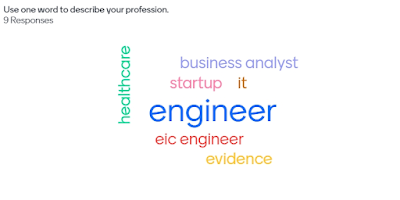

Sadly, the book was able to define the problem but does not delve into possible solutions. If anything, Singapore is already ahead of the curve - SIT does not look like a research university but an attempt to build a lucrative industrial apprenticeship program for polytechnic students. Skillsfuture also enables folks to qualify for new careers within a lifetime. We need to give Lawrence Wong time to rebalance the different work-collars.

We need to relook at the consequences of too much emphasis on the cognitive elite if Tan Kin Lian scores more than 20% after this Friday. I can think of examples where some policies are so complicated that folks with average IQ may need help to grasp them well.

The elected presidency is one such policy. Last night, we witnessed that even a presidential candidate, a student of RI and an actuarial scientist need to comprehend the limits of a President's power and be reminded by the moderator what the role of a President is all about.

Another policy is CPF Life. To make an informed choice between the Basic, Standard and Escalating plan, a citizen needs to understand the concept of an annuity and forecast his lifespan to minimise regret. Do we need three flavours of CPF Life? If you are an Oxford PPE, you can deal with 27 flavours of CPF Life, but even three flavours may be too much for ordinary citizens.

Suppose you look specifically at what makes Singapore successful. In that case, the scholarship system that allows the PAP to cherry-pick the best for their own ranks is one factor that keeps government expenses, corruption, and inflation lower than in other OECD countries.

If I were an opposition supporter, dismantling this scholarship system would be one of the surest ways to level the political field, more consequential than dismantling the GRC system because this is like the supply line that feeds the PAP army. The opposition can manipulate Hands and Hearts to vote for them to make this happen because they have been sidelined for so long. Tell me this: Has anyone ever celebrated when you parachute an army general into the C-Suite of a GLC?

Goodhart's book influenced Lawrence Wong because he has alluded to the head, hand and heart triad before in his speeches, but I'm afraid that Singapore may not have done enough.

A non-degree holder PAP MP has not existed for quite a while. The last was Charles Chong. Discrimination against non-degree holders in politics is current and more egregious than race or gender. If Tan Kin Lian wins big this Friday, we may need to reserve one seat for a non-degree MP in a GRC to ensure their views are heard.

Imagine a country where none of our Ministers have children studying in our Polytechnics or ITE.

Whenever a policy recommendation is made, it will always be one made for "other people's children".

Anyway, I might be wrong, and TKL loses his deposit on Friday, but I think we should still heed Goodhart's warning and bring balance to the head, hand and heart triad before angry Singaporeans start to vote to merge with Malaysia.

Like we learn from the West, when you spurn the heartlands, they may stop voting based on their best interests and start voting based on your worst.

There will be no dividends for me to collect after that.