This Valentine's Day, readers are in for a treat !

Today, I will explain in detail my quantitative approach towards finding a significant other.

If I become a dating coach, I will become so rich, Warren Buffett will be asking me for financial advice.

If every guy follows my approach towards meeting women, SDN will cease to exist and no one will use Tinder anymore.

Here is how to adopt a quantitative approach to seeking love.

a) Decide to make a choice about your life partner.

Once upon a time, I was matchmade to a lady banker. After two dates, we decided to mutually call it off.

Allowing yourself to be subject to matchmaking is to surrender yourself to fate.

Amor fati is the love of one's fate and promoted by philosophers like Nietzsche to suggest that one should view things like suffering as ultimately a good thing. Perhaps consequently, Nietzsche went insane from syphilis before he died.

Instead I suggest a superior approach which I term

Amor Electionis. Love of choice.

If I don't let a broker choose the stocks I buy, I don't suggest you let anyone choose who you date.

b) Know what you do not want.

What led the matchmaking attempt to fail was that time when the lady banker showed up 45 minutes late and pulled a long face throughout the date causing me to miss out 1/3 of a movie. Her reason for being a bad date that day was that "the options she bought was out of the money."

At that point of time, I felt like a spurned investor in a S-Chip stock.

I made a decision then that I will stop dating and pursuing Singaporean women. Similarly when I craft a quantitative strategy, I reject all stocks domiciled in China in SGX.

It's not a judgment on all Chinese companies.

just think that missing out on the good ones is a small price to pay to avoid the really bad ones.

c) Find a good place that acts as a screen for a good life partner.

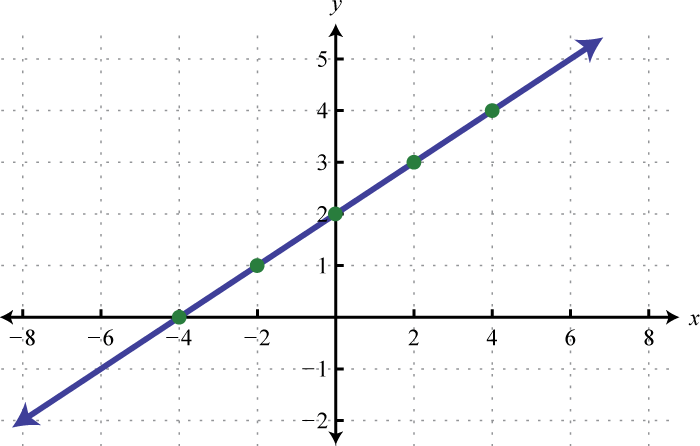

A good fundamental screen may be to select stocks with a low price to book value but coupled with high dividend yields. These generate portfolios that can be held for life with minimal rebalancing.

Good value factors also determine whether someone is a good spouse. Someone who is resilient, conscientious and very much into self-improvement is a good partner for life.

The location where you meet women is very important.

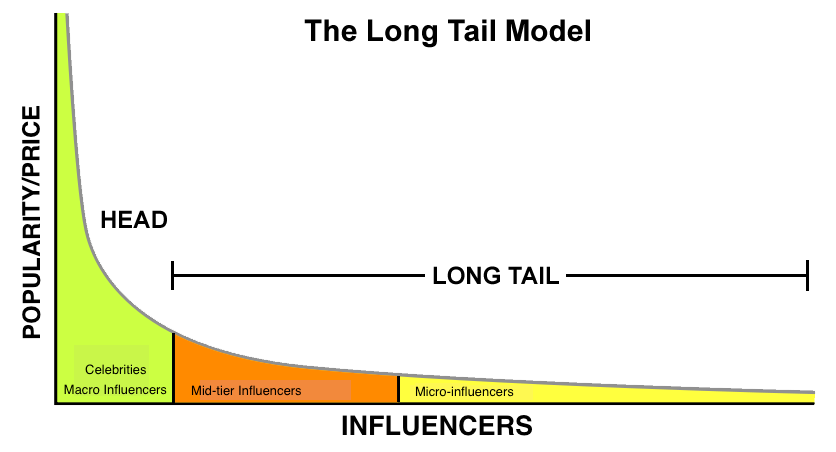

To meet women who meet my screening criteria, I chose to take up foreign languages because language classes naturally attract people who are out to improve themselves and have the patience to pick up something new. I would have preferred finance classes but such classes have few female students.

In those days, I refused to choose Salsa dancing because I cannot figure out why men want to pick it up for any reason rather than to find a spouse. Salsa also attracts people who might value style over substance.

For that same reason, I do not use growth metrics in my quantitative screens no matter how trendy growth investing is these days.

d) Screen for a reasonable number of candidates.

Initially, I thought that language schools are a great way to meet spouses because of class turnover. French classes run 6 times a year with each 20-30 students in each class. If half are women, I could be looking at 60-90 potential matches a year. If I keep shifting my weekday classes, I have a veritable buffet in my hands.

Sadly, my first attempt to find a girlfriend from French School failed because I felt that women who take up French are fooled by the romantic feel of the language but get a rude sock as French is highly technical and has a lot of conjugations. These women also seem to prefer Caucasian men. I did, however, earn myself a DELF certificate for my trouble.

If a screen does not give enough matches in one market, try another market ! A nice quantitative screen will test well even in Bursa Malaysia or the Hong Kong Stock Exchange.

In the end, I studied French and Japanese simultaneously.

e) Once you get a match. Take action !

Eventually, I lucked out.

A Malaysian girl popped into Bunka for two classes and decided to drop out because she did not like its teaching style. I told myself if I did not ask her out for a date, I would lose my chance forever... so I pounced.

A screen can flag many stocks, but at the end of the day, you need to open a brokerage account and create the portfolio that will take you out of the rat race.

As male readers might know, it is very hard for a Gen X RPG nerd to find a girlfriend and get settled down, but I took the idea of Love and scienced the shit out of it until I found my life partner.

I have won...

And for those who wonder about that lady banker I dated...

... according to FB, she is still single today !

Happy Valentine's Day and may your love life be as bullish as the stock markets in 2019 !

Huat Ah !