There is no article for today.

Instead The Simple Sum has written a nicely done up article on me.

I'll catch you guys on Friday.

Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Wednesday, November 27, 2019

Monday, November 25, 2019

MBA in a Nutshell #15 - Marketing : Marketing Mix - Promotion

We are now going to spend a few weeks talking about the last of the 4Ps which is promotion.

There two kinds of broad promotional strategies :

Once a promotional strategy is determined, the next thing to take care of is advertising strategy.

We must first determine what kind of demographic, geographic and impact we want to achieve in our advertising. I struggle with this because I have undergraduates and retirees interested in my program. Generally, in such a case, I will just target the 80% middle hump in your demographics so largely older Millenials and Gen X for my case.

Finally the metric used in advertising is CPM or Cost per thousand. Simply take the media cost and divide it by units of 1000 members of the audience. A typical CPM is abut $300 for a mailing campaign. Thanks to online marketing, 1000 impressions can be as cheap as $2.80.

I leave this work to my partners who are aces at this, but sometimes I wonder whether paying some money to mainstream media may boost profits.

Probably not worth sacrificing hard earned money on this at the moment.

There two kinds of broad promotional strategies :

- The Pull strategy employs advertising to get the consumer to want your product and so the demand will cascade from consumer, retailer, wholesaler and manufacturer.

- The Push strategy works in the opposite direction where selling will be made from the manufacturer to wholesaler, retailer and then to the retailer.

I doubt that these strategies are mutually exclusive so I expect companies to use a mixture of both.

Theoretically, I play the role of "manufacturer" with Dr Wealth as my "retailer" but in actual practice I make almost no decisions on promotion. In my case, I doubt any strategy can be categorized this way.

Once a promotional strategy is determined, the next thing to take care of is advertising strategy.

We must first determine what kind of demographic, geographic and impact we want to achieve in our advertising. I struggle with this because I have undergraduates and retirees interested in my program. Generally, in such a case, I will just target the 80% middle hump in your demographics so largely older Millenials and Gen X for my case.

Finally the metric used in advertising is CPM or Cost per thousand. Simply take the media cost and divide it by units of 1000 members of the audience. A typical CPM is abut $300 for a mailing campaign. Thanks to online marketing, 1000 impressions can be as cheap as $2.80.

I leave this work to my partners who are aces at this, but sometimes I wonder whether paying some money to mainstream media may boost profits.

Probably not worth sacrificing hard earned money on this at the moment.

Saturday, November 23, 2019

Shinigai (死甲斐) - Who would you short in Life ?

I just read an article where Warren Buffett asked a group of graduating graduates who thy will bet on in life if they could buy up 10% of the person's lifetime time for an upfront equity investment. He reasoned that, very often, the person with the highest IQ will not be invested in most of the time. Instead the most dedicated, conscientious and resilient person with leadership qualities would probably attract the most funding.

I would not be afraid to say who I will bet on in this blog : Alvin Chow of Dr Wealth would be top of my list. Heck we are partners in two businesses and make real money in both - supremely rare to meet people like this is real life since I did come from a retail business family.

Beyond the Dr Wealth people, the guy I will take a large leveraged bet on is Evan Koh, creator of Stocks Cafe.Their record of producing solid businesses or careers is beyond reproach.

Naturally, I like engineers and computer scientists who can combine a quantitative bent with a helicopter vision. Bonus marks if they are tad unsentimental and can see a business opportunity without all that touch-feely sentiment I see in ordinary human beings. Like I tell my students - Buy or don't buy.

There is no hold or qualified-buy statements in my class.

The harder question posed by Warren Buffett is which classmate will you short in life.

Who will you bet that would invariably destroy their human capital through their lives ?

The obvious answer from psychology is to pick the unconscientious guy, but high IQ guys also tend to be unconscientious. Kinda risky to bet against Sheldon Cooper or Einstein. The disagreeable fellow will actually earn more in his lifetime compared to his peers, so it's also risky to short the jerks and assholes in school.

Perhaps in psychology, you should short the BBFAs. The introverted, agreeable and unconscientious guys in class. Even then, you need to be careful because they might inch into the public sector or even marry up the economic ladder.

I do maintain a "short list" of my friends and classmates. This is a secret list of friends I keep tabs on who are on a self-propelled journey towards mediocrity in life. I keep this list because I want to avoid what they are investing in and the kind of personal projects they pick up.

Everything these guys touch turns to ash. Businesses they build lose money and friendship. Investments lose money. Diplomas and courses they study are not completed. Actually you can even build a self-help framework by just doing the opposite of what they do.

A friend ( who is definitely on on this list ) suggested the Shinigai (死甲斐) which is a totally bogus idea we made up to be the opposite of Ikigai.

Some people just want to pursue projects that are the opposite of their Ikigai:

- They do stuff they hate - Five minutes ago, it was stuff they love, but then it is revealed that to succeed, real effort needs to be invested in that task.

- They do stuff they are shit at - They have no talent or skill at the project they pursue.

- They do shit that does not pay - No one will part with money for this person's shit.

- The do the kind of shit the world does not need - No one gives a shit what they do.

So there you go - this week, quietly build a Shinigai checklist and position the pursuits taken up by your friends. If they get 4/4, it is time to short them like there is no tomorrow.

Don't do the shit they do. Don't even listen to the music and movies they watch of fear of getting tainted.

But keep them around just so that you can refine your open short orders.

But if you have no one in your list, you better watch out - Maybe you are on the list of all your friends. BWAHAHAHAHA !

Wednesday, November 20, 2019

Invest before you investigate

I was reading a book entitled What Philosophy can Teach You About Being a Better Leader by Reynolds, Houlder, Goddard and Lewis and was pleasantly surprised that it turned out to be an above average read for investors.

The authors asked to resolve this paradox concerning two uber-investors Peter Lynch and Warren Buffett:

- Lynch believes in hard work, but Buffett believes strongly that inactivity is much more intelligent behavior.

- Lynch was quite an opportunist but Buffett was famous for his self-restraint.

- Lynch makes thousands of decisions a year, Buffett only a few.

Although I think Peter Lynch is bad influence to retail investors because he seems to trivialize stock picking and made it seem to easy in his books, I find myself drawn to his behavior. One thing I do is to invest first and investigate later. A stock that is favorable to analysts and gives a high dividend should be invested into first before time is spent poring through their financial metrics. Generally, if I have a high yielding counter and I get confirmation from a blogger I respect, I would x10 to my holdings. Aggressively getting into a stock at a good price is better than waiting for others to pontificate and get in slowly after the fact.

I don't think there is a contradiction to Lynch and Buffett's approach. I think the unifying principle that determines how much effort you need to analyse the stock is the Kelly Criterion.

If you reduce the Kelly Criterion into it's mathematical components, it basically means three things :

- Take a larger position in a security that gives higher returns.

- Take a smaller position in a security where the risk free rate is higher.

- Take a smaller position in a security where volatility is higher.

This should not be limited to position size - this can be applied to intellectual effort as well.

But the rules are different - maybe intellectual effort is inversely proportional to position size.

- Spend more time investigating a stock if you suspect that it may give lower returns.

- Spend less time investigating a stock where the risk free rate is lower.

- Spend less time investigating a stock where the volatility is lower.

Why does Lynch seem so hyperactive compared to Buffett even though their performance was equally stellar? My hypothesis is that Buffett has cheap financing in the form of insurance float so he does not need to think too hard to win when it comes to investing. He may also invest in less volatile stocks. Lynch has always been categorized as growth investor.

I'm not a Buffett or Lynch scholar unlike many other financial bloggers so maybe I am wrong but I think there is credence to the idea that the Kelly Criterion can drive the amount of intellectual effort you put into portfolios as well.

A dividends portfolio consisting of 10-12 stocks can be designed to have a volatility about 2/3rds of the STI ETF. If you have such a portfolio, the intellectual energy you need to analyse this portfolio is going to be very small - so small that you may want to invest first, extract the dividend income and investigate incoming news through the Business Times later. I take these things one step further and even go as far to say that rookie portfolios need to have these mathematical qualities.

If you go with a a few growth stocks and go in with leverage, then you've got a serious problem. Your volatility is high so the amount of intellectual energy is going to be humongous. You have to pore through every financial statement and think hard before you make a decision.

What do you guys think ?

Once this idea reaches maturity, I may do a more comprehensive article on the Dr Wealth website so I want my personal blog to showcase my more zany ideas.

Monday, November 18, 2019

MBA in a Nutshell #14 - Marketing : Marketing Mix - Place

We are still trying to progress through the 4 Ps of marketing. Today we are covering Place.

The first we thing w need to understand are distribution options. There are three levels of distribution options.

We commit to intensive distribution if we are aiming for maximum exposure. We do this by using any wholesaler or retail outlet that would let us stock our goods. Most consumer products fall into this category.

We can also use elective distribution if we sell the higher ticket items. The RPGs and boardgames I play are normally sold through special FLGS stores.

Finally, we use selective distribution to aim for limited exposure. Specialty goods that a highly differentiated or luxury items fall into this category. For decades, Shiroi Koibito white chocolate biscuits can only be found in Hokkaido but these days you can buy them at Donki.

Specifically, there are four general forms of distribution channels that a business would need to choose to reach their customer.

Direct Response Marketing is the method adopted by my program under Dr Wealth. We sometimes employ our databases to get folks to attend our previews which results in converted customers for training. It is the conversion rates that makes me lose sleep at night.

Retail Marketing is probably the most common form of marketing where goods are placed in stores. In such a case, placement of products play an important role. Retailers are moving toward house-brands that erode the profits of manufacturers.

MLM or Network Marketing is actually a legitimate form of marketing that is mentioned in textbooks. MBA books like to think that MLM is going to rise in Asia, even going as far to say that MLM is more culturally compatible with Asians because we still believe in selling to family and friends. In all my preview workshops, attendees consider MLM one of the worse ways to make money - way lower than Internet Marketing or Forex Trading.

Finally, when an MBA text mentions Cyber Marketing, you will know that this book is a little bit dated. Cyber marketing is the predominant form of marketing today and probably warrants a separate textbook on its own. I've always wondered whether a formal textbook exist that contains the same material as those dubious Internet Marketing seminars. If you do know of a textbook, let me know.

The first we thing w need to understand are distribution options. There are three levels of distribution options.

We commit to intensive distribution if we are aiming for maximum exposure. We do this by using any wholesaler or retail outlet that would let us stock our goods. Most consumer products fall into this category.

We can also use elective distribution if we sell the higher ticket items. The RPGs and boardgames I play are normally sold through special FLGS stores.

Finally, we use selective distribution to aim for limited exposure. Specialty goods that a highly differentiated or luxury items fall into this category. For decades, Shiroi Koibito white chocolate biscuits can only be found in Hokkaido but these days you can buy them at Donki.

Specifically, there are four general forms of distribution channels that a business would need to choose to reach their customer.

Direct Response Marketing is the method adopted by my program under Dr Wealth. We sometimes employ our databases to get folks to attend our previews which results in converted customers for training. It is the conversion rates that makes me lose sleep at night.

Retail Marketing is probably the most common form of marketing where goods are placed in stores. In such a case, placement of products play an important role. Retailers are moving toward house-brands that erode the profits of manufacturers.

MLM or Network Marketing is actually a legitimate form of marketing that is mentioned in textbooks. MBA books like to think that MLM is going to rise in Asia, even going as far to say that MLM is more culturally compatible with Asians because we still believe in selling to family and friends. In all my preview workshops, attendees consider MLM one of the worse ways to make money - way lower than Internet Marketing or Forex Trading.

Finally, when an MBA text mentions Cyber Marketing, you will know that this book is a little bit dated. Cyber marketing is the predominant form of marketing today and probably warrants a separate textbook on its own. I've always wondered whether a formal textbook exist that contains the same material as those dubious Internet Marketing seminars. If you do know of a textbook, let me know.

Saturday, November 16, 2019

Personal Update

The week has been less relaxing than I thought. I was supposed to conclude my training for Batch 9 and then spend the next few days doing noting much but I ended up doing some administrative matters regarding my dad's matters.

a) My dad's matters

Things are moving much faster than I was taught in law school. In Part B, we were taught that you do up a will because things get slow and complicated otherwise. I ended up going through the Letters of Administration route, and initially I thought things would be really slow, but everything concluded in two months, a credit to our super-efficient Family Courts !

Some of the issues I had to deal with are as follows :

a) My dad's matters

Things are moving much faster than I was taught in law school. In Part B, we were taught that you do up a will because things get slow and complicated otherwise. I ended up going through the Letters of Administration route, and initially I thought things would be really slow, but everything concluded in two months, a credit to our super-efficient Family Courts !

Some of the issues I had to deal with are as follows :

- Sometimes the Family Court may not understand your investments completely. You need to be patient and work with your law firm to answer their queries. I wrote an email explaining that non-renounceable rights are not traded so have no market value and even attached ESR REIT's circular to show them. The paralegal then forwarded it to the Courts via E-Litigation.

- CDP needs the letter of administration be a certified true copy. Work with your law firm to certify everything before heading to CDP to complete your task. I should have known this myself but because I did not think about this, took a few extra cab rides.

- CDP share transfer from one account to another is $10.70 per counter. Budget this for probate matters if you have many stocks ! It may also take a month to happen !

If you really want to handle issues of probate well when it is your turn to pass on, my only advice is to make sure you have a child who is both legally and financially trained and trustworthy enough to play the role of trustee. My dad succeeded in doing this, but I have no idea how can I execute this myself.

Even now I cannot imagine what would happen if someone is not trained in these matters.

b) Training and Personal Finance matters

When I started on my gig, I really thought my career would peter out by now, but things are better than ever. One side-effect of having a career taking off this year is that I now have to take very proactive steps to manage next year's income tax statement which means opening and maxing out my SRS account and contributing to my wife's CPF account before this year closes.

Tax-deductibles are no longer a running joke for me so I have to start executing what I have been teaching my students these past months.

Maybe I might even need to incorporate in 2020.

c) Leisure and Hobbies

I could get into some light RPG gaming one a month but I'm not sure whether this is sustainable because I prefer to create a totally new investment program next year. Otherwise I managed to install an old game I bought last year called Banner Saga that is a turn based RPG tactics game.

My job is slowly crowding out my hobbies and even binge watching Netflix is now a luxury I cannot afford. What occupies my time is the notion of thought leadership - my investment articles on Dr Wealth have a readership that far exceeds this small blog and we're in competition for eyeballs and that means I need the knowledge to not just produce more articles but to deconstruct the work of other bloggers who may disagree or critique my ideas. One out of four articles I contribute will be less user-friendly and will read like this.

Maybe this is new multi-dimensional chess game I'm playing.

d) What I am reading

I did not enjoy Narrative Economics by Robert Shiller, the epidemiological economic analysis is great but the book is just a historical rundown on the narratives that impacted financial markets in the past. A good book should teach people how to think about new events and not just rehash old ones. I would have been much happier had the book provide a framework on how to measure and track the infectiousness of ideas as they wreak havoc on your investment portfolio.

The Man Who Solved the Market by Gregory Zuckerman is much better, tracing the lives of Jim Simons, one of the greatest quantitative investors of all time. I believe that a close reading may unlock the use of Markov Chains in determining which market cycle we are in which can be fantastic for investors like me.

I have to admit that the idea of picking up a PhD in Quantitative Finance is appealing to me much more these days but I'm worried that my age would make me slower at exploring fresh new areas of mathematics.

Wednesday, November 13, 2019

MBA in a Nutshell #13 - Marketing : Marketing Mix - Price

Wow ! It took ages to get out of the product segment.

The segment of Price only has enough material for one article. Here are all the possible approaches to price a product

Premium Pricing - Charging a high price relative to other brands. Hermes is a great example of a brand that does this. I wish I were here.

Fair Pricing - Price that is objectively regarded as being reasonable. NTUC Fairprice is definitely in this category. (OBVIOUSLY !)

Penetration Pricing - Charging a low price to generate volume. My program was here a year ago. I would argue that many unicorns like Grab employs this strategy.

Parity Pricing - Charging a price that matches that of competing brands. If you cannot differentiate your product, you will have no choice but to do this.

Cost-Plus Pricing - Charging a mark up based on costs incurred. You don't really want to get into a business that does this. I suspect the smaller law firms are slowly moving into this territory.

Idiosyncratic Pricing - Price based on what the value is to the individual customer. Another heaven I wish I could be in. The rules for selling in this domain is almost all consultative driven.

Leasing arrangements - Allow the customer to lease to push decision making into lower level management. Photocopiers employ this strategy very well.

Preemptive Pricing - Nasty stuff. You lower the price to damage a new entrant into the markets. I don't like doing this but over time, some folks may want to compete in my territory. As I do not spend my trainer fees on living expenses, I have enough dry powder to start a price war and even engage in painful IP litigation. As a somewhat paranoid, I have already assumed that this would happen and have a network of allies on standby. I guess the price for success is eternal vigilance.

Push versus pull pricing - Pricing at a compromise between buyer and seller. This is possibly what happens when a B2B arrangement occurs.

Threshold pricing - The reason why charging $99.99 will eliminate a lot of buyer resistance compared to pricing something at $100. This is so common I am not even sure whether it works anymore.

As much as I believe that I deserve Idiosyncratic and Premium Pricing, I don't think the market will allow my own product to be priced this way yet. I think the training industry has not really recovered from the crazy 2000s where these guys with fake credentials hawk derivatives strategies promising some kind of pipe dream to the hapless investor.

We currently price fairly for a 2-day workshop and lifetime access to a FB group. Price increases occur frequently, but I generally do not increase price unless I convince myself that value has increased.

The segment of Price only has enough material for one article. Here are all the possible approaches to price a product

Premium Pricing - Charging a high price relative to other brands. Hermes is a great example of a brand that does this. I wish I were here.

Fair Pricing - Price that is objectively regarded as being reasonable. NTUC Fairprice is definitely in this category. (OBVIOUSLY !)

Penetration Pricing - Charging a low price to generate volume. My program was here a year ago. I would argue that many unicorns like Grab employs this strategy.

Parity Pricing - Charging a price that matches that of competing brands. If you cannot differentiate your product, you will have no choice but to do this.

Cost-Plus Pricing - Charging a mark up based on costs incurred. You don't really want to get into a business that does this. I suspect the smaller law firms are slowly moving into this territory.

Idiosyncratic Pricing - Price based on what the value is to the individual customer. Another heaven I wish I could be in. The rules for selling in this domain is almost all consultative driven.

Leasing arrangements - Allow the customer to lease to push decision making into lower level management. Photocopiers employ this strategy very well.

Preemptive Pricing - Nasty stuff. You lower the price to damage a new entrant into the markets. I don't like doing this but over time, some folks may want to compete in my territory. As I do not spend my trainer fees on living expenses, I have enough dry powder to start a price war and even engage in painful IP litigation. As a somewhat paranoid, I have already assumed that this would happen and have a network of allies on standby. I guess the price for success is eternal vigilance.

Push versus pull pricing - Pricing at a compromise between buyer and seller. This is possibly what happens when a B2B arrangement occurs.

Threshold pricing - The reason why charging $99.99 will eliminate a lot of buyer resistance compared to pricing something at $100. This is so common I am not even sure whether it works anymore.

As much as I believe that I deserve Idiosyncratic and Premium Pricing, I don't think the market will allow my own product to be priced this way yet. I think the training industry has not really recovered from the crazy 2000s where these guys with fake credentials hawk derivatives strategies promising some kind of pipe dream to the hapless investor.

We currently price fairly for a 2-day workshop and lifetime access to a FB group. Price increases occur frequently, but I generally do not increase price unless I convince myself that value has increased.

Monday, November 11, 2019

Letter to Batch 9 of the Early Retirement Masterclass.

Dear Students of Batch 9,

It’s

been a great honour and privilege to be able to conduct a 2-Day Early

Retirement Workshop for you.

The

highlight of this session is that we managed to successfully conduct a new version

of the Emigration Exercise that used to be done for earlier batches. In this

exercise, students get to roleplay an emigrating singleton and to investigate one

destination that they would like to emigrate to by digging out the economic

data of a target country. Once they reach their destination country, students

will have to determine whether they can live on the dividends generated back

home in Singapore. Students will also get to present one new stock that they

would like to purchase once they open their trading accounts in their new home.

We

were unable to pick a favourite destination today after looking at the data because

New Zealand (Wellington) and Thailand (Bangkok) garnered equal votes. The results

of this fun and enlightening exercise will be shared in a future article on the

Dr Wealth blog.

I

have also learnt quite a bit from Batch 9.

The

first thing I learnt is that I can reduce my expenses further when I pick the

GrabHitch option carpooling feature when calling for a cab. I will make it a

priority to try this out from Bukit Panjang this week.

During

the qualitative analysis segment of equity counters, the discussion on OCBC was

unusually lively. Students shared useful

insights on how OCBC is resonating with millennials with their first mover

advantage on CDAC accounts and the tactical positioning of the Frank sub-brand.

The class also unanimously agreed that OCBC apps and webpage were more

user-friendly compared to the other local banks. As I am not an OCBC customer,

I was pleasantly surprised that my previous impression of OCBC as a stodgy old

bank no longer reflects the reality experienced by their customers today.

The

biggest pay-off from teaching Batch 9 came was when I discovered that one really

smart student is an actuary in real life so I jumped at the chance to ask her

what kind of insurance does she buy for herself. Her answer – just term life

and H&S, totally made my day. If you ever want insurance advice, you should

mirror the moves made by the folks who actually create them for a living.

By

this batch, the ERM has more or less settled down with our methodology of

stocks selection and this batch of students has managed to choose six blue-chip

stocks and six REITs to form the core component of the portfolio. I find this

class even-handed and balanced in their approach of stock elimination, so I

look forward to investing with my trainer fees before the end of this week.

As a

response to feedback during this course, I will be taking steps to align the

final portfolio closer to the asset allocation exercise done as part of early

stages of the course. We are always improving our material after your feedback,

so you can expect a supplementary write-up to be posted on the FB group within

the next few days.

Christopher Ng Wai Chung

Wednesday, November 06, 2019

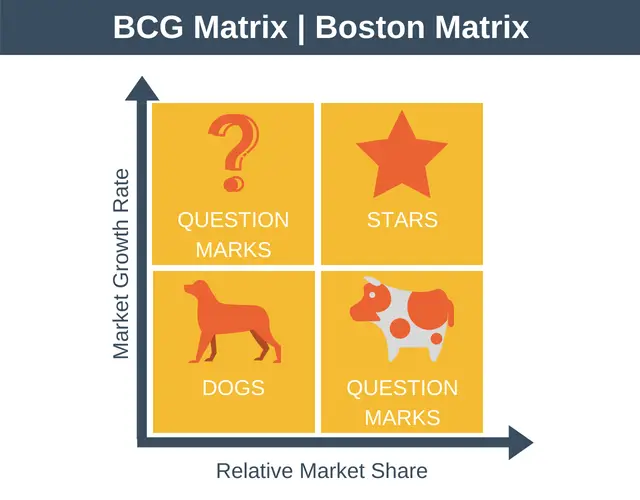

MBA in a Nutshell #12 - Marketing : Marketing Mix - Product - Boston Matrix

The Boston Consulting Matrix was my first exposure into the power of 2x2 matrices. Some genius found a way to build a map of where all your products stand vi-a-vis each other based on the twin axes of market share and growth rate.

This generates 4 possible quadrants :

a) Star - High Growth, High Market Share

These are the stars of the show who have a dominant position in a high growth industry. If your product is placed here, this is an enviable position to be. While my ERM class is growing fairly quickly in 2019, my market share has some room for improvement. At this stage, the only way I can resolve this issue is to clone myself.

b) Cash Cow - Low Growth, High Market Share

These are the bread and butter product lines that you need to have in your company. While the growth is no longer there, like dividend stocks, these product lines generate the cash flow used to sustain the rest of your company. The Stars of yesterday tend to become the cash cows of today.

c) Question Mark / Problem Child - High Growth, Low Market Share

Some industries can be high growth but you may not have a dominant position in this industry. Problem Child is named this way because it is not too clear how much more you want to invest in marketing these products. I suspect that effort will have to be made to differentiate this product further in order for marketing to succeed.

d) Dogs - Low Growth, Low Market Share

I would characterize a large number of my competitors as falling into this category. There are a lot of training vendors who cover value investing and each vendor has to compete over a shrinking pool of investors who are getting more sophisticated tools and information portals to invest in local markets. We're even seeing some major information vendors leave our market.

A significant part of running is getting rid of your Dogs so that resources can be deployed to turn your Problem Child into Stars.

After positioning all your products into a Boston matrix, a company owner can then decide whether to include/exclude a product, bundle one product with another, or raise the price.

For my own program, we have been refining materials, adding value and raising prices for a large part of 2019.

Sunday, November 03, 2019

Living the NERFed Murderhobo RPGer Life

The weekend post is a little late because I spent the greater part of Saturday and Sunday attending a course on Quantitative Investing by Dr. Wealth but as a paid customer. I'm not ready to blog about it because I want to do this some justice to the course, so instead I just want to do a philosophical piece about life.

I had a small epiphany about my life lately.

Of late, I have been drifting away from playing D&D and putting a lot of focus on my life as a trainer. A cursory explanation is that D&D does not pay but being a trainer does, but I think as a financially independent person there are reasons that go beyond money as I slowly move away from gaming.

I think my problems with playing RPGs is a reflection of what I've consistently encountered my whole life.

In D&D, players like myself are murder-hobos. We trend to play great-axe wielding barbarians or pole-arm swinging Sentinel Paladins. Otherwise we will be spellslingers like Diviners or Sorceror-Warlocks who never sleep. We focus on killing monsters, taking their treasure, and solving the problem is a quick, ruthlessly efficient manner.

The problem with murder-hobos is that we are seldom the majority in a gaming table. There are a class of gamers that my friend terms Yolofomos. Yolofomos want to play Kristina the Elven Beastmaster Princess who can develop a telepathic link with her pet cougar, maybe even have sex with it. The worse Yolofomos are those anime-loving BBFAs who insist on playing some kind of bard or "colorful personality". Such Yolofomos still focus on role-playing and exploration but can be objectively quite bad at it.

The truth is that Murderhobos are quite fine with Yolofomos and can work around inefficiencies in party tactics. They enjoy role-playing and exploration too. But you see, if a Murderhobo becomes too efficient as killing machines, Yolofomos feel threatened because " you play like that, it's not fun for me anymore. "

Enter the DM. The DM will do his best to make the game fun for everyone.

In theory the DM will run the module objectively and then split the rewards evenly. But in practice, the DM tries to stroke the Yolofomos by giving them more powerful magic items or over-budget monster encounters to challenge the Murderhobos and fudge the game for Yolofomos.

So Murderhobos RPGer have a perennial problem. They are always playing D&D in Hard or Inferno mode while Yolofomos get to play it in Easy or Normal mode. I once took a sub-optimized monk and went through 4 levels without a key material component to cast my most powerful spell when a fellow party member was given a Necklace of Fireballs that only found use after he rage-quit the party and I managed to hold of it.

KABOOM !

An investor will find this story very familiar.

Ed Thorpe, who found an innovative way to do card counting, was eventually marked by various casinos and barred from entering them. He eventually joined the biggest casino in the world, the Stock Exchange, and did very well as a hedge fund manager !

So fundamentally, what is a Murderhobo?

IMHO, Murderhobos are folks who incorporate mathematics and a cold economic logic into their basic lifestyles and personal philosophies. They have a Bayesian sort of outlook in life. For example, we know that given the way RPG modules are designed, there are probably secret doors in empty rooms, so we search for them. ( Then we get accused of metagaming )

Societies will always have mathematical loopholes whether they are a some kind of advantageous beta that works in a back-test or asset structures that are just too tax-advantaged to ignore, so we Murderhobos pile into these loopholes. Because I am empirical, and coldly logical about investment markets, if I find that a strategy works, it is only fair that with the right conviction I can supercharge it with leverage so that I can beat all the best talking heads in the blogosphere? Right now, as it stands, even my unleveraged students have a decent XIRR and all my portfolios are positive.

But I think my D&D experience has taught me saltiness lurks around the corner. I've been playing in this kind of hostile environment for three decades.

I am seeing a lot more passive aggression directed with at my business partners or myself these days. Overall, I think it is a good sign that we're growing. I want to take this in good spirit. Although I will never mention this here as to who they are, I do know which blogs are my biggest critics, and I do tell my students to read them and reflect upon their writing. Investors do best when they have a contrary opinion.

But here's the deal with financial markets.

My business can fail and my career can be over in a minute.

But until my models fail and I start seeing some investment losses, the Singapore Government, the real DM in this game of investing, can't NERF me without Singapore losing it's status as a financial hub.

So if I find a +5 Sword in the form of regulatory boost to REIT gearing ratios, or decide to pound someone with my Juris Doctor feat, no DM will be there to save a Yolofomo.

Anyway, if I get back to D&D publicly, I think I will be a DM moving forward and will probably find PCs in the financial circles.

We can run an all-Murderhobo party !