When the Stanford Marshmallow Test was conducted in the 1970s, psychologists concluded that kids who can exert enough self-control to resist eating a marshmallow move on to have greater life satisfaction and success. This rocked the world of self-help when the ability to delay gratification was then touted as a powerful predictor of personal success.

But in 2020, psychologists attempted to replicate the experiment with a more diverse and larger sample size, they found that the effects were very much more muted, with children with a higher SES background being able to resist the marshmallow much better.

Heck even when my son was sent to NUS to measure his ability to resist temptation, he coped well beyond what other kids could handle because I would buy him an ice-cream quite often when I brought him home from school so a Mars bars is not very much to him. Perhaps the modern test should be 10 mins on an iPad, with an extra 30 mins if the kids can do nothing for an hour. I think my kids will fail the test if it's designed this way.

Validity of the test aside, business and executives should design their own version of the Marshmallow test to see whether the folks they work with have the capability to delay gratification. Not everyone is designed to be able to commit to long term projects to make money.

I noticed a particular pattern among the younger people I get exposed to.

The folks who condone quick-fix marketing messages that hijack the emotions of other people also have a heightened fascination with get rick quick schemes. They might be useful to other business people, but these are not the kind of folks who can support a product or project that builds wealth steadily. When I work with folks like this, my brand almost always takes a hit.

So how do we design a Marshmallow test for our personal use?

The first cut is always educational qualifications. Sadly, Singapore is so hierarchical and obsessed with paper qualifications, a degree from a local university requires a lot of careful planning and execution. This will be followed by the field of study - the harder the field is, the more conscientious and intelligence the candidate will be.

But what if you're just stuck with candidates with the same qualifications?

Then you need to design something from your own industry. Maybe in software engineering, you might wish to see the developer's comments in their software code to see whether they are intelligible, whether Programming Patterns are adhered to and variables don't get recycled.

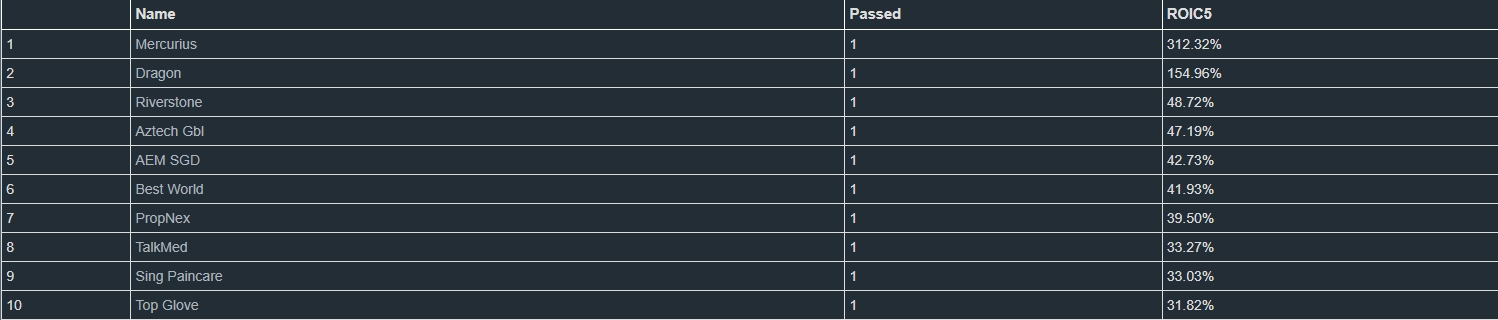

For me, I will just show or write about the latest REIT current dividends.

If you are an investor for a while, REIT dividends are fairly high right now and some of the heavily beaten down REITs like EC WORLD can be bought at bargain prices.

More of the folks who get excited about the table above tend to become my better clients. As yields are at a historical high around 8%, it's still mathematically impossible to get rich quickly by waiting for REIT dividends to arrive. Folks who are interested in this are generally willing to pay the price and delay gratification for financial independence.

Now to complete the test, we need the opposite of REITs dividend yields.

The above table shows the real-time yields of Apollo Vaults, a platform to do liquidity pool mining on the collapsed Terra Classic blockchain. The yields fluctuate by the day and are largely boosted by exploiting mathematical differences between APR and APY. More importantly, vaults compound in USTC, which is a stablecoin that has already collapsed in May 2022. So while you can compound your USTC at 1,600%, USTC can collapsed by 60-70% over a day's trade.

( I love channeling part of my REIT dividends into the Terra Classic Blockchain. )

Invariably, Apollo Vaults will attract a different kind of investor. These are the same folks who can really comfortable discuss options, drop-shipping, building a business empire with information products, direct selling and SEO. They may not be the students that I'd like to have but are grist for the mill for the dudes that show up in a Youtube ad.

( Yup, even my crypto course is too serious for them )

This is what I've discovered over time, as I flash the different mathematical properties of the two asset classes I teach, I excite a different demographic. The same goes for different blog articles.

The really sad thing was that I had an even more powerful Marshmallow Test when I was growing up :

I stared playing D&D at the age of 10. What's a fricking plate of marshmallows compared to a handbook that introduces the bell curve to primary school students using 3 six-sided dice?

The 1st Edition AD&D was so dense and difficult as a ruleset, it's impossible to play without at least processing 100+ pages of text. Worse, in the 1980s, no one plays D&D in a consistent manner.

Too bad the latest edition of D&D has become so simplified that it's now a staple of mainstream entertainment and playing D&D has lost it exclusivity.

Pfft, you can even catch Vecna on Netflix.