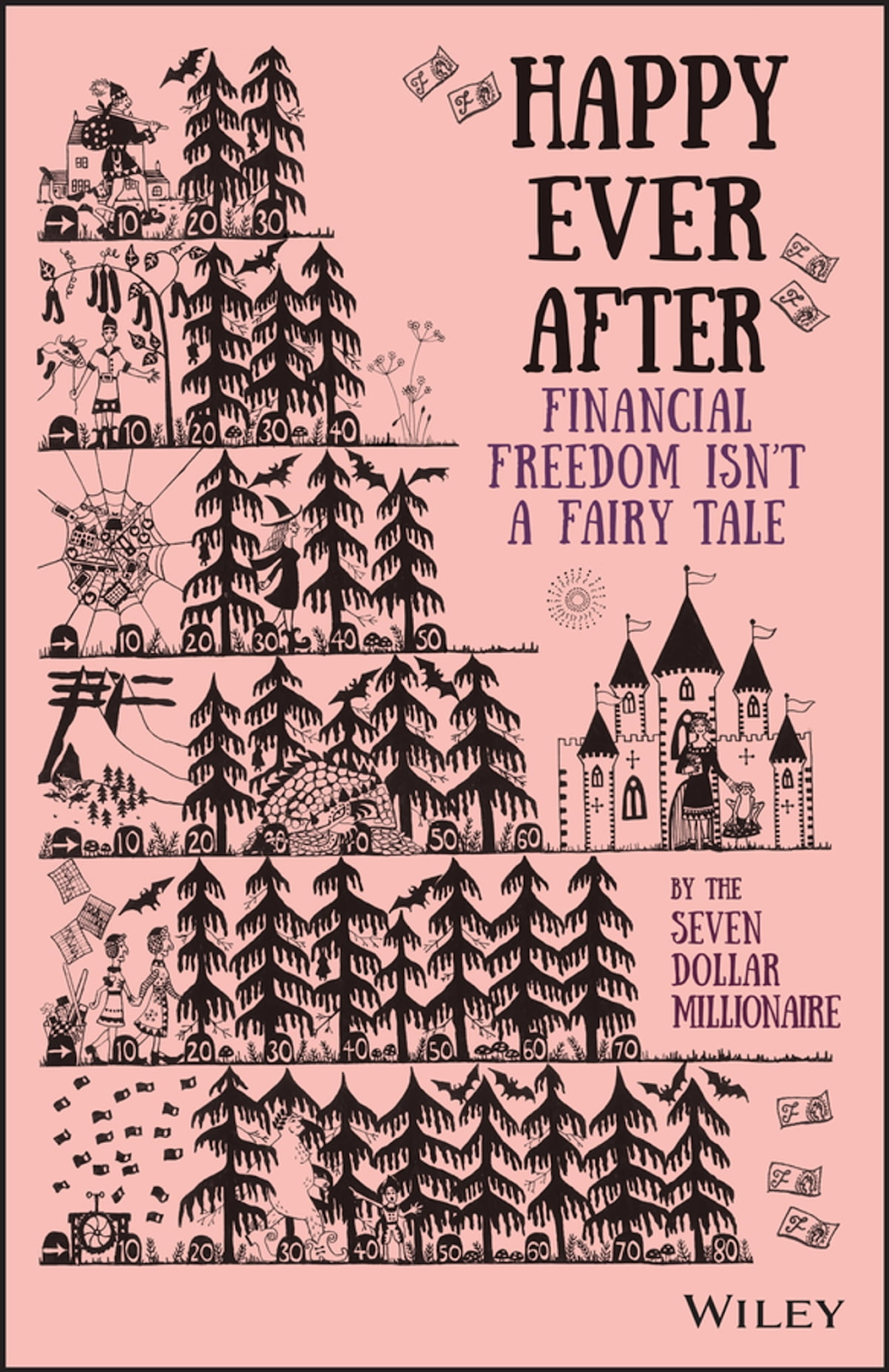

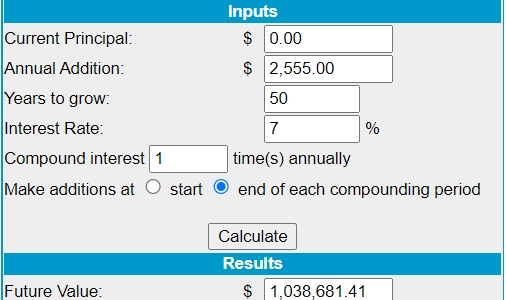

Who is the Seven Dollar Millionaire ?

I've attached the evidence here:

The main point of the idea is that becoming a millionaire is not hard if you compound your investments over time, the question is perhaps how much is $1M worth in 50 years' time, and whether you can retain your good health when you finally get it. For a guy who starts work at age 25, he would have to funnel his CPF Life into his portfolio from age 65 to 75 to get this right.

I'm in the middle of conducting a class. I hope on Friday I can talk about the more counter-intuitive ideas from this book.

If you can, try to support the author and the book, he's already done a lot for migrant workers here while most of us hadn't.

Sunday, September 11, 2022

On developing new personal hobbies

I'm not posting something too hardcore this weekend as I've just returned from Kulai JB where I spent a fun weekend with my in-laws for Mooncake Festival.

Instead, I want to just share with readers what's been happening on the personal front. Mirroring some of the changes in my career, I'm also making some drastic changes to my personal hobbies.

I've been playing Dungeons and Dragons for about 38 years, the game has its ups and downs. With the 5th Edition rules, the game has peaked in terms of elegance and playability, but of late, with more adoption by mainstream players, the game has also become more political. Extremely woke elements have entrenched themselves in D&D culture and it has become a lot more intolerant to campaign elements which were welcomed in the past by my generation of gamers. Recently, the game designers created a new race of monkey men that were supposed to be a slave race to an evil wizard. The player base decided to become offended because it reminded them of real-world slavery and game designers had to retcon the origins of the race.

I don't think game designers can do a good job and tiptoe around fragile players at the same time. The whole point of fantasy is that there is some kind of evil to defeat. I suspect if we push this to the logical conclusion, we will end up with mediocre campaign settings that will be politically correct but bland. I don't Game of Thrones would be so popular if every scene was censored by a woke fanbase.

So I continue to just buy D&D books online but I've almost given up on actual gameplay. My job as a parent is to get my kids involved in RPGs because it's still a healthy and educational hobby, but I think it's time to move on.

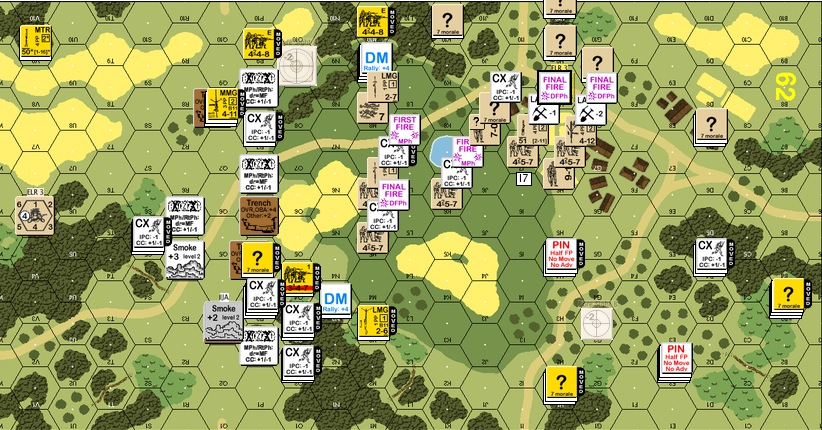

But as one door closes and another opens. By some stroke of luck, I bought some old-school hex and counter wargames and got in touch with the guy who actually taught me D&D 30 years ago, and he's looking for folks to play this seriously arcane wargame called Advanced Squad Leader (ASL).

ASL cannot be considered a game. It is a ridiculously complicated simulation of squad-to-squad warfare in WWII.

You control a few sections of men and have missions to take a few building objectives. Everything is resolved by a pair of dice and it takes maybe an hour of real-time gameplay to simulate a few seconds of WWII combat.

Like in real life, moving in open space to enemy fire is lethal. Not throwing smoke before advancing is lethal. Not trying to take a stone building with at least 3x the headcount of the defender will see you routed. There are tables for different types of ordnance and armour. The psychological makeup of US and German forces are totally different and matter in the game. The tutorial for the game is 133 pages long and recommends actual study like a university module. Rules are more complicated than our Penal Code. Worse, understanding the rules mean nothing as figuring out how to tie your strategic intent into successful mission objectives.

ASL also cannot be politically correct. Sometimes, one of the players actually controls the Nazis. The other player often controls the Rusian Communists. I hope this keeps the woke snowflakes from even trying.

Even right now, I don't understand why anyone would play a game that is more painful than building a diversified portfolio in real life, but I'm happy to meet a few like-minded souls, all guys in their 30s-50s who have the game at home, and did not have a gaming buddy for decades. So all of us are learning the game for the first time in our lives.

After two sessions, I can finally appreciate ASL as a metaphor for life.

We don't have an operating manual for real life or finance, and we can learn the fundamentals for decades before someone comes along and explain FIRE to you which provides the over-arching strategic intent of investing. And many folks who understand FIRE may not know how to invest to make FI a reality. It takes decades to get your finances to work and have it provide a positive impact on your life. Like ASL, finance also requires a knowledge of odds and statistics, but things often go wrong in practice.

With my increasingly heavy involvement in ASL, I'm also changing the way I look at the games I play.

For me, games should be hard. Hard games sharpen the mind. It also attracts a bunch of hardcore geeks and weirdos that I really missed in my RPG sessions in the 1980s. In the 1980s, AD&D players were almost hunted by the local churches. I kinda miss being persecuted actually, it shaped my life as a troll.

If you spend more time thinking deeply about tactics, you will adopt the same habit with your life and your investments.

I'm not sure how many readers will appreciate this post, but I think I'm going to dedicate my hobbies to the Big 3 hardest games with a fanatical fanbase around the world.

- Advanced Dungeons and Dragons ( 1st Ed ) - Just declare a grapple and see your DM's face

- Advanced Squad Leader

- Star Fleet Battles

I've not started Star Fleet Battles yet but my gang will join me after we master the use of Armour in ASL. They've already started sending me the game tutorials.

Wednesday, September 07, 2022

BaliFIRE and Geo-arbitrage - The case of Jean Voronkova

Sunday, September 04, 2022

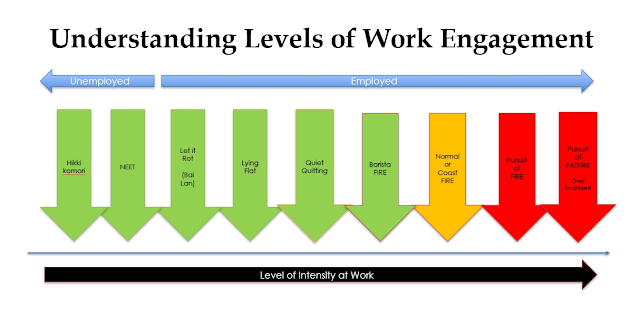

Overemployment as a method to achieve your FIRE ambitions