Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Saturday, April 30, 2022

Being aware of the latest FA tricks of the trade.

Tuesday, April 26, 2022

Back to the Grind

I'm still dead tired but I started updating my Cryptocurrency notes this morning. I think things have changed so much I am overhauling 20% of my material :

a) Crypto.com now accepts FAST transfers from local banks, rendering my notes on a centralized exchange obsolete. Significant portions of material became optional overnight, but this should make it easier for older investors to get started in crypto.

b) I'm now more open-minded about liquidity mining and think 1% allocation is ok, so I need to ramp up my notes in this area. Mouth watering yields over 100% is possible but so is losing your pants.

c) I suspect one of my students installed a hacked Terra Station wallet and it siphoned off his funds. The amount is small but I have to incorporate some troubleshooting notes. How do we the software we are installing is the right one? If we cannot answer these questions definitively, investing crypto will continue to be a bad idea.

I'm slowly beginning to realize that my course material is several magnitudes more dynamic than my notes on traditional dividends investing so creating an online webinar may not be feasible and I need to continue to run my classes live and adjust the fees accordingly.

As a business, we have go with our gut feel and learn new stuff along the way. I think there is blue ocean for trainers who can combine traditional and crypto investing in a coherent way that respects the fundamentals of finance.

How to really get there is the problem.

Saturday, April 23, 2022

Letter to Batch 25 of the Early Retirement Masterclass

Dear Students of Batch 25,

It’s been a great honour and privilege to conduct a 5-Day Early Retirement Workshop for you.

The current economic situation is a precarious balance between the optimism of recovery from the Omicron strain. I expect the following week to be bullish for Singapore markets as we move from DORSCON Orange to DORSCON Yellow. This will be primarily for REIT counters related to office and retail spaces.

However, there are dark clouds on the horizon.

America is looking at PE ratios above 35 and an inverted yield curve. Interest rates are expected to rise and while this will benefit local banks, it would be detrimental to growth sectors like Tech. We are also in the middle of a conflict in Eastern Europe, and any form of escalation will not bode well for our investment portfolios. As China grapples with COVID-19 without an mRNA vaccine to call their own, we cannot rule out a technical recession in Singapore as China stubbornly adheres to the zero COVID policy. However, I would like to think that, if this happens, this should be a bargain-hunting opportunity.

Nevertheless, Batch 25 has taken a slightly higher risk in-stock selections, likely directed by the factor models we’ve built. We’ve accepted 15 counters and rejected 8 of them with a strong bias towards higher dividend yields, and the final portfolio is projected to yield 6.2%, which is not too bad for the current climate.

I’m cautiously optimistic about the performance of this batch of students as we’re coming in at a point when the equity risk premium of the Singapore stock market has been rising for three consecutive courses I have run, but no investment strategy is fool-proof. I wish that students can take the lesson to heart that a 2-standard deviation drop from the mean can still mean a hefty 15-20% capital loss.

Lastly, I hope that Batch 25 will participate actively in the FB group. Sometime in Q2 2022, we should be meeting up for an online community webinar. At the time of writing, I have yet to determine the subject matter of this discussion, so suggestions are welcome.

Hope to see you then!

Christopher Ng Wai Chung

Wednesday, April 20, 2022

Too true to be good

Sunday, April 17, 2022

Will this Quick and Dirty FIRE for desperate people work in practice?

One of the things I do above and beyond training and investing is to challenge myself to see whether I can invent new ways to attain financial independence. And one of the things I teach my students to be wary of is liquidity pools. The idea is that for exchanges to be run in the cryptocurrency world, some folks need to provide liquidity in the form of currency pairs, those who are willing to do so can be rewarded. For obscure pools that need liquidity, rewards can be over 100%. The catch is that yields fluctuate and you get rewards in the form of tokens which can be volatile.

Naturally, I've been playing a few pools myself and after putting about $5,000 into a mix of these random currency pairs, I'm getting about $10 UST a day. When these pools hit about $50, I would farm it again to an attractive pool that yields over 100% and I will see a gradual increase in my daily earnings over time.

Do note, however, that this is chump change to me and I do this for fun, much like what folks will do at blackjack tables in casinos although I think that I'm doing much better than most casino customers. Sometimes I do this because I can warn my students and tell them not to.

I think that once you can accept that yields are not sustainable and you can even be subject to possible fraud, it may be possible to invent a new quick and dirty form of FIRE. This form of Liquidity Pool FIRE may lack the sustainability of real FIRE, but with small amounts, you can skip other forms of FIRE like CoastFIRE or Barista FIRE and "zerg rush" your way to financial independence.

The math is very simple. If you can live on $24,000 a year :

- A REIT/Bluechip portfolio yielding 6% needs to be $400,000 to sustain your lifestyle.

- A stablecoin portfolio yielding 10% needs $240,000.

- A diversified liquidity mining operation yielding 100%, needs only $24,000.

- The first bucket is to maintain $24,000 in your LP operations which can lose value quickly due to currency fluctuations and impermanent loss. There will be months you need to plug the leaky holes on your ship, how else can you get >100%?

- The second bucket is to start building a REIT/stablecoin portfolio to build a more stable version of FIRE. I prefer a 90/10 mix of traditional assets to stablecoins, but you can choose your own allocation.

Thursday, April 14, 2022

Structure vs Agency - The Unwoke View

The Woke Salaryman has once again hit the ball out of the park with this comic strip which you can read here. It's a very classy piece that really puts these folks a cut above the other comic strips that talk about personal finance.

I really like the sociological concept of Structure vs Agency. In our push for greater status in society, part of our results come from our personal drive and motivation, but a significant amount comes from structure, which is the environment we are born in - it can be wealthy parents, our gender or race.

What I find interesting is that Woke Salaryman has subtly lived up to it's Woke name by putting slightly more emphasis on structure, this is something I deeply disagree with. (although woke is woke lah)

Structure does play a role in a person's success, but how much it plays is a question of how much let it play a role. Right now, I'm just happy that our next PM comes from a neighbourhood secondary school, if we keep having this chip on our shoulder about the weaknesses of the institutions we grew up in, it would horribly impair our ability to rise in this world. One of reasons I'm especially motivated when facing elite competitors in JC was because my secondary school was run so badly, the top Pure Science class did not even have a classroom - our principal housed us in the physics lab and kicked us out whenever class needed access to do experiments. My personal narrative is that there is really no choice but to climb in this world given how shitty my secondary school education was in the late 1980s. If I elevate myself further and get to speak to my juniors, this is definitely a story I will tell.

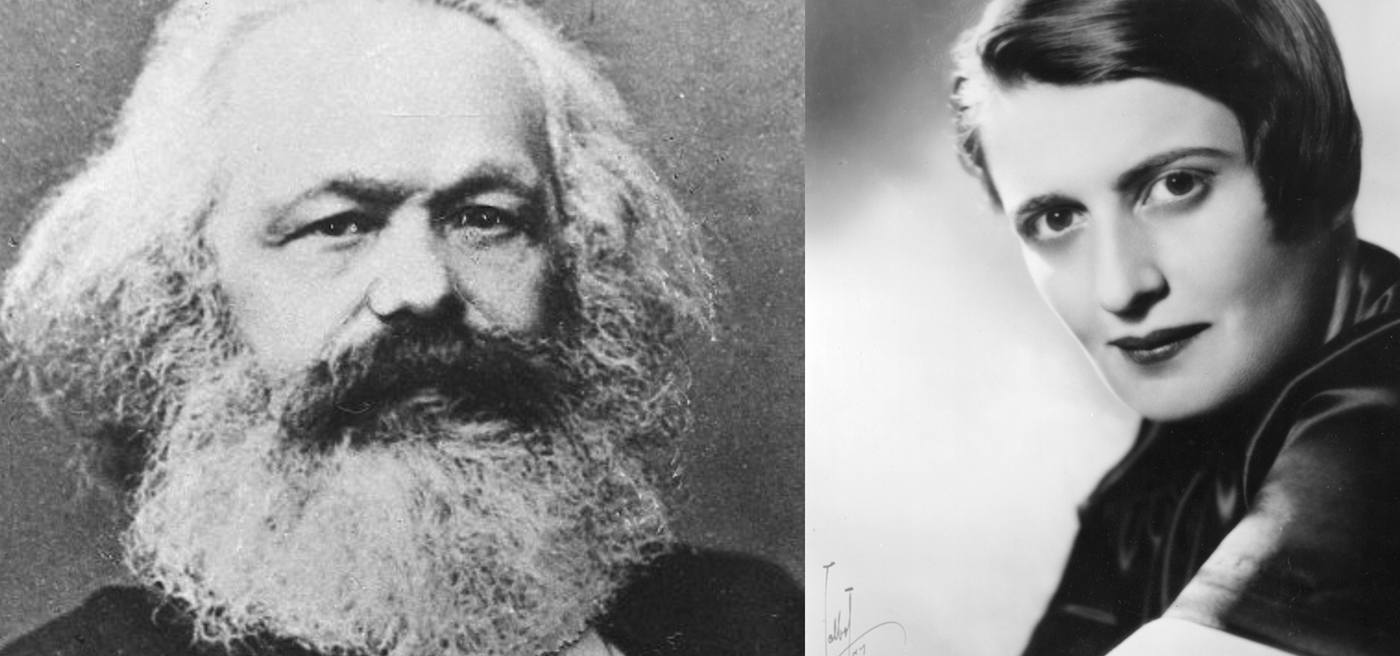

If you really examine younger Millenials and Gen Z, everyone has two daemons whispering in their ear. One daemon looks suspiciously like Karl Marx and he likes to remind the person that society plays a big role in their success and structure matters a lot. The other daemon looks suspiciously like Ayn Rand, and she wants to remind the person that agency matters more.

- If someone wants to believe that he's screwed because society did not give him a leg up. He's probably right.

- If someone else wants to believe that he can use his willpower to improve his lot in life, he's right as well.

This week, I met up with an old gamer pal lately and we were updating each other about how other gamer pals are doing, and we came to the conclusion that my pal has elevated himself over the other gamers as he reached his 40s. I suspect he never saw himself as a candidate for top dog, given that he had credentials in design from a private university, and flitted like a butterfly across several service level jobs in his youth.

But as he mellowed down and grew older, he managed to land an administrative role in an office and he basically showed up every day for a decade within that same organization. Today, he was even able to make hiring decisions for his organization.

I felt that he followed something Jordan Peterson has been telling a lot of young guys. No matter how low you are at the starting point of the totem pole, just make it a point to show up and be engaged in your work. This puts you above maybe 75% of your peers.

The gamer circles I was in, on the other hand, had not aged well, with some local grads getting managed out and driving Grab today, others have been structurally unemployed for years, and one became a morbidly obese hikkikomori and retreated from public life. I know because his dad bitches about him to my aunt everyday.

My friend is now well established in a multinational, owns a HDB under his own name and even has a Japanese girlfriend.

Sometimes like is a Euro Game, when you reach your 40s, you have to make a number of rerolls and some who were on top may find themselves at the bottom. I'm still in my 40s, and I'm worried that my next reroll would not be too far around the corner.

I hope that my pal's story will encourage you to listen to Karl Marx a little less and tune into Ayn Rand a little bit more.

Structure may be truth, but it's a losers game to put too much emphasis on it.

You have the agency to make a difference in your life.

Monday, April 11, 2022

If Singapore women can freeze their eggs, what do we guys get ?

First of all, I just want to say that I'm in support of new initiatives for Singapore women. The execution was a little iffy because when it comes from reproduction, it is inevitable that men will be affected by the changes but this has been swept under the carpet as it is framed as primarily a women's issue.

But it's not. I think talking about this issue from men's perspective is politically incorrect, but it's not wrong.

If you think deeper. The impact of these policies on men, especially single men in the future, can be quite deep.

Basically, young women now have a choice - they can start families when their biological clock is ready, or they can freeze their eggs and start a family later after gaining some headway in their career. This will not see small-scale adoption here - I predict that corporations and multinationals will want to encourage female executives to do this and will respond with initiatives to enable generational adoption that will make egg freezing a social norm.

Where does this leave young men? For one thing, the pool of marriageable women will shrink with women in their 20-30s leaving the marriage and breeding pool. Men won't complain about this, as they can just spend more time making money to build up their own value as a mate. But there will be some men straddling the borderline of marriage eligibility who will lose out more in starting families and they will need to hold to a higher standard - freezing and preserving eggs cost money - this raises the bar for single men in Singapore.

Furthermore, even if a women is reproduction-ready in 40 thanks to modern science, we 're not too sure how susceptible single men, who are by then quite well endowed financially, will be attracted to them. If I'm a financially independent guy in the future in my 40s, I will do what Mother Nature programmed me to do - find someone in her mid-20s. So I find the argument that women who want to freeze their eggs because they can't find a Mr. Right flawed. If you can't find a guy in your 20s, what makes you able to find a guy in your 40s?

I think policymakers, in enabling egg freezing, should in another forum, recognise the difficulties of being single men. Yes, there is the Patriarchy and all that, but men are still going to be judged as a mate based on how strong they are as providers. Just because you let women freeze their eggs, they will not suddenly go after that soft-effete caring empathic beta male overnight. A lot of borderline eligible men will join my constituency as BBFA incels.

One idea I propose is to speed up and streamline the process for single Singaporean men to find foreign spouses and widen the pool of marriage ready women in their 20s for Singaporean men who emerge from the corporate rat race in their mid-30s. There is a serious bureaucratic snarl with some wives getting social visit passes because their husbands are discriminated based on their educational qualifications. I say we grant them citizenship once they produce Singaporean babies.

As a society we really need more babies, no matter where they come from. So if I start a political party for BBFAs, my party battle-cry in the light of egg freezing for women would be :

Every Sperm is a Good Sperm!

Sunday, April 03, 2022

Shitting my way though life... A story of my food poisoning.

The last time I suffered such a nasty bout of stomach flu was when I was a trainee at law firm and it was the pivotal event that made me decide to quit legal practice because I felt aggrieved at the way some individuals treated me after missing one day of a critical hearing even though I got back to work before I fully recovered. Of course, as a trainee, SMU's reputation was in my hands, not to mention that if I acted dishonourably it would tar future mid-career types, so I sucked it all in and basically did everything I could until my last day, then I ran and never turned back.

Today, hundreds of associates leave the legal practice. Many are even getting into the Cryptospace.

So stomach flu is no joke. It can end careers. But if you think about it, there's a lot more at stake as a trainer due to the amount of money involved and the sheer amount of work my partners have done to make running the programme possible.

So I practically shat my way through the course, running to the toilet to do a number 2 during the plenty of breaks I built into the schedule. ( Tea breaks in course is 5 mins ! )

I'm just lucky that it was not a face to face session.

So on Saturday, I completed the first run of the course.

I was so tired and burnt out, I did not know what got into me, I tried reading a book on Quantum Economics and it was so theoretical and mind-boggling, but thanks to legal training, and running the program while on the runs, I forced myself to finish the book and was even more dissatisfied. Sadly, I don't think I can review the book at all on this blog.

Then I was feeling so horrible after reading so much crap, I went to look at my stash of unread books and I saw what I had in my room.

It's just nothing but a sea of books on Finance and Economics.

This is a different kind of diarrhoea. I have this shitload of economics books.

I never majored in Economics but now I am familiar with their ridiculous Physics envy and guilt over the damage capitalism has done to the environment and not to mention the amount of self-loathing over inequality.

That's all I have for you guys this weekend.

For something more useful and substantive, sign up for my next free community event where I talk about investment and the crypto space.

You can register for the event here :

https://us02web.zoom.us/webinar/register/2516487942700/WN_XEPZLcfuSc2F2lezBblfog

Friday, April 01, 2022

ERM-CCI Community Event for Q1 2022

Apologies as I've not been updating this blog, there have been quite a few article ideas but they've been translated to content on Dr. Wealth's blog and I've also decided to turn a book review into a full-scale presentation this coming Thursday evening.

On 7th April at 730pm, I will be conducting a short session to discuss some ideas in financial planning and update community members with the latest developments in cryptocurrency. This will be the first community session where I would have completed training my first batch of Cryptocurrency investing students.

I would have wanted to review Die Broke by Stephen Pollan as it was a classic and influenced some of my D&D gaming buddies in the 1990s. Sadly, as I was in my 20s and largely ignored their financial advice. It took me over 20 years to catch up on this important classic and it shows what the markets were like over two decades ago. I think there is value in shedding light on the Die Broke Philosophy and adapting it for use in Singapore, it's a refreshing change from FIRE.

You can register for the event here :

https://us02web.zoom.us/webinar/register/2516487942700/WN_XEPZLcfuSc2F2lezBblfog

The content is as follows :

Di Die Broke – Rebooting an old personal finance classic

o How 1997 was like in personal finance.

o How to adapt old ideas to new markets.

How to deal with lower yields as protocols begin to reduce them

o Coping with lower yields.

o Opportunities in liquidity mining

ERM Portfolio Update