Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Sunday, May 20, 2018

Feasibility of Bond Margin Financing

[ Feedback for this article is fast and furious !

Some concerns raised is whether investment grade bonds with a short duration can even be found in the markets ]

This has been a great week. The folks of Kim Eng held an open house and invited me to attend. The catered food was relatively good given that my exposure to free buffet is limited to what is available in SMU law school. They also gave me a pair of free movie tickets because I was such a special margin financing customer.

I'm just saying all this because I know they read this blog quite religiously.

Anyway, let's have a closer look at their bond margin financing facility.

Maybank Kim Eng has a fairly competitive rate to facilitate bond margin financing. I invite all readers to share with me what private bankers give them, but 2.28% is sweeter than my rates for REITs financing, but we have to live with the lower returns from bonds.

The framework I am using is the traditional use of the Kelly Criterion that blackjack players use to size their bets. The better the odds of winning, blackjack players will place bigger bets. I also employ a modification called the half-Kelly because gamblers generally half the output of the Kelly Criterion so as to err on the safe side when placing bets in a casino, this way they can survive longer.

Ok, so let's look at a typical deal the Maybank guys have suggested to me that night.

Suppose we have a bond with one year left to go. Let's assume that this is a bond issued by a local bank that returns 4% and is rated AA - it's a safe,conservative bet. As bonds are sold OTC, each bond position is a hefty $200,000. I also did some searching on Google and I found that in the worst case, a AA bond defaults with a percentage chance of 0.38% in a super bad year like 2008. This gives us a worst case scenario for a default. To simplify matters further, if a bond defaults, I assume that you will lose everything even though the insolvency process might give you higher priority than shareholders.

So assuming that we have war-chest how much of it can we put into investing in this bond without leverage?

We apply the Kelly Criterion, or [b(p) - q] / b, where b is the odds on a success or 0.04, p is probability of success or 0.9962 and q=1-p or 0.0038. If this bond were a blackjack game, the Kelly Criterion will recommend that 90.12% of your war-chest can be placed on this bond. Sane gamblers use the half-Kelly and can invest 45.06% of their portfolio into a bet. At $200,000 for one position, you need to be almost half a millionaire to take this bet.

Now let's look at the Kim Eng deal that allows us to employ some leverage to buy these same bonds but at a cost of 2.28%. By leveraging 300%, you only need $66,667 to place a bet on one bond. There is, of course, a 0.38% chance of utter ruin. Suppose we apply leverage, there is a 99.62% of winning (4%*3 - 2.28%*2) or 7.44%. This translate to odds of 0.0744. There is a corresponding chance of a disaster occurring with a probability of 0.0038 where we will lose 304.56% of our bet.

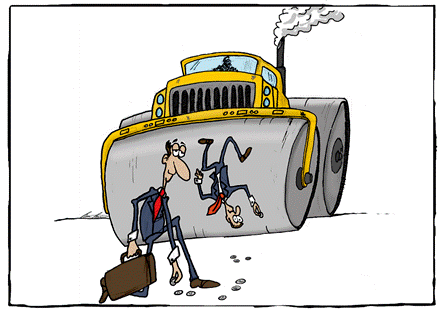

(Expect to lose everything when a bond defaults. Also you will owe the broker the money you borrowed from them as well. )

Put all the numbers into the Kelly Criterion, the equation will allow us to bet [0.9962 x 0.0744 - 0.0038 x 3.0456] / 0.0744 or 84% of your war-chest. Using a half Kelly, this is a bet sized at about 42% of your war-chest.

What can we conclude from this exercise ?

a) A margin account for bonds allows a smaller retail investor to bet on bonds, something that is the province of the UHNW investor. The first case where there is no leverage, you will need about $400,000 to justify placing one bet on a bond. In the second case where you employ leverage, you only need ($66,667/0.42 ) or $160,000 to justify one position.

b) The equation covers credit defaults but most of the fear in our current market comes from interest rate risk. The smart money is betting that the Fed raise interest rates three times in 2018 and twice in 2019. If this prediction is wrong, there will be bigger shocks to bond prices. This is why leveraged bond bets should focus on bonds that will mature soon, like within 1 or 2 years of placing your bet.

c) Having bets with a size of $200,000 or $66,667 is still fairly large for a retail investor, so expect only quasi-affluent folks to be making use of this margin facility.

d) Unless you are a multi-millionaire, most of your positions will not allow you adequate diversification.

For now, I will be sticking with my REITs margin financing account which is doing ok. After it hits my ideal size and leverage ratio, I will not be ready for bond financing yet because I want to start working on a market neutral portfolio using CFDs which is something I hope to start doing in 2018.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment