Funny things happen to Dr. Wealth part-time staff when they support our preview events.

Yesterday, one of my colleagues was telling me about a hilarious thing that happened to him when he was supporting some other event. Apparently the trainer next door was doing a preview on numerology and the staff for that event decided to strike up friendly conversation with my colleague.

This numerology masterclass support staff befriended and then attempted to "psycho" my colleague by asking to apply some numerology techniques to his phone number and then proceeded to make a couple of hilarious predictions. Some of these predictions included "you have recently lost money in gambling". As it actually never happened to him, my colleague disagreed with all of his predictions. Before giving up in frustration, this amateur numerologist then said "although my predictions did not happen in the past, they may happen in the future".

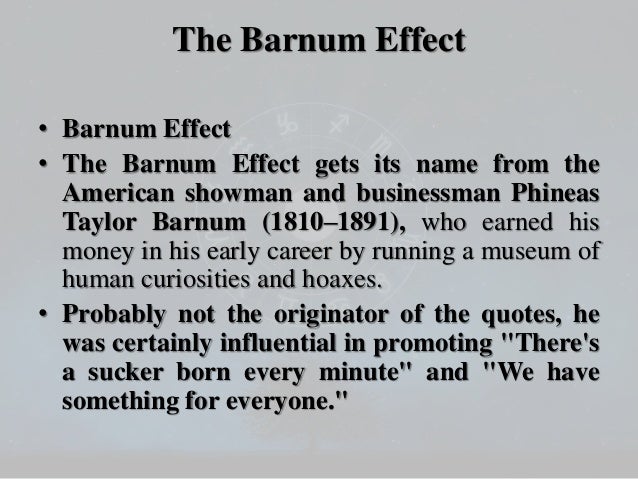

This led to funny conversation on the Barnum Effect.

I explained to my colleague that, actually, some predictions, called Barnum statements, can be made with over 95% accuracy and I proceeded to demo some my predictions on him. I told him that he is someone who seriously questioned his own capabilities in the past, but in his future, I see him regaining his confidence when his goals begin to bear fruit. He was amused and instantly agreed with my reading !

Barnum statements are statements that can never be wrong. You can find a list of examples on this wiki page here. Coming up with creative variants of the Barnum statements on the list will allow you to sell any form of Divination, from Bazi, East Indies Voodoo to energy focusing crystals.

Investors who know the Barnum Effect have to be careful when reading investment news because mass media is replete with some variant of Barnum statements. It's very common in any field of prediction.

One of the worst culprits can be found in Technical Analysis.

When a stock is trending is a particular direction, it is very common to talk about resistance and breakthroughs. A stock can meet a resistance and reverse direction, or a stock can breakthrough the resistance level.

The question is what is the probability that the stock will do none of the above ?

Almost nil. The technical analyst can never be wrong. The question is whether the prediction has any value to the hapless investor.

Value investing is not spared from Barnum statements.

Suppose we make a claim that a stock has an investment moat or sustainable competitive advantage. It is not difficult to justify that moat. A company, at any time of the day, can have a business niche, a license from a regulator, or solid management chops. It is possible for an analyst to fall in love with a stock, declare a moat first, and then find a number of positives to justify it later. This is called confirmation bias.

Worse, this is not limited to merely qualitative analysis.

Closer to my version of quantitative investing, some FAs are cherry picking unit trusts that outperform ETFs to show that active investing works to get more sales commissions. To justify their authority they are displaying a limited number of clients who made money. You need to be a very bad FA if you do not have a few clients who have done well buying your products.

You can also engage in dishonest valuation by varying discount rate when doing discounted cash flow analysis. Lower the risk free rate and you can justify any intrinsic value of a stock.

You also need to be skeptical even when you meet quants like me.

What is stop me from conducting 20+ back-tests and presenting the best one to sell to my students and call it the GOAT investing strategy of the day ?

To me, the only solution is for the predictor is to have some skin in the game.

Don't talk cock, put your money where your mouth is when you talk about direction of interest rates and market cycles.If you tell my fortune and see good luck in the future, let us both buy a $100 4D ticket together and see what happens. This Chinese New Year, as someone born in the year of the Tiger, I gave money to all my Pig nephews and asked them to gamble on behalf, splitting my winnings with them.

I probably won the largest amount I ever did on any individual new year.

To be consistent, have consistently farmed my trainer fees into a leveraged portfolio built by my students and have earned enough from this to have taught a new class.

This way, while I cannot guarantee that my students will do well, I will be there to suffer the consequences if my investments go bad.

You should treat any modern day Shaman, Oracle or Forecaster the same way.

I think the old method of hiding behind "conflict of interest" whereby most fund managers & analysts don't even have a single cent of skin in the game when it comes to funds and/or stocks that their hawking .... will soon become obsolete. And be replaced by actually having a substantial chunk of their own networth in whatever they're selling or promoting --- you see more & more of this with fintech founders & Millennial startups of ETFs & portfolio mgmt.

ReplyDeleteEven more so when it comes to insurance agents, financial advisors & RMs with products like endowments & ILPs. The day will come when they can no longer hide behind "everyone's financial situation is different". That *may* still apply to pure insurance, but when it comes to savings & investments --- like they say with insider buying --- there's only 1 reason & it applies to everybody --- to maximise returns & gains.

Hi Chris

ReplyDeleteIt is good to seek differing views that challenge the assumptions of your valuation metrics. Dishonest valuations based on tweaking discount rates, growth rates and terminal value is omnipresent in absolute valuation models by analysts. There are times whereby even the analyst are not certain about the assumptions in his model.

Do you have such problems when attempting to substantiate your investment decisions?

INTJ,

ReplyDeleteI don't really run into that issue because I do not use DCF models. My biggest issue is convincing myself that that historical performance will translate into the future.

I try not to drink my kool aid too much so I am always looking for signs of an inflection point and reasons that my models can be wrong.

Regards