Market segmentation used to be easy when I was reading about it for fun.

When I actually do it as part of running a business it becomes very hard. This is because when you have a business running, market segmentation is an empirical exercise. You need data to understand the customers paying for your service offering. Old school approaches to guessing the profile of your customers can lead to sub-optimal profits for this section must be taken seriously.

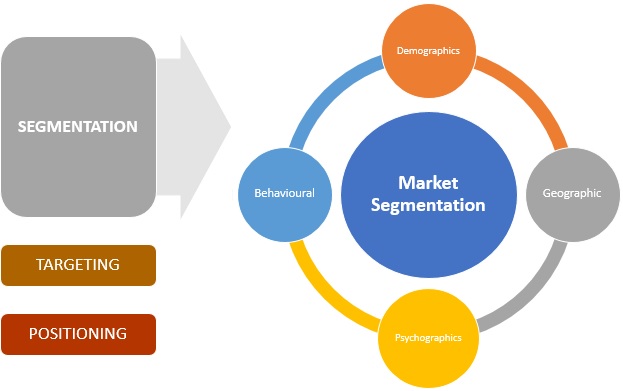

There are 4 dimensions to market segmentation :

a) Demographic

This is basic information on age, gender, marital status and education. When it comes to demographics, trainers generally attract their own kind. My course has a very strong male population in their 30s-40s - many sign up because are fans of my relationship articles on this blog.

How to expand beyond this middle aged males segment is an important question I need to answer. Millenials would have made great ERM customers not because of the amount of capital they have, but because of the amount of time they have to compound their investments and propensity to take on more leverage risk.

I really don't want to lose this crowd so I will be working with Millenials to see how I can appeal to them in a better way.

b) Geographic

This is based on location and I do not have any information on my customer. Perhaps it would be nice to map customers into Districts. I am confident that valuable insights can be gleaned if I can get some visibility on this.

c) Psychographic

Interestingly I had a conversation with Alvin Chow, CEO of Dr Wealth on this topic yesterday. He believes psychographics is even more important than other forms of segmentation. Fact is that my class attracts a lot of engineers. In fact, Dr. Wealth attracts a lot of engineer-trainers so the bias may be built into the whole company design ! Their latest Quantitative Investing class is totally run by engineer hedge-fund gurus.

Attracting engineers is great but it limits the scope of investment training. I increasingly believe that this is not through active design as the mathematics in my course is not that hard and social science majors can benefit more from my program.

It is likely that I attract engineers because I status-align with them much better. While I am a dinosaur in IT these days, I still emphathize with project managers and can converse very comfortably about software development and IT infrastructure. I find it much harder to talk about feelings and relationships, that's unless someone wants a really cynical conversation about divorce law and it's effect on families.

I am seeing opportunity in stretching beyond the engineering sector. Recently, I am enrolling students who are athletes and designers and it is very satisfying to see them get some dividends rolling into their bank account, but I suspect I need a lot more to show them a lot more empathy to convince them that I can help them.

Still, I doubt I'll get enough lawyers to attend my class, though. Lawyers are supremely skeptical folks and may not have much respect for data that rely on historical precedence. Some may want a rational-deductive approach to show why an investment will work in the future, I doubt I can provide a definitive assurance for that. ( They should be careful when meeting gurus who claim that they do. )

d) Usage

This is the most exciting part about Market Segmentation I want to explore. A lot of folks buy baking soda for reasons other than baking. Baking soda can be used for cleaning as well.

I've known for a while that a lot of retirees attend my Early Retirement Masterclass and increasing I am getting students who can teach me a thing or two about early retirement themselves.

So I am building a new consumer profile - someone in their late 40s to early 50s who is very competent about making money, but coming from the business or property investing world. They may not trust their private bankers and want to educate themselves on how to deal intelligently with them and want someone to ruthlessly bust the myths spread by the financial advisory personnel.

For this to happen, I need to bring in some legal chops in the relationship to be able to understand the class of problems they face - some may need a trust-like structure to provide a legacy for their children.

The payoff for good market segmentation is high. If I can successfully define my customer segments, I would be able to craft a marketing message for each segment that adds value to them and we will not need to blast emails that trade-off on our goodwill in the future.

Some trainers ave already become public enemies for the FB marketing campaigns they have launched and I'd rather quit the business then fall into this category.

No comments:

Post a Comment