So here are some of the changes in the way I do my blog articles.

This blog, which has a small and dedicated readership will become more "meta", focusing on thoughts on my evolution as a trainer as well as snippets on my personal life. For the folks who want to read about my politically incorrect theories about dating, that's going to remain here.

For the more advanced investing articles, I will be posting on Dr Wealth. The reason is that Dr Wealth has a much wider reach and have the SEO chops that brings more exposure for folks who wish to come for my workshop previews.

My free workshops are rapidly evolving into an actual free public lecture that anyone can attend without making a substantial financial commitment for my courses. I've reached a stage in financial independence where I can evolve to do more pro bono work and the feedback on my workshop content is actually fairly good at the moment. We've also had two successful runs without email blasting so I can safely say that I've stopped spamming your mailboxes for quite a while. While I can't write direct mailing off totally because it's still a good strategy for others, I'm doing everything commercially possible to avoid spamming members of the public.

Moving forward, I have a new challenge - I'd like to think of ways to improve how finance communities are run.

All my students ( now close to 300 in size ) are placed in a closed FB group where they receive future course updates for no additional membership fee with the caveat that updates will last only up till the point I decide to stop being a trainer.

So I am now in the privileged position of administering a walled garden, much like the Apple iOS ecosystem compared to other personal finance forums which look more the like Android ecosystem. These are fairly serious investors and I got investing heavy-weights in the community.

On my part, I'm using the community size to drive a hard bargain to see whether I can get better deals for my community. Right now, I got a better deal for Stocks Cafe and made some friends with non-commissioned FAs to help my students out. Recently, I just helped out a friend using my contacts who told me that he can't seem to convince an FA to sell him term life insurance. I have also cultivated a broker ally that can provide promotional rates for margin financing.

Right now I'm on the lookout for a trustworthy law firm (it has to be small and ferociously customer oriented) to direct my students if they need help with legal matters. In all these engagement, with the exception of Stocks Cafe where I do get paid, I do not seek a commission - I want to win the best deals for my community.

I just want my students to be winners in life.

Beyond developing superior bargaining power, I am also looking for a better way to run a finance community and the Philosophy of Science has something to say about that. It was Robert Merton who came up with the CUDOS framework that govern how scientific communities work.

I believe this can be translated into the management of an online Finance community :

a) Communal

This condition cannot be met in full but communal sharing of information can happen within a walled garden community and with paying customers, it does not make sense to share the best data with outsiders. Otherwise, I try to practice full transparency with portfolios created by all batches of students in private domain.

Some attempts to co-create material with some alumnis have materialised but died down in the past. I hope to do more of this in the future.

b) Universal

This is basically about non-discrimination. Beyond race and gender, I believe in the wisdom of crowds and it does not really matter what a person's education is.

If this person votes on asset allocation or market cycle, a class of 30 students and a trainer is light-years smarter than one trainer working it out on his own. To reinforce this aspect of community building, if I decide to sell a component of portfolio, i normally give the community a chance to vote for its replacement.

c) Disinterestedness

This is really hard to achieve in an online community and is the reason why public forums attract so much animosity when FAs provide a teaser to a person's query and then ask for a personal PM if the person wishes to carry on further. In this case, the FAs are not disinterested. They have potential money to make for every answer they give.

In a walled garden, it is a lot easier to be disinterested and give the best answer to benefit the entire community because folks already paid to get there.

d) Originality

We're slowly inching towards more originality, but we are not there yet. To achieve this milestone, my course has to win over and enroll the thought leaders in investing - that's a super difficult task.

I have a strategy to deal with this and it's inspired by Chan Brothers that my family is quite loyal to. Chan Brothers is not known as the cheapest travel agency. I think Chan Brother's longevity is that prices are high because they are not interested in the "fish market" crowd as told to me by my tour guide. They also provide better hotel rooms and want classier customers.

With higher prices, you are forced to create material to be worthy of the higher price point. The reward is not just more revenue but also higher quality of students that end up creating better portfolios for your trainer fees.

Ultimately if you want a better community, your course offering has to crack the barrier of serious investors who are confident of reading up on their own and making their decisions autonomously. The course has to seriously shorten the learning curve and bring auxiliary deals that justify the course fee.

In that I have an advantage, I was totally self taught using the CFA texts and never had a sifu in my life.

e) Skepticism

I think this is the most important trait that a Finance community need to cultivate. I'm glad the current membership has a few "grumpy" guys who will question every deal that is shared by a newbie. This is important that we don't make things personal and question everything that we read about.

Science advances by falsification of ideas and replacing it with a better hypothesis. A good community has to be like this. Ideally, a revelation has to have the power to make me want to make a U Turn and change my slides. For example, The latest Keppel DC and MINT rights issue raised their traded price ! I had to revise my lecture slides after that because I previously taught that rights issues are often punished by the financial markets.

So, over time, what is my wish a a trainer ?

Perversely, I want my offering to be less about my course and the knowledge that can be gained from it even though I am working on my materials everyday. I want my final product to be the student itself. People buy the course because it speaks to their personal values and they want a network of folks who think like themselves.

Signing up should say something about their own personal identities.

Because of commercial realities, I am a long way from this goal, but at least it's something I can work towards as some means of personal actualisation.

Growing your Tree of Prosperity is an introductory investment guide written specifically for Singaporeans who wish to take their first step towards financial independence.

Sunday, September 29, 2019

Friday, September 27, 2019

Dealing with Maid Problems...

One the same day we buried my dad at sea, my mum and myself went over to the police station to make a police report. This is first time in my life that I had to do so and it was an interesting experience.

We fired our maid after she racked up $800 in phone bills using my father's phone while he was on his deathbed. The following month Singtel sent us a bigger bombshell - a $2,000 bill for the calls made to Myanmar as well as paid apps installed on my father's phone !

My first objective was to see whether this can somehow be positioned as theft on my maid's part, my second objective is to create a paper trail to seek an exemption from these fees by appealing to Singtel.

I was not successful at the police station to convince them that our maid stole from us. The IO felt that I might have a better case if the phone was locked and the maid hacked the phone. This, I somewhat agree, but it's good to have a printed copy of the police report. The police sergeant said that I have recourse at the Magistrate's Court in a civil suit, but I don't think it makes sense trying to sue a Myanmar maid.

Next, I went to Singtel, gave them a copy of my dad's death certificate, police report and, in essence, begged them to waive the fees while transferring the home line to my bank account. My concern was that the deduction will be by GIRO and given that I'm fresh from burying my dad, there is nothing I can do if Singtel decides to deduct the phone bill anyway. In this attempt, Singtel was compassionate enough to agree to waive the $2,000. I suspect this happens fairly often in Singapore.

I have decided not to make my final move which is to lodge a complain to MOM about my maid agency. They knew that the maid used my phone and racked up $800 of bills for our family and yet they foisted my maid to another employer days later. I thought MOM should be warned of this kind of behavior even though there is some chance that no action will be taken.

As the $2000 has been waived, I have decided to devote my time and effort on my father's estate and move on with my life.

Feel free to share your opinion as to whether I did right and what you would have done in my place. I am willing to entertain any legal suggestion on how to get my maid out of Singapore for good - I don't think any employer deserves to have her on payroll.

I am writing this so that other folks who have domestic helpers looking after senior citizens will get at least one data point on what to do.

The largest damage done to us is that my mum is now so terrified of domestic helpers and we will have challenges when eventually she will need someone to look after her later in life.

We fired our maid after she racked up $800 in phone bills using my father's phone while he was on his deathbed. The following month Singtel sent us a bigger bombshell - a $2,000 bill for the calls made to Myanmar as well as paid apps installed on my father's phone !

My first objective was to see whether this can somehow be positioned as theft on my maid's part, my second objective is to create a paper trail to seek an exemption from these fees by appealing to Singtel.

I was not successful at the police station to convince them that our maid stole from us. The IO felt that I might have a better case if the phone was locked and the maid hacked the phone. This, I somewhat agree, but it's good to have a printed copy of the police report. The police sergeant said that I have recourse at the Magistrate's Court in a civil suit, but I don't think it makes sense trying to sue a Myanmar maid.

Next, I went to Singtel, gave them a copy of my dad's death certificate, police report and, in essence, begged them to waive the fees while transferring the home line to my bank account. My concern was that the deduction will be by GIRO and given that I'm fresh from burying my dad, there is nothing I can do if Singtel decides to deduct the phone bill anyway. In this attempt, Singtel was compassionate enough to agree to waive the $2,000. I suspect this happens fairly often in Singapore.

I have decided not to make my final move which is to lodge a complain to MOM about my maid agency. They knew that the maid used my phone and racked up $800 of bills for our family and yet they foisted my maid to another employer days later. I thought MOM should be warned of this kind of behavior even though there is some chance that no action will be taken.

As the $2000 has been waived, I have decided to devote my time and effort on my father's estate and move on with my life.

Feel free to share your opinion as to whether I did right and what you would have done in my place. I am willing to entertain any legal suggestion on how to get my maid out of Singapore for good - I don't think any employer deserves to have her on payroll.

I am writing this so that other folks who have domestic helpers looking after senior citizens will get at least one data point on what to do.

The largest damage done to us is that my mum is now so terrified of domestic helpers and we will have challenges when eventually she will need someone to look after her later in life.

Wednesday, September 25, 2019

How should FAs sell their insurance products ?

First of all, calm the fuck down.

[ Note that this post was removed from the Seedly discussion group because of my use of the four lettered word. Moderators wrote to me to explain their stance. There is no hard feelings but this reflects how much FAs fear articles like this on the web. They rather censor me than debate earnestly on this topic. Do spread it around because the context behind my use of 'fuck' is not meant as a cuss word. ]

I'm not here to bash Financial Advisors today.

I am teaching myself how to sell better and thought the best way would be to get to the level that I can teach someone so that I can become an ace salesman myself. Also, Dr Wealth sales staff are fans of my blog and I want to give them a little bit of training of my own.

I think there is nothing better than to demonstrate to FAs how to sell better to level up my own skills as a sales person. As it turns out, the old formula of introducing the product, acting exceedingly fake and optimistic about it, trying to close and then working super hard to deal with objections, is a thing of the past. As consumers, we know that you will employ these Jedi mind tricks on us and this explains why the internet is full of negative press about financial advisors.

Instead int he book Flip the Script by Oren Klaff, a much better model is proposed.

I think if an FA were to follow this script, they can do much better.

[ Note that I am not qualified as an Financial Advisor and the dialogue serves to demonstrate a sample sale and should not be taken as investment or insurance advice * Wink * * Wink * ]

Oren calls this the Buyer's Formula :

a) Introduce the buyer's formula

The trick is not to sell any product, but to sell a buyer's formula. Unfortunately, this formula has to come from a position of sincerity and earnestness. I will demonstrate my Buyer's formula for term life : "Look, a lot of students I have overpay for insurance. The quickest way around this is to find a mix of products that produces the lowest commissions for insurance sales personnel. This means hunting for a range of products that they will NOT SELL to you."

Now I got your attention, I'm not a just another fly-by-night FA.

b) Outline obvious ways to fail.

" Look at ILPs being peddled by FAs. They are obvious commissions generators. I know someone who is aged 60 and he tells me that he pays so much for his mortality credits for his ILP, his investments no longer increase in value after he pays his premiums. Also his ISP's with a Class Ward A has just gone up in premiums again. And critical illness is just a lottery ticket that pays when you get cancer. That's no fun if you are at the age where you can't work anymore ! "

This is not only believable. This can be true. More interestingly you are an FA who seems not to be interested in pushing expensive products to the buyer. Intriguing.

c) Highlight Counterintuitive ways to fail.

"I'm all for buy-term-and-invest-the-rest and I can process your term insurance purchase right now if you wish, but the problem with term life is that it may not cover the case where you have some accident or mental illness and can't perform your task. I have disability income insurance and I bet no other FA has ever tried to sell to you before."

You highlight the small flaws for strategies that investors employ like BTIR but support it along so that I can find a genuinely good product to complement it - Disability Income insurance.

d) List Obvious Actions

" The trick would be to buy insurance without an investing component but figure out how to invest for a better future. Investors need a different kind of insurance plan : a cheap accident policy, a minimalist hospitalisation and surgical plan of up to B1 ward, and this disability income insurance. You can do all this with your term life for less than $300 per month if you already have AVIVA Group Term Life. You can focus the rest of your income on dividends stocks."

e) Less Obvious Hacks.

" Oh yes, you're probably smart enough to create a REIT portfolio on your own. At 6% yields, this insurance is free if you have a $60,000 REIT portfolio. A good investor should never pay for insurance from his earned income ! "

Genius ! Who thinks of shit like that ?

f) Hand over Autonomy

" Look, you are already a dividends investor, I can't really tell you what you should buy but I've done this hundreds of times with other clients and they are really happy with this combination of insurance products. "

Modern buyers don't like to be told about how to run their financial lives by Financial Advisors. This pisses me off. If you hand over autonomy to me, I am actually more plaint to future requests.

g) Redirect to keep buyer in bound.

" Yes, the combination may not pay out too well if you get cancer because there is no Critical Illness insurance, but that's what your investment portfolio is designed to do. Your investment portfolio will cover contingencies not covered by insurance such as getting retrenched, kids going to university, or that stupid cousin wants money to open a coffee stall. "

Just let the customer object and get their satisfaction. You don't have to deal with every objection aggressively.

I'd like FAs to seriously consider using this gentler sales approach to earn their money, it requires a more intimate understanding of the customer and an honest assessment of products you can sell to make the world a better place. Maybe over the long term, you may earn lower commissions per sale but you can make it up with stronger volume coming from better referrals.

Another way of looking at this is that competing FA reading this will try out my script and actually starts getting sales from it - can you risk ignoring this different approach used by your competition ?

Monday, September 23, 2019

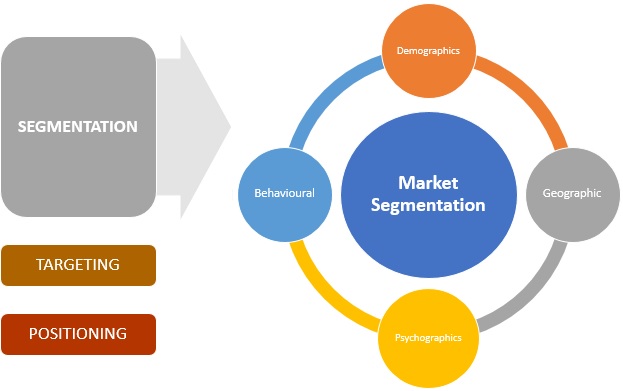

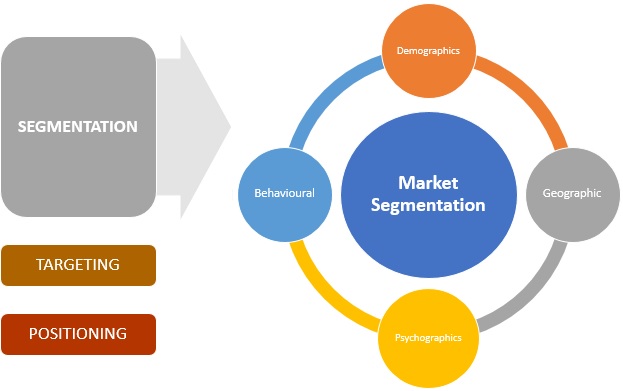

MBA in a Nutshell #6 - Marketing : Market Segmentation

[ Thank you for the well wishes. It is time for this blog and myself to move on. We will be slowly getting back to our regular programming. ]

Market segmentation used to be easy when I was reading about it for fun.

When I actually do it as part of running a business it becomes very hard. This is because when you have a business running, market segmentation is an empirical exercise. You need data to understand the customers paying for your service offering. Old school approaches to guessing the profile of your customers can lead to sub-optimal profits for this section must be taken seriously.

There are 4 dimensions to market segmentation :

a) Demographic

This is basic information on age, gender, marital status and education. When it comes to demographics, trainers generally attract their own kind. My course has a very strong male population in their 30s-40s - many sign up because are fans of my relationship articles on this blog.

How to expand beyond this middle aged males segment is an important question I need to answer. Millenials would have made great ERM customers not because of the amount of capital they have, but because of the amount of time they have to compound their investments and propensity to take on more leverage risk.

I really don't want to lose this crowd so I will be working with Millenials to see how I can appeal to them in a better way.

b) Geographic

This is based on location and I do not have any information on my customer. Perhaps it would be nice to map customers into Districts. I am confident that valuable insights can be gleaned if I can get some visibility on this.

c) Psychographic

Interestingly I had a conversation with Alvin Chow, CEO of Dr Wealth on this topic yesterday. He believes psychographics is even more important than other forms of segmentation. Fact is that my class attracts a lot of engineers. In fact, Dr. Wealth attracts a lot of engineer-trainers so the bias may be built into the whole company design ! Their latest Quantitative Investing class is totally run by engineer hedge-fund gurus.

Attracting engineers is great but it limits the scope of investment training. I increasingly believe that this is not through active design as the mathematics in my course is not that hard and social science majors can benefit more from my program.

It is likely that I attract engineers because I status-align with them much better. While I am a dinosaur in IT these days, I still emphathize with project managers and can converse very comfortably about software development and IT infrastructure. I find it much harder to talk about feelings and relationships, that's unless someone wants a really cynical conversation about divorce law and it's effect on families.

I am seeing opportunity in stretching beyond the engineering sector. Recently, I am enrolling students who are athletes and designers and it is very satisfying to see them get some dividends rolling into their bank account, but I suspect I need a lot more to show them a lot more empathy to convince them that I can help them.

Still, I doubt I'll get enough lawyers to attend my class, though. Lawyers are supremely skeptical folks and may not have much respect for data that rely on historical precedence. Some may want a rational-deductive approach to show why an investment will work in the future, I doubt I can provide a definitive assurance for that. ( They should be careful when meeting gurus who claim that they do. )

d) Usage

This is the most exciting part about Market Segmentation I want to explore. A lot of folks buy baking soda for reasons other than baking. Baking soda can be used for cleaning as well.

I've known for a while that a lot of retirees attend my Early Retirement Masterclass and increasing I am getting students who can teach me a thing or two about early retirement themselves.

So I am building a new consumer profile - someone in their late 40s to early 50s who is very competent about making money, but coming from the business or property investing world. They may not trust their private bankers and want to educate themselves on how to deal intelligently with them and want someone to ruthlessly bust the myths spread by the financial advisory personnel.

For this to happen, I need to bring in some legal chops in the relationship to be able to understand the class of problems they face - some may need a trust-like structure to provide a legacy for their children.

The payoff for good market segmentation is high. If I can successfully define my customer segments, I would be able to craft a marketing message for each segment that adds value to them and we will not need to blast emails that trade-off on our goodwill in the future.

Some trainers ave already become public enemies for the FB marketing campaigns they have launched and I'd rather quit the business then fall into this category.

Market segmentation used to be easy when I was reading about it for fun.

When I actually do it as part of running a business it becomes very hard. This is because when you have a business running, market segmentation is an empirical exercise. You need data to understand the customers paying for your service offering. Old school approaches to guessing the profile of your customers can lead to sub-optimal profits for this section must be taken seriously.

There are 4 dimensions to market segmentation :

a) Demographic

This is basic information on age, gender, marital status and education. When it comes to demographics, trainers generally attract their own kind. My course has a very strong male population in their 30s-40s - many sign up because are fans of my relationship articles on this blog.

How to expand beyond this middle aged males segment is an important question I need to answer. Millenials would have made great ERM customers not because of the amount of capital they have, but because of the amount of time they have to compound their investments and propensity to take on more leverage risk.

I really don't want to lose this crowd so I will be working with Millenials to see how I can appeal to them in a better way.

b) Geographic

This is based on location and I do not have any information on my customer. Perhaps it would be nice to map customers into Districts. I am confident that valuable insights can be gleaned if I can get some visibility on this.

c) Psychographic

Interestingly I had a conversation with Alvin Chow, CEO of Dr Wealth on this topic yesterday. He believes psychographics is even more important than other forms of segmentation. Fact is that my class attracts a lot of engineers. In fact, Dr. Wealth attracts a lot of engineer-trainers so the bias may be built into the whole company design ! Their latest Quantitative Investing class is totally run by engineer hedge-fund gurus.

Attracting engineers is great but it limits the scope of investment training. I increasingly believe that this is not through active design as the mathematics in my course is not that hard and social science majors can benefit more from my program.

It is likely that I attract engineers because I status-align with them much better. While I am a dinosaur in IT these days, I still emphathize with project managers and can converse very comfortably about software development and IT infrastructure. I find it much harder to talk about feelings and relationships, that's unless someone wants a really cynical conversation about divorce law and it's effect on families.

I am seeing opportunity in stretching beyond the engineering sector. Recently, I am enrolling students who are athletes and designers and it is very satisfying to see them get some dividends rolling into their bank account, but I suspect I need a lot more to show them a lot more empathy to convince them that I can help them.

Still, I doubt I'll get enough lawyers to attend my class, though. Lawyers are supremely skeptical folks and may not have much respect for data that rely on historical precedence. Some may want a rational-deductive approach to show why an investment will work in the future, I doubt I can provide a definitive assurance for that. ( They should be careful when meeting gurus who claim that they do. )

d) Usage

This is the most exciting part about Market Segmentation I want to explore. A lot of folks buy baking soda for reasons other than baking. Baking soda can be used for cleaning as well.

I've known for a while that a lot of retirees attend my Early Retirement Masterclass and increasing I am getting students who can teach me a thing or two about early retirement themselves.

So I am building a new consumer profile - someone in their late 40s to early 50s who is very competent about making money, but coming from the business or property investing world. They may not trust their private bankers and want to educate themselves on how to deal intelligently with them and want someone to ruthlessly bust the myths spread by the financial advisory personnel.

For this to happen, I need to bring in some legal chops in the relationship to be able to understand the class of problems they face - some may need a trust-like structure to provide a legacy for their children.

The payoff for good market segmentation is high. If I can successfully define my customer segments, I would be able to craft a marketing message for each segment that adds value to them and we will not need to blast emails that trade-off on our goodwill in the future.

Some trainers ave already become public enemies for the FB marketing campaigns they have launched and I'd rather quit the business then fall into this category.

Wednesday, September 18, 2019

How I arranged for my father's wake.

A good friend reminded me that I have to undergo six stages of grief. Right now, I have no idea which stage I am - I still feel sad and would tear a little when I think of my dad, but the best way forward would be to keep writing and sharing. In fact, I will be back at working on my next preview tomorrow.

I am very grateful for the well wishers who were very supportive of this blog as well as social media presence.

Right now I would just like to explain some thoughts regarding how I organized my father's wake with the hope that this provides at least one data point for blog readers.

Me and my mum we recalled into the hospital at 3am in the morning. After some paperwork, we selected Direct Funeral Services to manage the wake because legendary undertaker Roland Tay is very distant relative of ours. To my surprise, Roland Tay was the first person to pick up my call at 4am in the morning and sent a director to our location to get everything settled.

The most crucial decision is that my father's wake will not involve any religious elements.

This is consistent with his and my lifelong beliefs.

When I was young, my dad always thought I should go a mission school and study the Christian Bible. But his philosophy towards religion was purely functional - I should become closer to Christians because I can cultivate valuable business relationships and networks in the future. As a twelve year old, I protested. I was bullied quite badly by ACS kids in my estate and told my dad that he would not appreciate the repeated calls for school donations. I also knew that without all the shiny toys I would not be able to fit along the mission schools in Bukit Timah road. There was also the witch hunt conducted by fundamentalist Christian teachers against D&D players in the 1980s.

I inherited my dad's attitude towards religion.

Even as my dad did not care about rites, most of the time I burned paper during the seventh month with my mum, for vague reasons like good health and 4D winnings. I burnt paper because I wanted to be close to my mum, and because I'm Chinese.

If you are a cynical relative, you might conclude that me and my dad worshiped money. But I think it is a lot more sophisticated than that. I followed this famous evangelist before he went to jail and devoured his sermons on postmodernism because it was so mesmerizing and relevant to me. To me, this guy is not a man of God - This guy is a hedge fund manager who figured out how arbitrage your very soul. For that same reason, I spent a lot of time watching him on God TV while outsourcing jobs in India - it felt good seeing another Singaporean while working in Bangalore.

So it's not negotiable that my dad will have a free thinker's wake. If I had an imaginary fundamentalist Christian brother who pressured my dad to convert on his death bed, I cannot understand who will take bigger offence - me or actual Christians who find my dad hanging outside their GCBs in Heaven, riding his Ducati Daytona motorbike and wielding his shotgun.

And what a good decision a "free thinker's" wake turned out to be.

Direct Funeral Services conducted an event that gave my dad dignity sans all the noise, incense and (to me) pointless hymns/sermons. Initially, I thought relatives would silently disapprove our godless decision but many uncles and aunties all said that they wanted something similar.

The actual framing of the event is a marvel. It is priced and packaged as a Christian package minus religious elements. During the wake, some vestige of Chinese culture were adhered to, like red strings were placed on the tables.

After the 3-day affair, my dad was cremated at Mandai and buried at sea the following day.

The entire proceedings cost about $10,500 including the sea burial. The newspaper article cost $2,500. Total collections of "white gold" offset around 2/3 of my expenses.

My father was a paragon of frugality. I hope he would have been proud of how consistent I was in containing the costs, all this while producing an event that sent him off in dignity.

For readers who do not profess to any religion, you might consider having $20,000 standing by to deal with funeral expenses. There should be plenty remaining to deal with matters after the wake such as probate matters.

I was extremely lucky because I am an only child - there was no fundamentalist Christian elder brother I had to fight to get my way for my father's wake, but if you do, please get this matter settled while your parent is still alive. Ask them what their wishes are.

Otherwise the guy who pays the most will get to dictate the terms - this is the Singapore way.

I am very grateful for the well wishers who were very supportive of this blog as well as social media presence.

Right now I would just like to explain some thoughts regarding how I organized my father's wake with the hope that this provides at least one data point for blog readers.

Me and my mum we recalled into the hospital at 3am in the morning. After some paperwork, we selected Direct Funeral Services to manage the wake because legendary undertaker Roland Tay is very distant relative of ours. To my surprise, Roland Tay was the first person to pick up my call at 4am in the morning and sent a director to our location to get everything settled.

The most crucial decision is that my father's wake will not involve any religious elements.

This is consistent with his and my lifelong beliefs.

When I was young, my dad always thought I should go a mission school and study the Christian Bible. But his philosophy towards religion was purely functional - I should become closer to Christians because I can cultivate valuable business relationships and networks in the future. As a twelve year old, I protested. I was bullied quite badly by ACS kids in my estate and told my dad that he would not appreciate the repeated calls for school donations. I also knew that without all the shiny toys I would not be able to fit along the mission schools in Bukit Timah road. There was also the witch hunt conducted by fundamentalist Christian teachers against D&D players in the 1980s.

I inherited my dad's attitude towards religion.

Even as my dad did not care about rites, most of the time I burned paper during the seventh month with my mum, for vague reasons like good health and 4D winnings. I burnt paper because I wanted to be close to my mum, and because I'm Chinese.

If you are a cynical relative, you might conclude that me and my dad worshiped money. But I think it is a lot more sophisticated than that. I followed this famous evangelist before he went to jail and devoured his sermons on postmodernism because it was so mesmerizing and relevant to me. To me, this guy is not a man of God - This guy is a hedge fund manager who figured out how arbitrage your very soul. For that same reason, I spent a lot of time watching him on God TV while outsourcing jobs in India - it felt good seeing another Singaporean while working in Bangalore.

So it's not negotiable that my dad will have a free thinker's wake. If I had an imaginary fundamentalist Christian brother who pressured my dad to convert on his death bed, I cannot understand who will take bigger offence - me or actual Christians who find my dad hanging outside their GCBs in Heaven, riding his Ducati Daytona motorbike and wielding his shotgun.

And what a good decision a "free thinker's" wake turned out to be.

Direct Funeral Services conducted an event that gave my dad dignity sans all the noise, incense and (to me) pointless hymns/sermons. Initially, I thought relatives would silently disapprove our godless decision but many uncles and aunties all said that they wanted something similar.

The actual framing of the event is a marvel. It is priced and packaged as a Christian package minus religious elements. During the wake, some vestige of Chinese culture were adhered to, like red strings were placed on the tables.

After the 3-day affair, my dad was cremated at Mandai and buried at sea the following day.

The entire proceedings cost about $10,500 including the sea burial. The newspaper article cost $2,500. Total collections of "white gold" offset around 2/3 of my expenses.

My father was a paragon of frugality. I hope he would have been proud of how consistent I was in containing the costs, all this while producing an event that sent him off in dignity.

For readers who do not profess to any religion, you might consider having $20,000 standing by to deal with funeral expenses. There should be plenty remaining to deal with matters after the wake such as probate matters.

I was extremely lucky because I am an only child - there was no fundamentalist Christian elder brother I had to fight to get my way for my father's wake, but if you do, please get this matter settled while your parent is still alive. Ask them what their wishes are.

Otherwise the guy who pays the most will get to dictate the terms - this is the Singapore way.

Monday, September 16, 2019

Eulogy to my father, Kenneth Ng Fook San (1942 - 2019)

[ This eulogy was never delivered during my father's wake. I was too distraught and cried throughout both attempts to finish this write-up. Before my father was cremated, I wished my families well and told them that my speech would be completed on my blog. ]

My father Ng Fook San passed away on 14th September 2019 3am. The doctors deemed that he died due to an infection that got him onto the hospital bed for 3 months, but I believe that it was probably because he could no longer cope with an added dosage of antibiotics that was administered because he developed a new bacterial infection from medical equipment being used to assist doctors in the drawing blood samples.

My father was born in the middle of World War II. As a child he was probably quite bad in school, dropping out in Secondary 2. I remember as a primary school kid, I found his report card in the family storeroom and saw that he scored 11 / 100 in mathematics. I have never seen him so angry and embarrassed in my whole life. My mum told me that he was so ashamed that he threw his report book away and never wanted me to see it again.

His formative years were spent in Ritz Farm where he managed my grand-dad's farm. An uncle Joe Chng who showed up at the wake and related a story that my dad was quite a cool teenager. He owned a Daytona Ducati motorcycle and spent his youth skiving at Sarabat stalls in Tuas, returning only to his farm office when his dad was inspecting the farm premises. As a farm manager who had to hunt and protect his property from trespassers, my dad was also a legitimate bad-ass. He was proficient and was subsequently licensed by Malayan authorities in the use of a shot-gun.

What my dad lacked in book smarts, he has plenty of hands-on practical intelligence, something which I was unable to inherit from him. When the fences in my old semi-D house was blown down after a very strong wind, my dad built his own wooden fence with no external help and it lasted until we sold the property.

As a lover and boyfriend, my dad was relentless when chasing my mum. Being a Singaporean "interloper" dating a Senai lass who tapped rubber, my dad attracted a lot of negative attention from village gossipers. My mum was a subject of a lot of negative comments after my father bought her a car. This was a really big deal in the 1960s and my mum told me that her dad, unhappy with villagr gossip, beat her up so bad that she almost left home and eloped with my dad in her twenties. Somehow, my dad was able to find for his wedding a Chevrolet - A car that was unheard of at that time and no one was able to top that after that.

My dad spent the greater part of his career years in retail being one of the founders of Pet Lovers Centre then moving on to start his own pet business in mid-1980s. My father did not get along with his siblings and they soon parted ways long before my cousins turned Pet Lovers into this powerhouse today. Because I grew up in a retail environment so I had greater access to my parents during my formative years.

My dad had a pragmatic attitude towards his career. After we wound down the pet business, he took up a job being a manufacturing worker in a packing plant, retiring only after I graduated with my first degree. This was a story I payed in my head every time my dividends hit a new high and I reminded myself that if my dad could go on being useful to society, why not me.

As an investor, my dad was second to none, clinging onto his piece of landed property even as his friends sold theirs and mocked him for stinginess and frugality. Even as I took over the portfolio and rebuilt it around the concept of dividend payouts, my father's portfolio continued to outpace mine because he has a day trader's instinct and years of experience with Teletext always timing his buys with a slight advantage and always selling it before I did it in my own portfolio.

As my father, his influence on my life was, unsurprisingly, large. He has probably spanked me only one or twice in my life and his laissez faire approach to parenting allowed me to develop my own personal interest towards my academics. I studied whatever I liked ( mainly engineering, mathematics and IT programming), where i felt like ignoring my books, I did that with no negative consequences (failing CL2 repeatedly every year) I was never berated for producing bad results and my dad, never really pressured me to take on any particular vocation. Unlike other parents, both my dad and mum were very open to new experiences and I spent my 'O' level and JC days hanging out in lounges listening to country music with my parents.

What my dad did give me is an unrelentingly tight-fisted attitude towards money and an amazing ability to cling onto my investments no matter how much my peers mocked me for being a fool. This worked wonders for me as piled my paycheck into the markets during the Great Recession of 2008 when everyone was panicking and running away from the financial markets.

When I was a teenaged rebel I did many things I was not proud of and said many negative things to my parents, I thought I was totally different from my dad in every way, excelling in my studies when he had not. As I got older, I find myself becoming more and more like my father, and being very proud of of the legacy that he has left for me.

I am, after all, my father's son.

Rest in Peace, Dad.

I miss you.

One day, we will meet again.

Friday, September 13, 2019

A meaningful gift.

One of my students gave me a very meaningful gift last weekend along with a touching hand-written note.

Perhaps I share a little bit of background of this gift while keeping the student's identity secret.

My student is, objectively, a very successful man by local standards - richer and way more successful than me to he point whereby I asked him whether he has a class that I can attend. He attained his wealth the hard way without family support and is much younger than me. You might want to ask why he would even bother attending my investment class. I will only say that his wealth was made through illiquid investments and he wants to pick up some DIY investing skills to avoid the hassle of dealing with them.

Privately, I told him that my course cannot address his biggest issue, which is transmitting the right values to his children and then, somehow, the conversation veered into our favorite brands.

I vaguely recall that we had a conversation about the Rolex Daytona and how much we don't really aspire to owning a Rolex but his eyes lit up when I told him how much I loved shopping at Decathlon.

The conversation about Decathlon is what sales people call the "Show Hand" moment. I was not making a sale, but I was just inadvertently signalling and demonstrating to someone that we hold a very similar philosophy in life. Sometimes a sale is not made on the merits of a product, a salesmen may have actually be a vintage car geek like the customer. I once told a potential customer how to buy a revision guide to study for a Project Management qualification and he ended up paying for my course. Salesman then complained to me that this guy was different to get around until I started talking about IT Project management with them.

I have a few $3.90 T-shirts from Decathlon although my wife and mum really hate it when I wear them in town. Until my mum got fed up and got me a pair of Skechers, I wore a pair of $15 sandals everywhere I went with my signature Mr Greedy Uniqlo T-shirt.

My student was telling me that he bought $9.90 bermudas in bulk. At first I did not believe him because I would have seen that deal when I visited. After class I conferred with another Decathlon fan about bermudas and he had to use Google to extract information on it.

Anyway, I really loved my gift. I'm the kind of guy that pumps my trainer fees into student's investment ideas - I can wear what my students give me. In fact, I wore it three days non-stop and even had a key meeting with a brokerage house where I met a team, including senior managers, to discuss future areas of cooperation.

So thanks to my student, I found my future corporate look !

Anyway, Decathlon is opening their first outlet on Orchard Road and I expect it to be in Centrepoint.

It's really poetic justice as Centre-Point kids of the 1980s are probably Decathlon biggest customers today.

Wednesday, September 11, 2019

MBA in a Nutshell #5 - Marketing : Miscellaneous considerations

When marketing to a customer, there are a series of extra considerations that has to be made.

a) Other participants in the buying process

Sometimes, it may seem that one party may be the key decision maker but another party exerts a very strong influence in the decision making process. When buying my EC, I let my wife be a primary decision maker, I just make sure that the final decision is within my financial budget. Fortunately, almost all my customers for the training program show up for my previews alone and there is only one key decision maker to take care of. A variant of this arrangement is when one person gets to make a choice subject to the veto power of another. This is common in toy sales.

The downside of simpler decision making is that I seldom meet couples in my training classes, advising them to split up and share notes on two different courses instead.

b) Buying as a rational and emotional process

If buying is a rational process, all I have to do is to let everyone know my course syllabus and pitch my class at a reasonable price.

If I really did this, I would probably be a divorce lawyer today.

No matter how cold and calculating my students are ( a majority are indeed engineers ), buying an investment course has a emotional component that can only be dealt with with a preview. This preview must have enough pathos to elicit interest.

I have recently transitioned from a very powerful message of "The Death of the Singapore Dream" to my newest performance of "The Four Seasons of Life".

Luckily, I spent my childhood DMing RPGs and manage theatrics fairly well.

c) Cognitive Dissonance

Every buyer faces conflicting emotions when purchasing a product. A person who buys a cigarette is probably aware that smoking is harmful but conquers his internal logic anyway. This is why marketers like to tell a customer that they are "worth it" or they should reward themselves.

In this aspect, my training courses face an uphill task.

For the sake of portfolio that I will build as part of the program, I prefer calmer and rational students who are more likely to understand what I teach. I told my partners that it is better not to hijack the amygdala of workshop participants because a bunch of Warren Buffett worshipper-fanatics may not be able to build working investment portfolio to do justice to my invested trainer fees during class.

If it is one emotion that I do channel is everyone's anger about being powerless in a capitalistic economy and the student's desire to give themselves one shot at financial freedom. Hopefully the anger is replaced with determination once I show them that succeeding even partially will have a huge impact in their lives.

d) Post-purchase Dissonance

When you spend thousands of dollars on something, you get buyer's remorse. This happened to me many times when I buy gadgets like e-readers (something I am still obsessed about).

Coming up with a reasonable money back guarantee program and building a vibrant community of alumni is how I deal with this. I know I can't answer all the questions from my students which is why now I have a community of 270+ members to help each other out.

Monday, September 09, 2019

Letter to Batch 7 of Early Retirement Masterclass students

Dear Students of Batch 7,

It’s

been a great honour and privilege to be able to conduct a 2-Day Early

Retirement Workshop for you.

This

particular class is distinguished by its active class participation. The

Q&A for this session is so intense that we finished both days at around 6pm.

What I really like about this batch is that some questions shared are quite

novel and learned a lot from everyone.

I

think the question that left the biggest impression on me is the concern that

investment class participants being permanently tied to the trainer via an

“umbilical cord”.

Having

a community that is becomes too heavily reliant on back-testing results from

the trainer to cherry pick strategies is not the design intent of this program.

Instead, I hope that over the next few months, you will be able to detect some

common themes in the subsequent strategies published to gain enough courage to

develop an opinion on what works on the SGX, and then screen and invest stocks

of your own. Sharper students have noted that picking counters with low P/E

ratios seem to consistently work in local markets.

As

we’ve crossed the month of August, optimism is slowly returning into the

Singapore markets and a smaller number of class participants believe that we

are undergoing a market trough. This may be a sign of improving conditions in

the markets.

For

this batch of students, we have, once again, evolved the method that we use to

pick our stocks. Students are now given a choice to vote between two strategies

based on five-year and ten-year back-tested results to grant them more autonomy

over what stocks to select for the Batch 7 portfolio. As such, your selections

can be found in the two spreadsheets attached and I have also included the

screens that were not chosen by the class for your future reference.

The

passive income portfolio built by this class this time round is particular

attractive having forward yields of 7.2%. You should prioritize this portfolio

if you do not have sufficient capital to buy both portfolios. Using $20,000 of

course proceeds, I intend to also buy the equities portfolio that has been

built by this class but it the allocation will be equally-weighted between 17

counters short-listed by this class.

Finally, there are requests to accompany me to witness actual

back-test strategies on a Bloomberg terminal. I doubt I can do this for such a

large class of students every month so I will be putting up a video of how I

perform a back-test soon.

Christopher Ng Wai Chung

Friday, September 06, 2019

Sorry ! You can never escape being part of the Sandwich Generation.

I'd just like to take the opportunity to provide a personal update on this post and take the opportunity to point out to everyone NTUC Income's fairly viral advertisement on retirement planning that forms the theme of my personal update today.

The conclusion I'd like readers to accept is this : There is no escape from being part of the Sandwich Generation. Managing your finances well can, at most, mitigate the negative effects of being part of it.

a) Training business and marketing

First of all, if you are familiar with the going on in the Finance Blogosphere Wu Lin, my business partner Dr Wealth had to apologise to FAs for an overly aggressive marketing email that was sent out this week.

While the issue did not concern my ERM Masterclass, I was affected somewhat by the event as I did volunteer little help to review the email to see whether any legal liability has resulted from it. Even as I found no legal risk, it led me think about the current conventional approach of marketing aggressively via email which have its fair share of critics as of late.

Direct emails are important because they have a broad reach. But the truth is that a trainer's personal brand can be affected negatively by the quality of these marketing emails. For months, I can only review these email broadcasts on hindsight. As a non-employee, I don't have powers of vetting over these documents. Needless to say, my good friends and customers have given me some really blunt and candid feedback regarding this marketing approach when sharing with me on why they unsubscribed from the channel.

At this stage, I still believe that my business partners know what they are doing, but I have subtly proposed a shift in the way the ERM class does business.

Last night we concluded a fairly good evening where my audience were driven by my investment articles and not by those emails sent to the mailbox so I am going to start getting my leads without direct mail for a month or two to see if I can sustain my course intake. More importantly, I had a friendly crowd what I could genuinely interact with.

If you wish to review the quality of these posts that I will be using to get new leads, you can refer to this link here. So bottom line, I really hope that I will not need to spam your mailboxes in the future.

Consequently, as a peace offering, I stopped asking my preview attendees whether they trust financial advisors, instead, I ask a less confrontational question which I shared above.

All these months, I thought I would become the "problematic trainer" who will have the testiest relationship with FAs but, over time, I realise that my biggest allies in the ERM are in fact the licensed financial advisors and tied agents who helped me refine my course material to reflect the truth about the Financial Advisory business and debunk some of the worse tactics used in the industry.

( Even in discussion groups, occasionally I would back Money Maverick and he would come to my defence when I get attacked. We're at the opposite ends of the spectrum and should have been sworn enemies. But life is not simple that way. )

There are good people out there who are really uncomfortable with what's happening in the industry.

Right up to the point that they are volunteering to help me - the proverbial Satan in the insurance agent cosmology !

( For no referral fee, I can introduce my FA allies to you ! )

b) My father's hospitalisation.

Work problems are very microscopic compared to my personal problems.

My dad has gone back to hospital and things seem to be getting worse. Unfortunately for me, visiting relatives heard my dad struggle against nursing staff and then "kindly" decided to advice my mother to move my dad to a new hospital. The result is that my mother could not sleep one entire night, thinking that she did not do right by my dad.

I think my dad's medical numbers are getting better and had to put my foot down to prevent moving my dad. What makes people think that going to older hospital would be better if we preserve the same B2 class ward ? What's next, destroying six digits of wealth by going Mt E ?

Relatives do not pay for our dad's hospital stay and certainly do not play a role in caregiving. They have no right to advice me or my mum on next step. Worse, my mum was sensitive to being called a bad daughter-in-law because she was bullied by my grandmother in the past. I can't allow this to repeat itself.

From now on, I have to balance my mother's welfare against my dad and now have to play the role as an "unfilial son". All decisions made on my dad's behalf are mine and mine alone.

Now tell me how your kids can avoid not becoming a sandwich class when Asian values try to interfere with family decisions.

c) I fired my maid

All in all, my relatives still meant well, all I had to do is to just ignore them, so the previous issue is microscopic compared to what happened to me yesterday.

My dad on his sick bed received a call from Singtel. My maid took my dad's handphone while he was lying in bed and racked up $800+ of phone bills with calls to Myanmar. I was furious and I just sent my maid back to the agency with a warning never to provide her with employment in Singapore again.

The financial damage is minimal, but my maid received months of caregiver training from Khoo Teck Puat hospital. My mother is so traumatised, we are not getting a new maid in the meantime and she'd rather do the housework herself.

Now my family is in serious trouble.

If my dad gets discharged, there will be no manpower resources to help him at home. I would either have to send him to a home or hire expensive nursing staff to come to my parent's flat. So far, my father has mental capacity and will not be willing to be put in a home.

There is no workable solution so far other than to get my dad round the idea that he needs professional care that my mum and me cannot provide. When we tried and he got rehospitalised as a result.

As a trainer for Early Retirement, I'm going to say that no amount of money can prevent you from joining the Sandwich class. I think this is an impossible aspiration and I don't want it any other way myself.

In fact, the future is even worse.

As we find a solution to cancer and live-spans increase to 110, we may end up with a Double Sandwiched class - A generation that supports 3 generations at the same time because people are living so long.

Finally, we are Asian, even if the family is wealthy, family ties and smaller households will mean spending the Autumn of our lives caring for our loved ones and spending time in their service.

My dad has given to me so much as he only had one child.

Now I have to make the tough decisions on his behalf.

Tuesday, September 03, 2019

MBA in a Nutshell #4 - Marketing : Dimensions of Buyer Perception

Dimensions of buyer perception is a very practical framework that forces an executive to think really hard about his product offering.

This is a very useful checklist for marketers to ask themselves whether their products tick all the boxes and where areas of improvement can be made.

Let's look at the primary dimensions of my own product offering, the ERM Masterclass :

a) Perceived Risk - How can this product harm me ?

It is impossible to avoid self-harm in DIY investing. The trick is to manage the harm when it does occur.

Being one of the few instructors who address leverage as an investment strategy, my students are not too far from having their investments explode in their face. My solution is to do everything empirically and give them the means to calculate the odds of avoiding a margin call.

If you use numbers to make a decision, even if harm occurs, you might be able to limit it to a reasonable level.

b) Relative Advantage - How does this product compare with others ?

It is the statistical and empirical approach that differentiates my offering from the others who seem to want to craft a beautiful narrative for every stock they buy.

While I do not compete on relative performance of my student's portfolios, I compete on how transparent my results are. I also put a substantial amount of trainer fees into the portfolios built by my students making me the only trainer in the whole industry to voluntarily hurt myself if my students pick the wrong stocks attending my program.

( Right now, my XIRR for all my student portfolios stand at around 13.68% unleveraged. In practice I employ a multiplier of two to put more skin in the game and I have been benefiting from leverage thus far. )

There are also secondary dimensions that I have to come to terms with :

a) Observability and Immediacy - Can the product's benefits be seen and how soon can they see it ?

As dividends require at least one quarter to appear in your bank account, expect results only after a few months. Sometime if the student is lucky (or unlucky), Trump does something funny and the student gets to see how defensive their portfolios are in practice.

One out of six batches of my students are currently sitting on losses after a brutal August 2019, but given how they fared compared to the rest of the market,they might be the lucky ones amongst my students because you always learn more from your failures than successes. ( Loss aversion bias )

b) Complexity - Is the product difficult to understand and use ?

When I started out, feedback was that the course was too difficult for beginners who feel lost. I have since rectified this with pre-course readings and online videos so that beginners will be able to hit the ground running.

I now have a steady record of getting absolute rookies into getting regular dividends every quarter.

c) Compatibility - Is the product usage congruent with my belief system ?

I am not an expert on get rich quick schemes, so I generally attract very down to earth folks who are willing to put in the hard work of managing their money towards early retirement. The word cloud of my student professions reflect a strong following among engineers, teachers and accountants.

My students are not the kind of folks who sign up for a program so that they can "shake leg" in pyjamas in Bali.

d) Trialability - Can the product be used without a commitment from the customer?

A preview workshop is the best way to use the product without a commitment. We had to tweak our money-back guarantee to eliminate abuse several times.

I guess it is quite hard to get better than this.

e) Divisibility - Can the product be purchased in smaller quantities?

I'm surprised this is an issue in my business. Some customers want to pay less and only attend the leverage component of my course and I spent a large amount of time fending off such requests. I think any framework for financial leverage much be combined with an investment methodology as the alternative would be to court disaster.

So these guys can keep their money, they are going to need it one day.

f) Availability - What about after sales service ?

This is why building a community of student alumni is so important for modern trainers. I have about 200+ members in my FB group who get updates on all future courses along with stock lists. I do not charge subscription fees because the members double up as support for incoming students.

Maybe in the far future, some kind of advanced investing course can be marketed to these students. But I just want to build a different kind of financial community than the free social media groups out there right now.

This is a very useful checklist for marketers to ask themselves whether their products tick all the boxes and where areas of improvement can be made.

Let's look at the primary dimensions of my own product offering, the ERM Masterclass :

a) Perceived Risk - How can this product harm me ?

It is impossible to avoid self-harm in DIY investing. The trick is to manage the harm when it does occur.

Being one of the few instructors who address leverage as an investment strategy, my students are not too far from having their investments explode in their face. My solution is to do everything empirically and give them the means to calculate the odds of avoiding a margin call.

If you use numbers to make a decision, even if harm occurs, you might be able to limit it to a reasonable level.

b) Relative Advantage - How does this product compare with others ?

It is the statistical and empirical approach that differentiates my offering from the others who seem to want to craft a beautiful narrative for every stock they buy.

While I do not compete on relative performance of my student's portfolios, I compete on how transparent my results are. I also put a substantial amount of trainer fees into the portfolios built by my students making me the only trainer in the whole industry to voluntarily hurt myself if my students pick the wrong stocks attending my program.

( Right now, my XIRR for all my student portfolios stand at around 13.68% unleveraged. In practice I employ a multiplier of two to put more skin in the game and I have been benefiting from leverage thus far. )

There are also secondary dimensions that I have to come to terms with :

a) Observability and Immediacy - Can the product's benefits be seen and how soon can they see it ?

As dividends require at least one quarter to appear in your bank account, expect results only after a few months. Sometime if the student is lucky (or unlucky), Trump does something funny and the student gets to see how defensive their portfolios are in practice.

One out of six batches of my students are currently sitting on losses after a brutal August 2019, but given how they fared compared to the rest of the market,they might be the lucky ones amongst my students because you always learn more from your failures than successes. ( Loss aversion bias )

b) Complexity - Is the product difficult to understand and use ?

When I started out, feedback was that the course was too difficult for beginners who feel lost. I have since rectified this with pre-course readings and online videos so that beginners will be able to hit the ground running.

I now have a steady record of getting absolute rookies into getting regular dividends every quarter.

c) Compatibility - Is the product usage congruent with my belief system ?

I am not an expert on get rich quick schemes, so I generally attract very down to earth folks who are willing to put in the hard work of managing their money towards early retirement. The word cloud of my student professions reflect a strong following among engineers, teachers and accountants.

My students are not the kind of folks who sign up for a program so that they can "shake leg" in pyjamas in Bali.

d) Trialability - Can the product be used without a commitment from the customer?

A preview workshop is the best way to use the product without a commitment. We had to tweak our money-back guarantee to eliminate abuse several times.

I guess it is quite hard to get better than this.

e) Divisibility - Can the product be purchased in smaller quantities?

I'm surprised this is an issue in my business. Some customers want to pay less and only attend the leverage component of my course and I spent a large amount of time fending off such requests. I think any framework for financial leverage much be combined with an investment methodology as the alternative would be to court disaster.

So these guys can keep their money, they are going to need it one day.

f) Availability - What about after sales service ?

This is why building a community of student alumni is so important for modern trainers. I have about 200+ members in my FB group who get updates on all future courses along with stock lists. I do not charge subscription fees because the members double up as support for incoming students.

Maybe in the far future, some kind of advanced investing course can be marketed to these students. But I just want to build a different kind of financial community than the free social media groups out there right now.

Sunday, September 01, 2019

How to think about the value of a Master's qualification

I thought I'd follow up on this excellent but fundamentally flawed article on Rice Media.

The article was excellent because the author was the first to admit that our financial blogs are canonical literature in Singapore fueling my fantasies of becoming Singapore's very own William Shakespeare and having my rants about our Polytechnic students and BBFAs studied intensely as the equivalent of the A levels in 400 years time.

The article was fundamentally flawed because the author showcased too many examples of folks who took Masters Degrees in Arts or Social Sciences, and only had one example from someone who did a Masters in Applied Finance. Totally missing from the article are the folks who studied the bread and butter MBA programs. For many pragmatic Singaporeans, a Master's degree is just not an exercise in intellectual hedonism. It is truly a gateway to a middle class existence.

a) Quantitative analysis of the INSEAD MBA

So let's do this properly the way canonical literature should analyse a situation.

Remember I did a POTS analysis on local degree programs ?

Here is the table comparing degrees in a previous article. In my last article I said that a good degree should achieve an Adjusted POTS score of at least 0.5 with a Nursing degree a surprisingly good option for Gen Z students.

Let's analyse the classic MBA for the most ambitious Singapore executives, the INSEAD MBA.

According to the data release by INSEAD itself, the median starting salary of an INSEAD MBA is $145,000 USD. That is about $200,000 SGD / year. Also 91% of INSEAD MBAs receive an offer 3 months after graduation.

Naturally, the cost of such a top flight program is not cheap. It could set you back $110,000 EUD or $160,000 SGD.

Now, suppose your salary is $80,000 before enrolling into the program. The Adjusted POTS score is ($200,000 - $80,000) / $160,000 * 0.91 or 0.6825 - not as good as signing up for Law or Computing at an undergraduate level but it can hold it's own against Engineering. Hardly the kind of degree you study to get into some serious intellectual masturbation.

So my advice to anyone who can actually get a seat in INSEAD would be to go ahead and sign up for the program.

b) Modelling a Master's degree as a real option

I don't really view a Master's degree as a tool for a career change. In fact, for my own life I failed in two major career transitions in my life. First after I studied Finance, and second, after I studied Law.

So like the Arsenal (?) football coach, I was a specialist in failure - At least in career transitions !

My Masters in Applied Finance barely landed me a job interview because I graduated sometime after the SARs period. Outplacement in NUS was non-existent with one Finance professor sarcastically asking me whether I had a job to offer to him when I tried to ask him for outplacement services. The real reason why this never bothered me was because my IT career was doing rather well during those days before CECA was signed and we became flooded with foreign IT engineers.

The Masters in Applied Finance was possibly the most important qualification I studied because it was crucial in getting me to take my personal investment portfolio seriously than my day job. You can argue that my substantial dividends today is a direct result of attending that course.

A Master's degree should be modeled as a call option on your human capital. You gain the right but not the obligation of making a career switch. If I exercised my Juris Doctor option today and joined the legal industry, I would probably be making less than 25% what I am earning today.

That's the equivalent to exercising an out of the money call option !

If folks asked me whether I regretted studying Law, I will say that I would gladly do this all over again if SMU offered to let me do it one more time ( But I will skip Constitutional law and Legal Theory thank you ) . My current approach to investing was based on my time spent on the free Bloomberg terminals in campus which, if I rented them on my own, would cost more than my Juris Doctor school fees. ( JD-Bloomberg arbitrage anyone ? )

Right now, my JD qualification is so far out-of-the-money it may expire worthless, but I think all it takes is one big mistake and an actual litigation for my degree to start paying for itself.

Let's pray that never happens (unless I am the one doing the suing.)

The article was excellent because the author was the first to admit that our financial blogs are canonical literature in Singapore fueling my fantasies of becoming Singapore's very own William Shakespeare and having my rants about our Polytechnic students and BBFAs studied intensely as the equivalent of the A levels in 400 years time.

The article was fundamentally flawed because the author showcased too many examples of folks who took Masters Degrees in Arts or Social Sciences, and only had one example from someone who did a Masters in Applied Finance. Totally missing from the article are the folks who studied the bread and butter MBA programs. For many pragmatic Singaporeans, a Master's degree is just not an exercise in intellectual hedonism. It is truly a gateway to a middle class existence.

a) Quantitative analysis of the INSEAD MBA

So let's do this properly the way canonical literature should analyse a situation.

Remember I did a POTS analysis on local degree programs ?

Here is the table comparing degrees in a previous article. In my last article I said that a good degree should achieve an Adjusted POTS score of at least 0.5 with a Nursing degree a surprisingly good option for Gen Z students.

Let's analyse the classic MBA for the most ambitious Singapore executives, the INSEAD MBA.

According to the data release by INSEAD itself, the median starting salary of an INSEAD MBA is $145,000 USD. That is about $200,000 SGD / year. Also 91% of INSEAD MBAs receive an offer 3 months after graduation.

Naturally, the cost of such a top flight program is not cheap. It could set you back $110,000 EUD or $160,000 SGD.

Now, suppose your salary is $80,000 before enrolling into the program. The Adjusted POTS score is ($200,000 - $80,000) / $160,000 * 0.91 or 0.6825 - not as good as signing up for Law or Computing at an undergraduate level but it can hold it's own against Engineering. Hardly the kind of degree you study to get into some serious intellectual masturbation.

So my advice to anyone who can actually get a seat in INSEAD would be to go ahead and sign up for the program.

b) Modelling a Master's degree as a real option

I don't really view a Master's degree as a tool for a career change. In fact, for my own life I failed in two major career transitions in my life. First after I studied Finance, and second, after I studied Law.

So like the Arsenal (?) football coach, I was a specialist in failure - At least in career transitions !

My Masters in Applied Finance barely landed me a job interview because I graduated sometime after the SARs period. Outplacement in NUS was non-existent with one Finance professor sarcastically asking me whether I had a job to offer to him when I tried to ask him for outplacement services. The real reason why this never bothered me was because my IT career was doing rather well during those days before CECA was signed and we became flooded with foreign IT engineers.

The Masters in Applied Finance was possibly the most important qualification I studied because it was crucial in getting me to take my personal investment portfolio seriously than my day job. You can argue that my substantial dividends today is a direct result of attending that course.

A Master's degree should be modeled as a call option on your human capital. You gain the right but not the obligation of making a career switch. If I exercised my Juris Doctor option today and joined the legal industry, I would probably be making less than 25% what I am earning today.

That's the equivalent to exercising an out of the money call option !

If folks asked me whether I regretted studying Law, I will say that I would gladly do this all over again if SMU offered to let me do it one more time ( But I will skip Constitutional law and Legal Theory thank you ) . My current approach to investing was based on my time spent on the free Bloomberg terminals in campus which, if I rented them on my own, would cost more than my Juris Doctor school fees. ( JD-Bloomberg arbitrage anyone ? )

Right now, my JD qualification is so far out-of-the-money it may expire worthless, but I think all it takes is one big mistake and an actual litigation for my degree to start paying for itself.

Let's pray that never happens (unless I am the one doing the suing.)