I had a discussion with a friend on why are there so many failures today who see themselves as polymaths - folks with wide knowledge or learning. It was suggested that these people should not be labelled polymaths, but dilettantes - folks who cultivate a little bit everything without making a real commitment to develop knowledge or skill in a field.

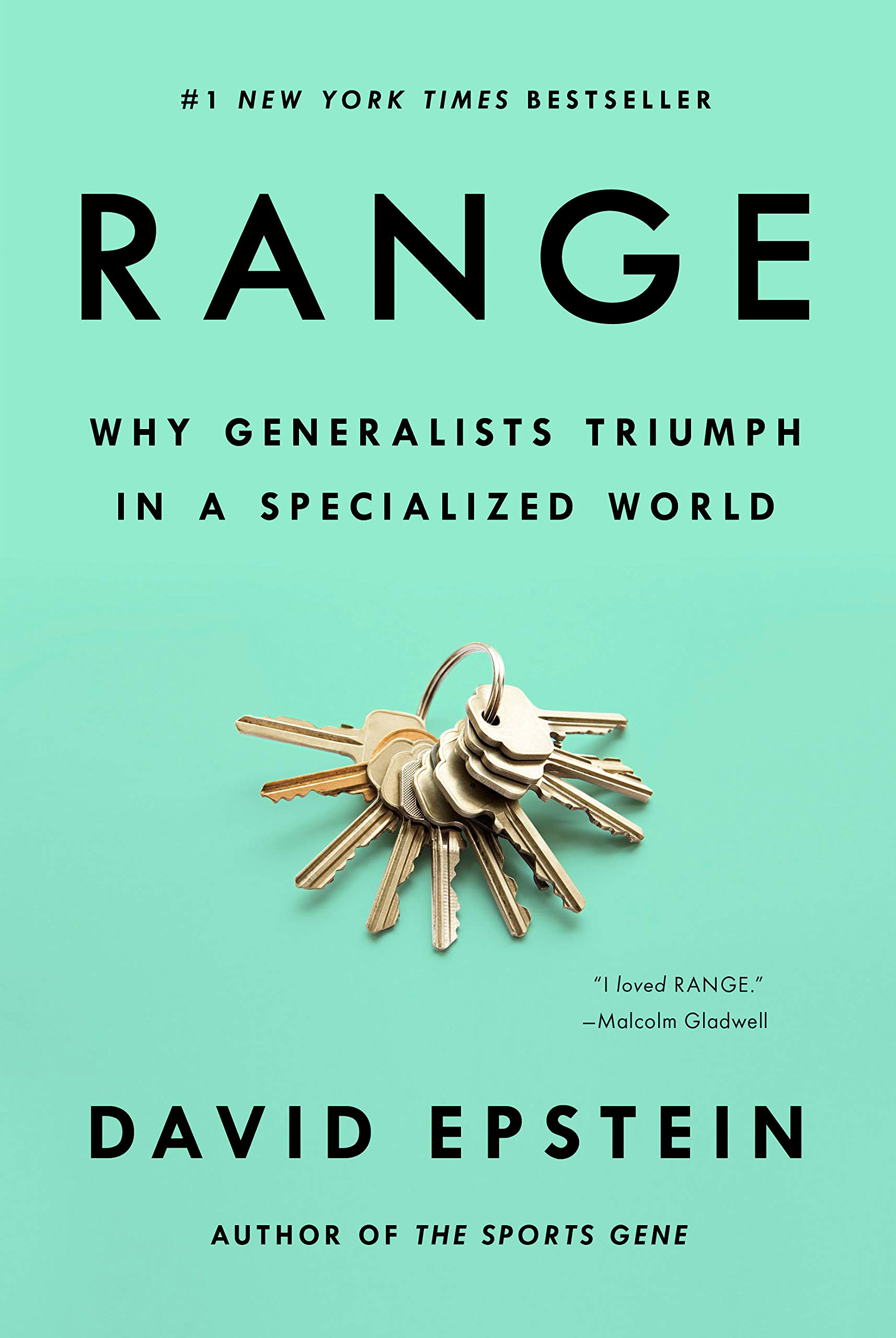

As I've always feared becoming a dilettante myself because I have both legal and engineering degrees but never really did any serious legal or engineering work, so I thought it be better to read the latest book that pits generalists versus specialists.

This book exceeded all expectations and, unlike other books in its genre, did not spend too much time defending a liberal arts education, a very pathetic feature of most works written by philosophy or English professors with little real life working experience. Instead the book focuses on empirical data on forecasting and innovation and showed us why the most wicked problems can only be countered by multi-disciplinary thinking.

I am going to share one useful nugget I picked up from this book which I felt is useful to readers here.

Apparently the dominant paradigm to live our lives in Asia is the "plan and implement" paradigm. Most of us lived lives that are planned by our parents. You decide that you want to become a professional, then you move towards your target by planning all the intermediate steps to achieve your desired outcome. This "plan and implement" approach is what makes Singapore so successful today. Our streets are orderly and a lot of thought and pre-planning goes into government policy.

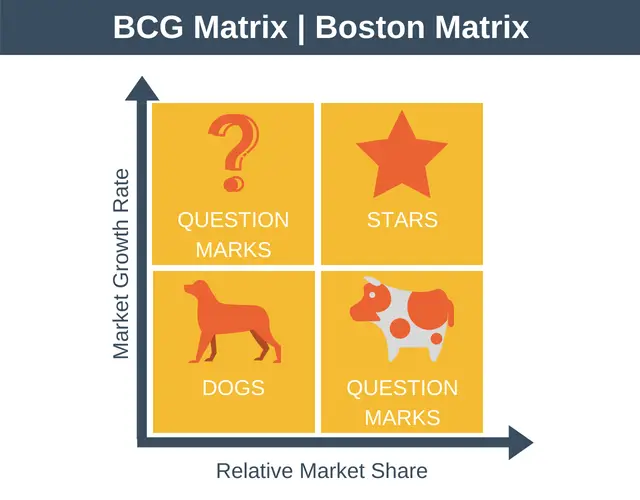

The classic "plan and implement" model is the Gantt Chart and the certification program is the PMP qualification. The financial analogue is the Markovitz Portfolio theory. The legal equivalent is our statutes.

Where the "plan and implement" approach fails is when it comes to law students, the very folks I met and studied with during my JD program. Getting into law school requires decades of planning. You need to get excellent A level grades to qualify for law school. After that you need excellent grades and connections to get into a law firm of choice. Life outcomes between lawyers who get the biggest firms and the smallest firms can be very different.

The "plan and implement" approach fails if the entire legal industry gets upended by technology and oversupply. Imagine working hard only to end up in an industry that also admits Australian graduates all thanks to a free trade agreement Singapore has with Australia. Soon, NUS and SMU law graduates will have to contend with the new SUSS graduates.

Thus, I may be the few very unfortunate PMETs who had to compete against Indian IT professionals via the CECA and Australian law graduates via our FTA within a single lifetime.

There is an alternative approach to life.

This the "test and learn" approach. You take small bets to see what you can learn from doing something. If the bets work, you can scale it, otherwise you start doing something else with the experience picked up after a few false starts. The classic model behind the "test and learn" approach is the Kelly Criterion approach to bet sizing and the Agile methodology in software development. The legal equivalent is our common law.

It is very hard to use the "test and learn" approach to get into a professional vocation because picking up professional skills is a huge investment of time and money. Our education system also does not have any feature that gives people exposure to this alternative paradigm although reforms are happening quite fast in this area. However, this is the ideal approach for entrepreneurship and investing - keep your position sizes small and always be pivoting into a better option.

My move into the training industry came after multiple failures at planning and implementing professional career changes. As it turns out the skills I picked up from all this time in school can be combined into a career that is more profitable and time-friendly than an engineering and legal career combined.

Of course, readers should not view the two paradigms as being mutually exclusive. Many areas in life can benefit from more careful planning and agile pivots. I remember when I was in P&G the IT project managers that came in from China view P&G Singapore only as a stepping stone. Openly displayed on their computer screens were Gantt charts on how to eventually obtain Canadian citizenship. But Singapore was mere the first in many moves to gently pick up some skills in moving from country to country.

I think as Singaporeans, there is too much emphasis on planning and implementation. This is why so many of us are stuck working 45 hours a week in jobs that make us unhappy. Let's have more "test and learn" in our approach towards life so that we can make small incremental changes to make our lives better.