Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Thursday, March 01, 2018

The Influence of Language on Personal Finance

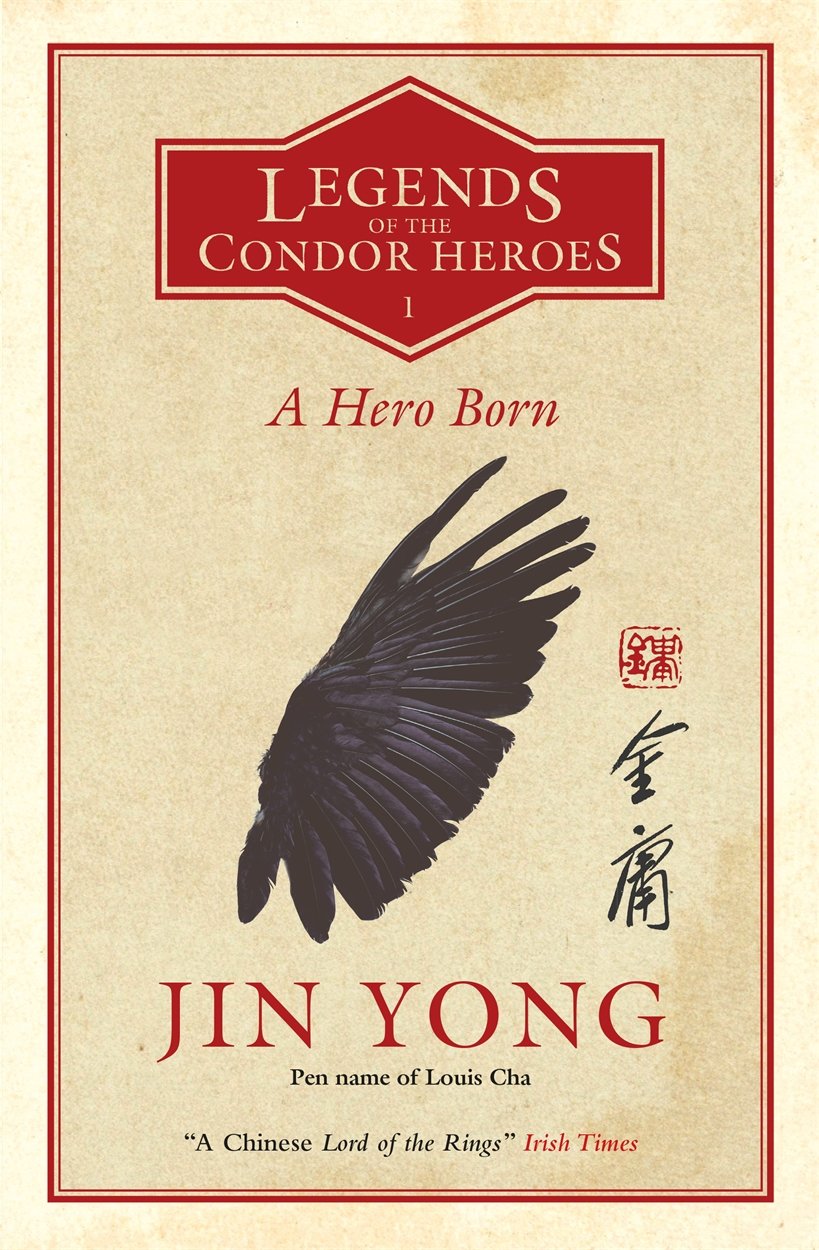

This is the single most momentous event in Fantasy Literature with Legend of the Condor Heroes being successfully translated into English. Translation of this work is so difficult and thought to be previously impossible, even the Economist published a book review last week. I was never able to watch a complete series on this storyline so I was kept mostly in the dark when it comes to Jin Yong's work, having only completed the Duke of Mount Deer series which starred a young Tony Leung Chiu Wai in the 1990s.

Reading this in book form is epic. Imagine the possibilities - we could read the same book as part of English Literature class but also as part of Higher Chinese. This will resolve the issue of CL2 being boring. Dream of the Red Chamber is about an effeminate man-child and his side chick, nothing can make you lose interest faster than being forced to read this kind of drivel. Legend of the Condor Heroes features non-stop Kung Fu fighting that pits the Seven Freaks of the South against the Twice Foul Dark Wind. Even Tolkien is boring compared to Jin Yong.

I see my daughter's love for Mandarin being killed slowly by the current education system where every mis-stroke is being cruelly penalised in Primary 1. This is slowly driving my daughter to become a banana person like me.

Ok, let's talk about language and personal finance.

The impact of language on personal finance is profound and social science is only coming to grips to this new reality. In a working paper entitled The Effects of Language on Economic Behaviour : Evidence from Savings Rates, Health Behaviours and Retirement Assets by Keith Chen of Yale University, thinking in particular language can shape your savings behaviour.

Some languages, like English and French, have a specific grammatical framework to mark out a future event. eg. I will be going to a seminar. Clearly the seminar will happen in the future. Other languages like Mandarin, do not have a future tense, Wo3 Qu4 Ting1 Jiang3 Zuo4 does not clarify whether the speaker is going to seminar right now or in the future. You preface it with Ming2 Tian1 if you want to specify the time as tomorrow.

Social scientists discover that people who think in a language like English and French have a tendency to distinguish their future selves from their present selves. As a consequence of that, the savings rate and accumulated assets of these people are low. In contrast, folk who think in Mandarin, German or Malay have higher savings rates and larger accumulated asset base because the delineation of the future self with the present self is less clear. Even within a country like Switzerland, German speakers were found to have higher savings rates than French speakers.

The current explanation is that we will take action that will benefit our future selves if the future does not seem to distinct from the present.

Some findings within the paper is really surprising.

There are larger proportion of English speakers in Singapore compared to Malaysia. And as a consequence of that the paper reports that the savings rate of Malaysians exceed Singaporeans !

I'm sure the folks who are most excited about this finding might be the old school Nantah Graduates because it vindicates the bilingual policy.

But can making your children act and function in Mandarin or Malay make them more conscientious and money savvy?

This is, indeed, a possibility.

Hopefully, this weekend, we can explore the influence of religion on our personal finances.

No comments:

Post a Comment