Long Tails are the bane of many investors. As I derive a lot of investment insights from quantitative investing, I have to accept the precarious position of comparing investment strategies using mean and variances while obviously being aware that markets do not act "normally".

Unlike the normal distribution, long tails are modelled differently.

One example is the size of cities.

Cities have a tendency to arrange themselves in power-law distributions which is governed by Zipf Law. The rank of a city multiplied by its size is a constant. New York has a population of 8.6M. Second in rank is Los Angeles has a population of 4M. 2 x 4M approximates the population of New York. The third largest city is Chicago has a population of 2.7M which is about a third of that of New York.

One model that explains why things somehow arrange themselves neatly into Power Laws is the preferential attachment model. This model assumes that entities like cities grow at rates relative to their proportional size.

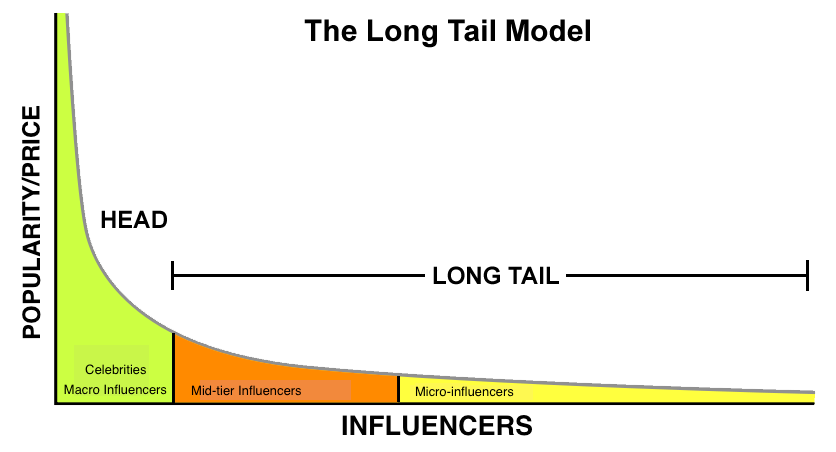

One effect of long tails is that the social influence creates greater inequality. A better book or catchier song may be slightly better than the book that is in second place, but it garners rewards much higher level than what it deserves.

In a world of long tails, we have to be prepared for large events to happen with much greater probability. Earthquakes satisfy a power law.

This is one reason why many investors do not sleep well at night.

When the market goes south, correlations increase to one so large losses will also be felt by portfolios with plenty of diversification.

Here's an experiment the reader can try with cryptocurrencies. One hypothesis of mine last year is that the market capitalisation of crypto-coins should also follow Zipf Law and perhaps some sort of long-short trading technique can be used to trade cryptocurrencies.

Sadly, I lost interest in this asset class after it tumbled in 2018.

One can either accept & face a long tail straight on, or devise some way to side step or mitigate a long tail.

ReplyDeleteCommon methods include:

- large portion of low correlated assets like treasuries, cash & gold

- maintain a position of puts as portfolio insurance

- use trend following

- short selling

A person with a large enough portfolio can probably sit thru a temporary -50% drawdown and -50% dividends cut, while being sufficiently diversified to not be killed by 2 or 3 of his stocks or securities going belly up. The reduced dividends are still sufficient while one waits 1-3 years for the portfolio & economy to recover.

Those with high human capital e.g. young with in-demand skills, will be better able to sit tight and redirect more of their earned income to buying depressed stocks.

I used a couple of the stuff above to guide myself thru 2008-2009.

Thanks, Unknown.This advice is gold !

ReplyDelete